What Is Operator/ Market Maker/ Big Boys?

roundnsurge

Publish date: Fri, 25 Feb 2022, 10:12 PM

Operators are a person/ group who take advantage of small investors and traders for their own monetary gain, also known as Big boys. However, Big boys can also be institutional funds or sovereign funds. The differences are the Operators usually look into mid-term price operation and market making to make the stocks look liquid to attract retail investors. Institutional funds are focusing more on long term investment in listed companies. Institutional funds will not do market making to attract retail investors, but they will make sure the company that they invested in have capital gains through more institutional funds coming in later. The idea is similar to venture capitalists investing in a start-up & making sure the business went well and being able to value the company shares at a higher value than the amount they invested in the next round of funding.

But we are not going to write about how institutional funds make profits in this blog. Retail investors & traders’ objective is to make a capital gain, whether it is short term, mid-term, or long term. But most of us will prefer the short term to mid-term capital gain. Even if you are a long-term investor, you will still feel much more excited when you are able to profit in the short term. This is because we see the stock market as a secondary income generator.

However, to have your trades & investments in the stock market to generate a secondary income is not as easy as many other financial books or speakers said. Often these kinds of financial planning or consultation always ask us to diversify our investments into different asset classes such as properties, businesses, and stocks. But they never specifically help us in how to do it. That’s why we see many investors losing money in the stock market because they don’t know how to find the right stocks and think that investing in the stock market is as easy as the book says, investing in the stock market you will get dividends & capital gains. But they didn’t tell you that not all stocks will move up! The worst thing is to ask some investors to hold on to a losing stock for the purpose of getting the dividends. How many dividends do you need to receive in order to cover your capital gain?

Since our intention is to make a capital gain from the stock market as our secondary income, the first thing we need to know is how to select the right stocks. But we are not going to share with you the conventional analysis of plotting resistance or support line, reading indicators, or analysing chart patterns.

Because all of the above doesn’t work in the equity market now, at least from our experience in Malaysia's stock market. If the conventional analysis is working, why are there still so many investors losing money in the stock market?

The main reason why traditional technical analysis is not working in the stock market is that the theory is based on every market participant, including retail investors like us can influence the price. However, in the actual market, retail investors have little influence in price up, due to all of us having different expectations at price. Therefore, the price will not move in the same direction unless we are grouped together having the same expectation, entry timing, exit timing, and the same target price.

In the operator case, it is exactly the opposite of retail investors. Because the operator has large shareholding & has the same expectation to move the price in the direction that they want. Creating liquidity & price activity to attract retail investors on the way up.

It is difficult for retail investors to do the same as the operator because we are separated & not operating at the same time. It will be difficult to connect large amounts of retail investors together and it is even much more difficult to have all retail investors come into the same agreement in the operation. Especially the trust between each other.

Therefore, as a retail investor, we need to know how to follow these operators/ big boys in order to make a better profit from the stock market.

Isn’t it risky to follow the operator/ big boys?

Is there no risk or you will lose less by using traditional analysis or listening to some opinions/ reports? There is still risk even if you are not following the big boys/operator, the question is whether you know which one to follow and MOST importantly you have to manage your risk.

There are many different operating styles in the stock market, we don’t follow all of them. Specifically, we avoid 2 types of stocks by their liquidity & 1 type of stock by the operating style in the stock market.

Liquidity of the stock

1) Too Liquid (floating shares 40% or more)

Too liquid stock usually is difficult to see the big boys’ intention during pre-price up (unless you look into each of the transaction data). Because there are too many shares in the market and make it much more difficult to analyse the price action to know they are preparing to push the price up. Usually, this kind of stock will have a quick pump & dump, when we realise it, is when the price is at a high. If we can’t understand it, we avoid it, we will not bet on it.

2) Illiquid (floating shares less than 20%)

Illiquid stocks are usually the majority shares held by a few shareholders. These kinds of companies usually have no interest in managing their share price. Their main intention is to hold the majority of the shares to avoid hostile takeover and lose their business or management control. Because of their protective behaviour, institutional funds will not have the appetite to invest in these companies.

