WTI Crude - Falling From the Top

rhboskres

Publish date: Thu, 28 Oct 2021, 05:04 PM

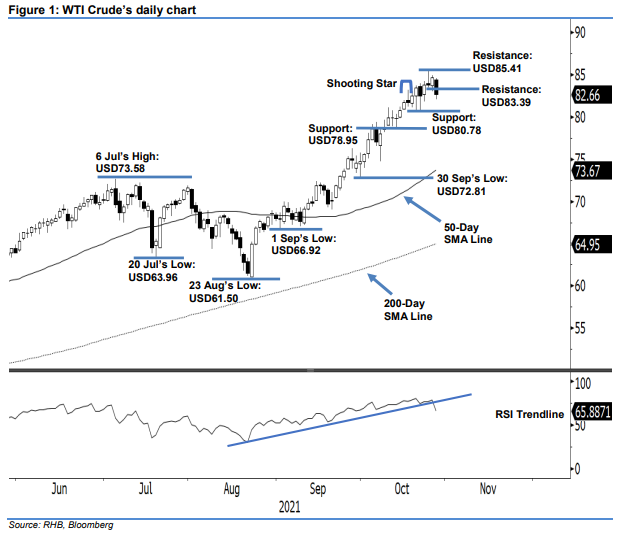

Trailing-stop mark triggered; initiate short positions. The WTI Crude reversed its trend southwards yesterday, as it breached the immediate support – also its trailing-stop – level, falling USD1.99 to settle at USD82.66. The commodity opened slightly lower at USD84.39 to merely touch the day’s high of USD84.51 before gradually falling southwards throughout the sessions. It hit the intraday low at USD82.01 before rebounding mildly at the close. The long black candlestick that broke below the USD83.39 immediate support signals the bears are back in the driver’s seat – heading towards the next support level: USD80.78. This is supported by the weakening RSI, which dropped significantly to 65% from 78% yesterday. Since the trailing stop is breached, we shift to a negative trading bias.

We closed out our long positions – initiated at USD67.54 or the closing level of 24 Aug – after the USD83.39 trailingstop mark was triggered. Conversely, we initiate short positions at the closing level of 27 Oct, ie USD82.66. To manage the trading risks, the initial stop-loss threshold is placed at USD85.41.

The support levels are eyed at USD80.78 – 20 Oct’s low – and USD78.95, ie 11 Oct’s low. The resistance level is pegged at USD83.39, or 25 Oct’s low. This is followed by the USD85.41, which was 26 Oct’s high.

Source: RHB Securities Research - 28 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024