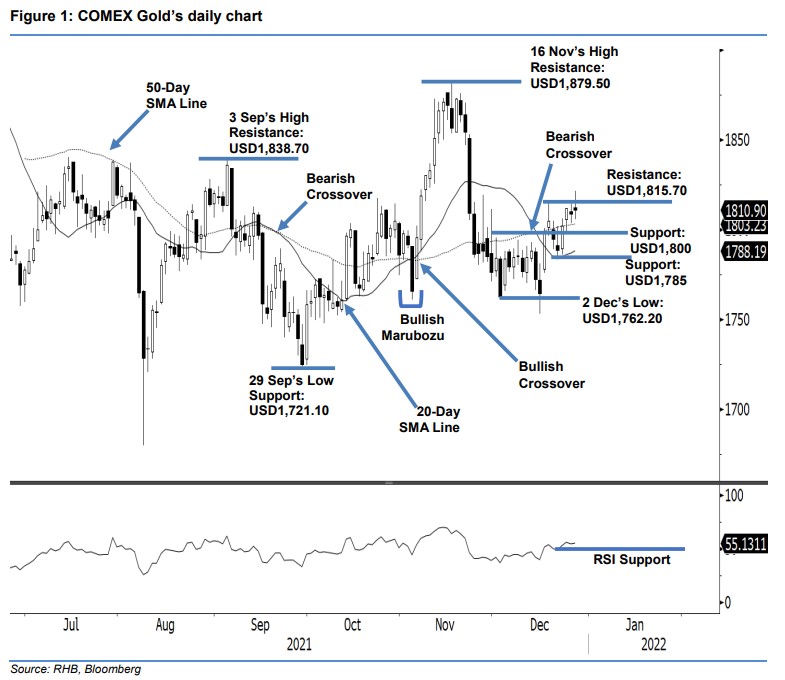

COMEX Gold : Bulls Struggling Near the USD1,815.70 Resistance

rhboskres

Publish date: Wed, 29 Dec 2021, 05:57 PM

Keep long positions. The COMEX Gold stuggled to move up yesterday after having written off almost all the intraday profits to close just USD2.10 higher at USD1,810.90 – still below the immediate resistance. It opened at USD1,812.10 and then gradually moved higher towards the USD1,821.60 day’s peak. However, strong selling pressure shifted the direction southwards during the early US trading session, which saw the yellow metal fall towards the USD1,805.50 day’s bottom before rebounding mildly at the close. The black body candlestick with long upper shadow signalled that strong selling pressure appeared at the USD1,815.70 immediate resistance. That said, strong buying pressure is needed to pass through the immediate resistance level. If that happens, strong bullish momentum remains in the medium term. Meanwhile, we expect the COMEX Gold to trade sideways between USD1,815.70 and USD1,800 before propelling higher. With that, we retain our positive trading bias.

We suggest traders maintain long positions at USD1,811.70, ie the closing level of 23 Dec. For risk management, the stop-loss threshold is revised higher to USD1,800. The immediate support is set at the USD1,800 threshold, followed by USD1,785, ie 21 Dec’s low. Towards the upside, the nearest resistance is set at USD1,815.70 or 17 Dec’s high. This is followed by USD1,838.70, ie 3 Sep’s high.

Source: RHB Securities Research - 29 Dec 2021