Some of these companies' share prices might show prices trending up in the long term, but it is better to avoid because there are not enough shares in the market to do proper market making to allow sufficient share in the market for you to sell. As a result, you will have to sell at a much lower price to exit, which might reduce your profit a lot.

Operating Style

1) Forever Churning Volume, we call it washing machine

You will often see some stock in the market will have the price moving up gradually every day while volume is consistently high (often the volume will be every 4th day after the previous high volume). These kinds of operators usually rely on margins or limits for their operation. Therefore, they will need to move their shares from 1 hand to another hand to avoid force selling on T+4. While maintaining the price higher bit by bit every day to attract retail investors who think this stock is good because the price is gradually moving higher day by day with active traded volume (thinks there is a lot of demand). Slowly repeat this operation until they have distributed the majority of their shareholding and throw the price down.

This kind of operation is very risky to investors and also operators. Because they are relying on limits or margin, if there’s a margin or limit cut due to a bad market, the share price will fall sharply if the operator doesn't have enough funds to pick up the shares. In another case, a hostile attack by another operator (which rarely happens, but it happened before.), the attacking operator will throw the price down to force the original operator to bail out at a lower price.

When we are following the big boys, we don’t follow blindly. We choose a steady operator to follow. We need to be smart when we are investing. The risk is not about following the operator, because when you invest in the stock market, the risk is incurred. Risking more or less always depends on our control, not the market or operator. Other than knowing which type of stock you can follow; you need to know how to limit your losses in terms of monetary & also mentally. From our experience and observation of our students, the majority of the investors cannot afford or are unwilling to cut losses because they didn’t expect the losses to be that much, because they are trading more than their emotions can handle. Therefore, they choose not to sell or cut loss and HOPE that one day the price will move back higher.

You may look into this video to understand more about how our risk management can reduce your emotional trade:

https://youtu.be/ebeovsGZcA0

Which type of Operation are we looking at?

Other than those that we mentioned above, we always look into those stocks that have a firm accumulation as the base. You will not believe us that the accumulation can be identified, but usually, these are the stocks retail investors will not even lay their eyes on. Because retail investors want something more solid, ironically, most retail investors don’t know what to look for. Therefore, retail investors believe that the more volume traded, the more liquid is better. Some also include their financial status as part of the consideration.

But, with total “hot funds” circulating in the financial market being more than the fundamental value of all investment assets, most asset values are traded at an overvalue stage. As such, the pricing mechanism is no longer based on the fundamental value, rather it is based on the expectation or future possible growth. That’s why we can see many stocks are overvalued than their true value and still trading higher and higher. Because these funds can no longer be based on the fundamental value of the investment to invest in. So, they invest based on the future possible projection of the investment. This expectation factor varies depending on the individual.

Also, high volume or trading activity does not necessarily mean that the stock is solid. We know operators are creating these volume and price movements, can you still believe actively traded means there’s a lot of demand but not a way to attract your attention?

A smart trader or investor should look deeper into the data shown in those common lists. We need to understand the price & volume movement in minutes and transaction patterns in the particular stock to know the main intention of the operator.

