FCPO - Rising Marginally Above The MYR5,000 Mark

rhboskres

Publish date: Wed, 27 Oct 2021, 05:10 PM

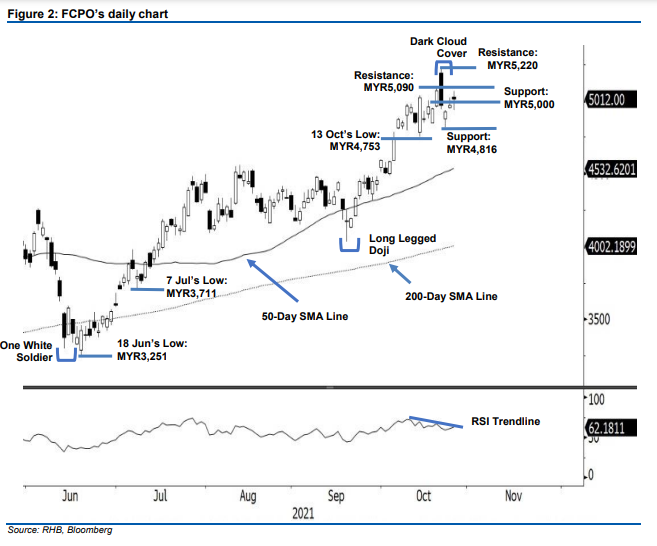

Keep short positions. Despite strong profit taking from the intraday high, the FCPO managed to closed higher for the third consecutive session yesterday, soaring MYR43 to close at MYR5,012 – lower than its opening. In line with Monday’s gap up, the commodity opened higher yesterday at MYR5,027. It then oscillated in a mildly positive tone between the intraday’s high of MYR5,067 and low of MYR4,936. It then bounced off mildly to settle at MYR5,012. The latest session, which formed a black body candlestick, suggests strong selling pressure has emerged from yesterday’s intraday high after rallying from the bottom over the past three sessions. The commodity may pullback to retest the MYR5,000 support level in the immediate session before travelling higher to test the immediate resistance of MYR5,090. Since the stop-loss has not been triggered, we keep to our bearish trading bias.

We suggest traders stick to the short positions initiated at MYR4,924, or the closing level of 22 Oct. To manage the trading risks, the initial stop-loss is set at MYR5,090.

The immediate support is pegged at the MYR5,000 round figure, followed by MYR4,816, or the low of 22 Oct. Towards the upside, the immediate resistance is sighted at MYR5,090, or the high of 20 Oct, and subsequent resistance at MYR5,220, or the high of 21 Oct.

Source: RHB Securities Research - 27 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024