COMEX Gold - Climbing Above the USD1,800 Mark

rhboskres

Publish date: Tue, 26 Oct 2021, 11:04 AM

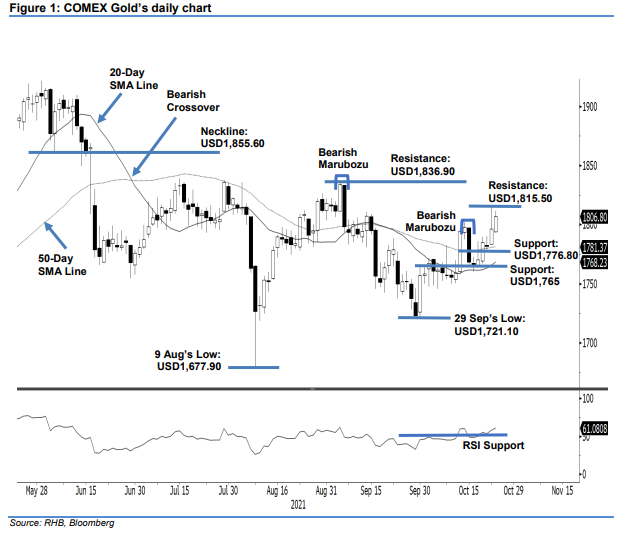

Maintain long positions. The COMEX Gold extended its bullish movement for the second consecutive session, rising USD10.50 to settle at USD1,806.80 – reclaiming the USD1,800 level. The commodity started yesterday’s session at USD1,794.20. It briefly touched the day’s low of USD1,793 and progressed higher to test the USD1,811.50 high before the close. The latest bullish candlestick showed that the bulls were firmly in control, and managed to negate the Bearish Marubozu formed on 15 Oct. Amidst renewed bullish momentum, the commodity is looking to cross its immediate resistance, and then retest September’s high of USD1,836.90. If the bears decide to take profit, we expect the 50-day SMA line to act as a strong downside support. As the commodity is poised to see another leg up, we retain our positive trading bias.

We recommend that traders keep the long positions initiated at USD1,784.90 or the closing level of 20 Oct. To manage downside risks, the stop-loss is set at USD1,760.

The immediate support is marked at USD1,776.80 – 21 Oct’s low – followed by the USD1,765 whole number. Towards the upside, the nearest resistance is eyed at USD1,815.50 (22 Oct’s high), followed by USD1,836.90 or 3 Sep’s high.

Source: RHB Securities Research - 26 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024