Maximize day trading potential returns 10%-50% a day [ Hang Seng Index : CBBC VS. STRUCTURED WARRANTS ]

roundnsurge

Publish date: Tue, 27 Jun 2023, 01:30 AM

When it comes to trading on the Hang Seng Index (HSI), there are a variety of options available to investors. Two popular choices are Callable Bull/Bear Contracts (CBBC) and structured warrants. While both instruments provide exposure to the HSI, it's important to understand their distinct differences. In this blog, we will explore the dissimilarities between CBBCs and structured warrants on the HSI, highlighting their unique characteristics and potential advantages.

Delta:

One significant difference lies in the delta value. CBBCs have a delta close to 1, meaning they closely track the movements of the underlying HSI. On the other hand, structured warrants typically have a lower delta, which may result in a less precise correlation between the instrument and the HSI.

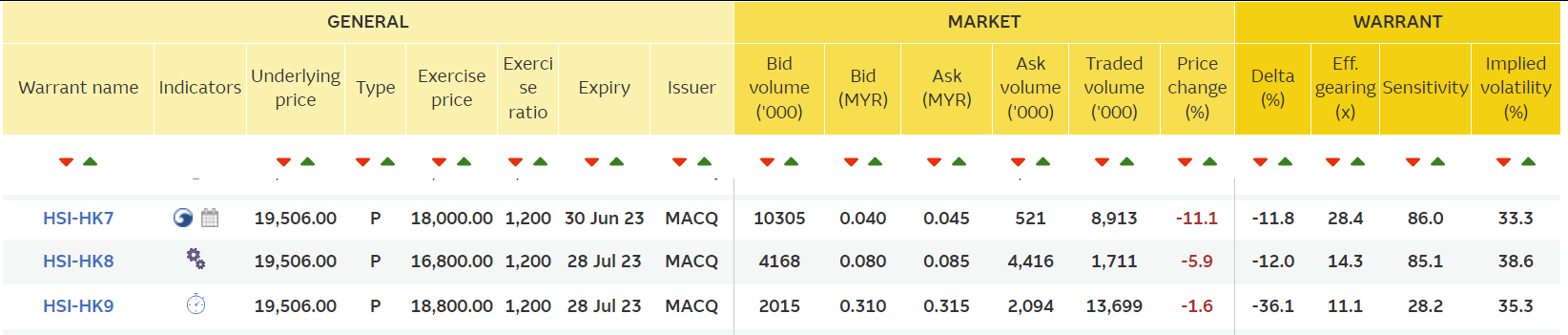

Example:

