E-Mini Dow - Printing a New High

rhboskres

Publish date: Mon, 25 Oct 2021, 11:00 AM

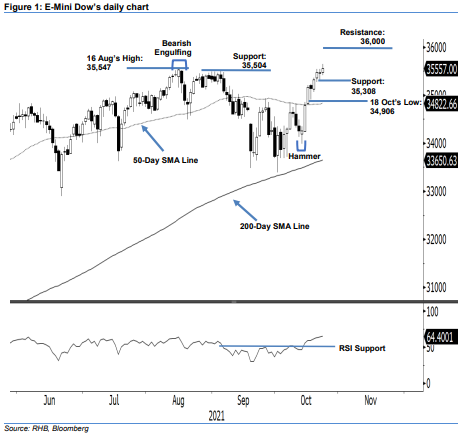

Maintain long positions. The E-Mini Dow managed to mark its new high level despite intraday profit-taking activities held last Friday, which saw it close 77 pts higher at 35,557 pts. It opened at 35,476 pts and gradually moved higher towards the European trading session. High volatility was observed during the start of the US trading session, which saw it jump towards the 35,645-pt day high before swiftly falling to its intraday low at 35,412 pts. It later climbed higher to recoup the losses to close positive at 35,557 pts. The latest white body candlestick with long upper shadow that closed above the historical high of 35,547 pts suggests the bulls are eager to move higher into uncharted territory in the coming sessions. Supported by the RSI pointing higher above the 60% level, this primes us to expect the E-mini Dow to persist its bullish momentum in the coming sessions. Nevertheless, we do not discount for short-term sideways consolidations before moving higher. Hence, we stick to our bullish trading bias.

We suggest traders keep to the long positions initiated at the closing level of 7 Oct, or 34,638 pts. To manage the trading risks, the initial trailing-stop threshold is set at the 35,308-pt support level.

The immediate support level is revised at 35,504 pts, or 3 Sep’s high. This is followed by 35,308 pts, ie 21 Oct’s low. On the upside, the immediate resistance is eyed at 36,000 pts before possibly reaching the 36,500-pt threshold

Source: RHB Securities Research - 25 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024