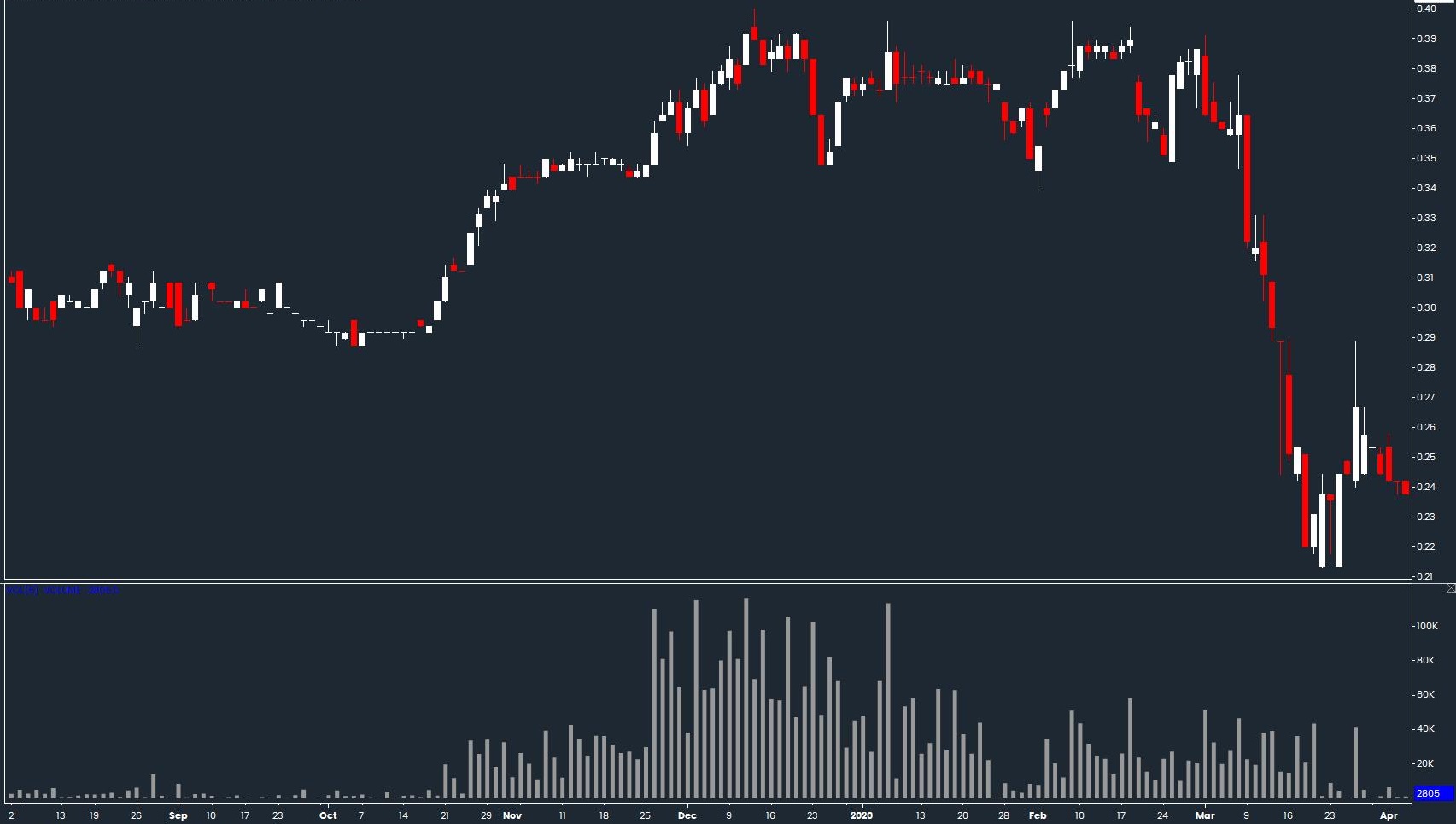

For example, we always try to find stocks that are accumulating by the operator. Usually, they will choose stocks that are not liquid or actively traded during the accumulation period. That is why you will not notice these stocks. While they are accumulating, they will not create high volume or price to avoid attention from the public. Therefore, you will not see these stocks in the Top Active List or Top Gainer list. You will only see these stocks when they want you to see them, so they can sell their shares to you for profits.

The operator will accumulate the shares slowly and quietly with minimal volume and price hike each time. The whole accumulation stage can last from 3 months to 2 years depending on different stocks and operators. So, if you want to follow the operator, we shouldn’t move in when they are accumulating shares, because they have the holding power and we don’t want to trap our fund in a not performing stock for too long. We want our fund to roll as much as possible, jumping around stocks that are ready to markup is a much better choice.