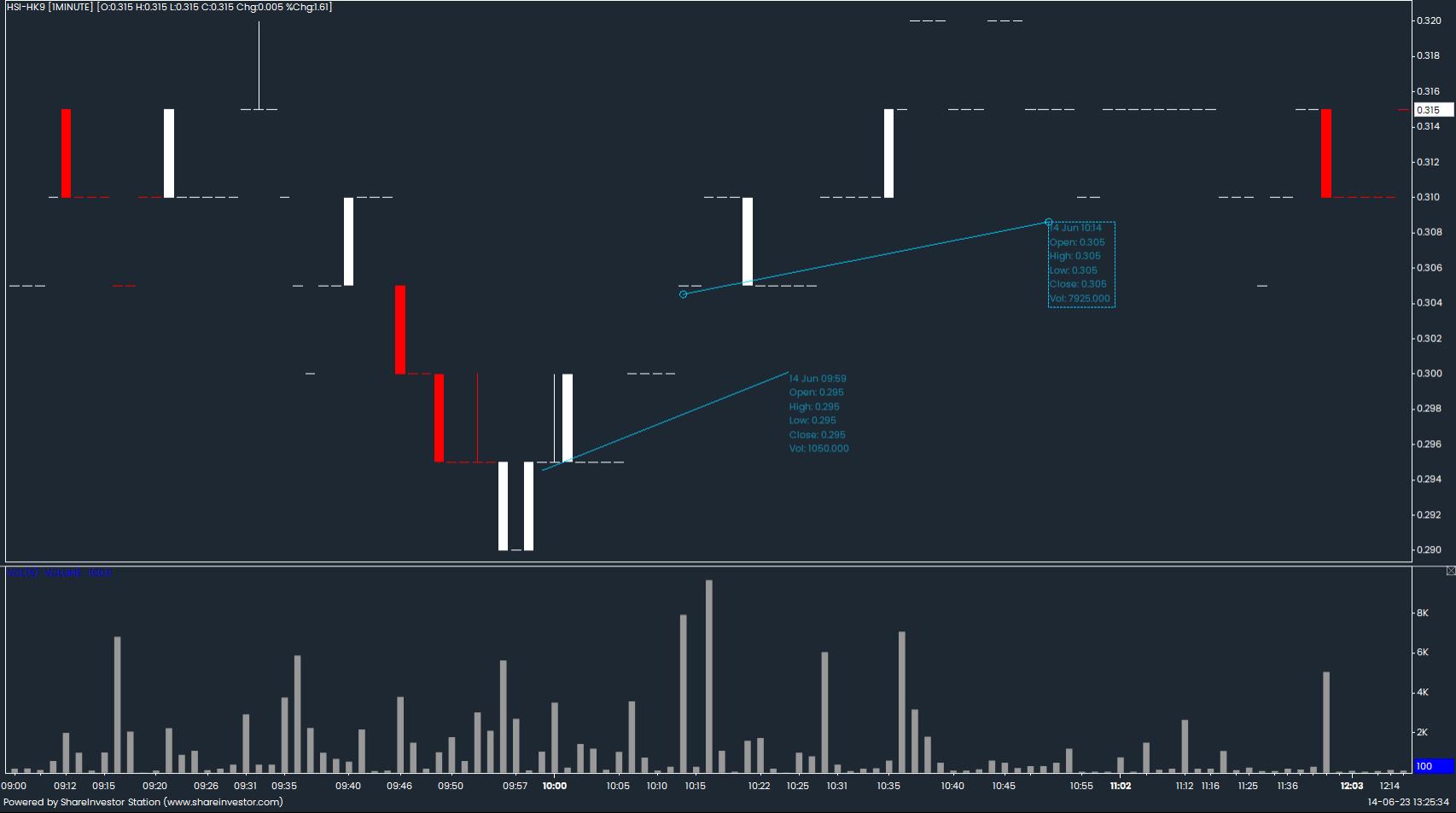

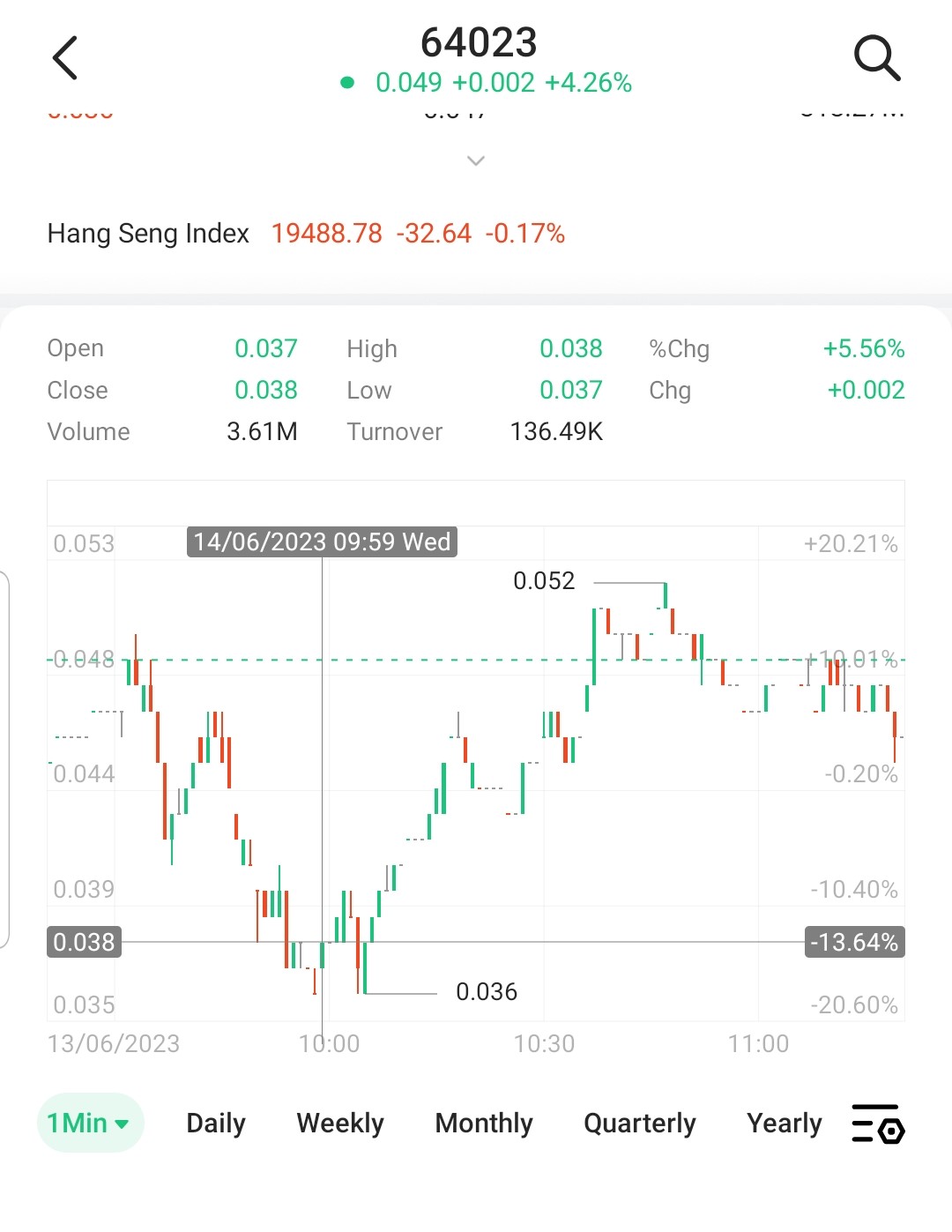