Once they are ready, you can ride along with them until they start to distribute the remaining shares that they have at the final markup stage. Usually, the big boys will take profit on the way up, selling the majority of the shareholding in the markup stage. When the majority of the shares are sold on the way up and left a small shareholding in hand, it is telling us the price is about to peak. Because the operator had their majority of the profit taken at a higher price, it is ok to throw the remaining small amount of shares out at a lower price, which they can still make a profit.

Once the operator is out of the particular stock, there won’t be anyone to mark up the price anymore. Because there’s no point for them to mark up when all of their shares are sold and profit is taken. They can’t make a profit by marking up the price again, at the same time, they won't accumulate again at the high price, because it costs them a higher price per share. Why not throw the price down first and accumulate again at the lower price? The next accumulation could be a few years later after the previous operation. They won’t do it immediately because they need to farm their “marketing material” such as good news, reports, and financial ratios that reflect the market price. Especially those operators who use rumours to attract buyers. Consistently spreading rumours in the market, investors will not believe it. It is like the story of the boy that cried wolf.

Trading becomes simple when you know who to follow in the market. You don’t need insider news or socialising with people that are doing the insider job. Their intentions are all shown in the market with transaction pattern, price, & volume action, which all of us have access to through our trading platform. You just need to know how to read it and act accordingly. We are living in a modern world with information everywhere. You just need to know how to interpret all these data to your advantage.

Find out more about how our Operator Analysis can help you to make your trading journey much easier by learning how to “interpret” these market data in our YouTube Channel link below.

Big Boys Accumulation Explained:

https://youtu.be/mE6RDUrHU6I

Day Trading in the Golden Hour:

https://youtu.be/NUCh3s62LE8

If you want to know more details about our Operator Analysis, join our Facebook/ YouTube Livestream on 27th February 2022, 10am - 11am for a preview of our 6-months training course. You will learn how to interpret or “decode” the big boys' transactions in our course.

Livestream register here:

Facebook: https://fb.me/e/4m4KipRNr

YouTube:

https://youtu.be/r-pgTXSeYyA

For more topics and videos about Big boys in the Bursa Malaysia Stock Market, follow the link below to our YouTube Channel or Facebook page.

Please give us a LIKE to support our contribution if you find this blog helpful to you. Thank you!

To find out more about our Operator Analysis Pro-Trader Course, visit this link : https://bit.ly/3NVMHfS

Website : www.roundnsurge.com

Facebook: www.facebook.com/roundnsurgeofficial

Youtube: www.youtube.com/c/RoundSurgeoperatoranalysis

Instagram: @roundnsurge

Kelvin's Instagram: @kelvinnny810

Malaysia stock market is a unique market, hence it requires a customized trading approach to tackle & swerve. Many existing traders in Malaysia apply a plug-and-play strategy from the overseas stock market, but it is not necessarily the best strategy to trade in KLSE. This is due to the difference in local and overseas stock market regulation and the size of market participants of institutional funds & retail investors.

“True traders react to the market.” is the backbone of our trading method. Our findings and strategies are developed through years of trading experience and observance of the operating style in Malaysia’s stock market.

Trading Account Opening

They are offering an IntraDay trade brokerage rate at 0.05% or RM8 whichever is higher for day trading stocks RM 50,000 & above-transacted volume (buy sell the same stocks on the same day). Buy & hold at 0.08%or RM8 whichever is higher.

Open a cash account now at the link below :

https://registration.mplusonline.com/?ref-id=R311

As Kelvin’s trading client, you will be exclusively invited to join Kelvin’s weekly webinar and telegram group. Click here to join.

For more inquiry contact him by email: kelvinyap.remisier@gmail.com or 019-5567829

If we have missed out on any important information, feel free to let us know and feel free to share this information out but it will be much appreciated if you can put us as the reference for our effort and respect, thank you in advance!

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons do not warrant, represent, and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever. No reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for your own trading decision. The author of this blog is not liable for any losses incurred from any investment or trading.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.