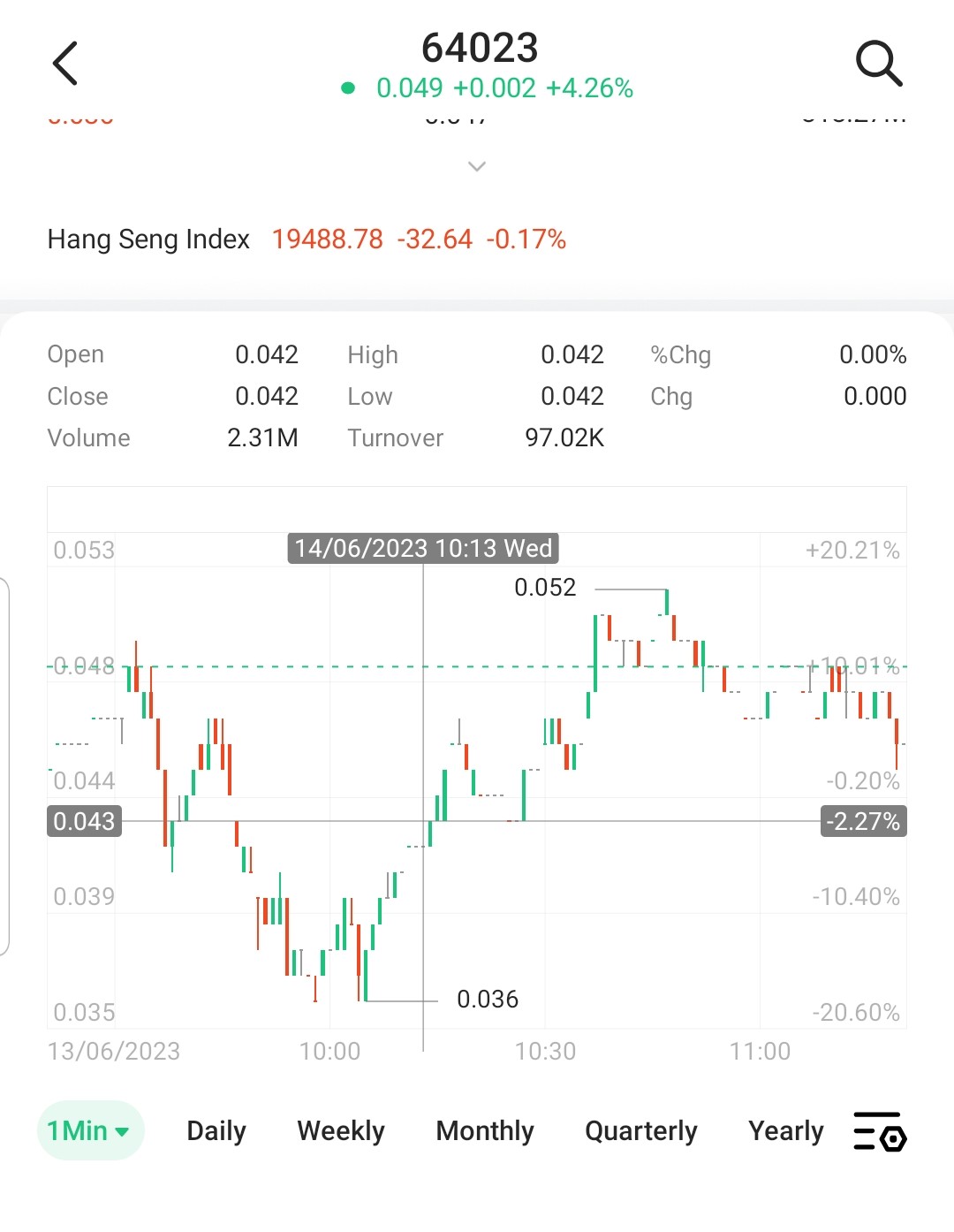

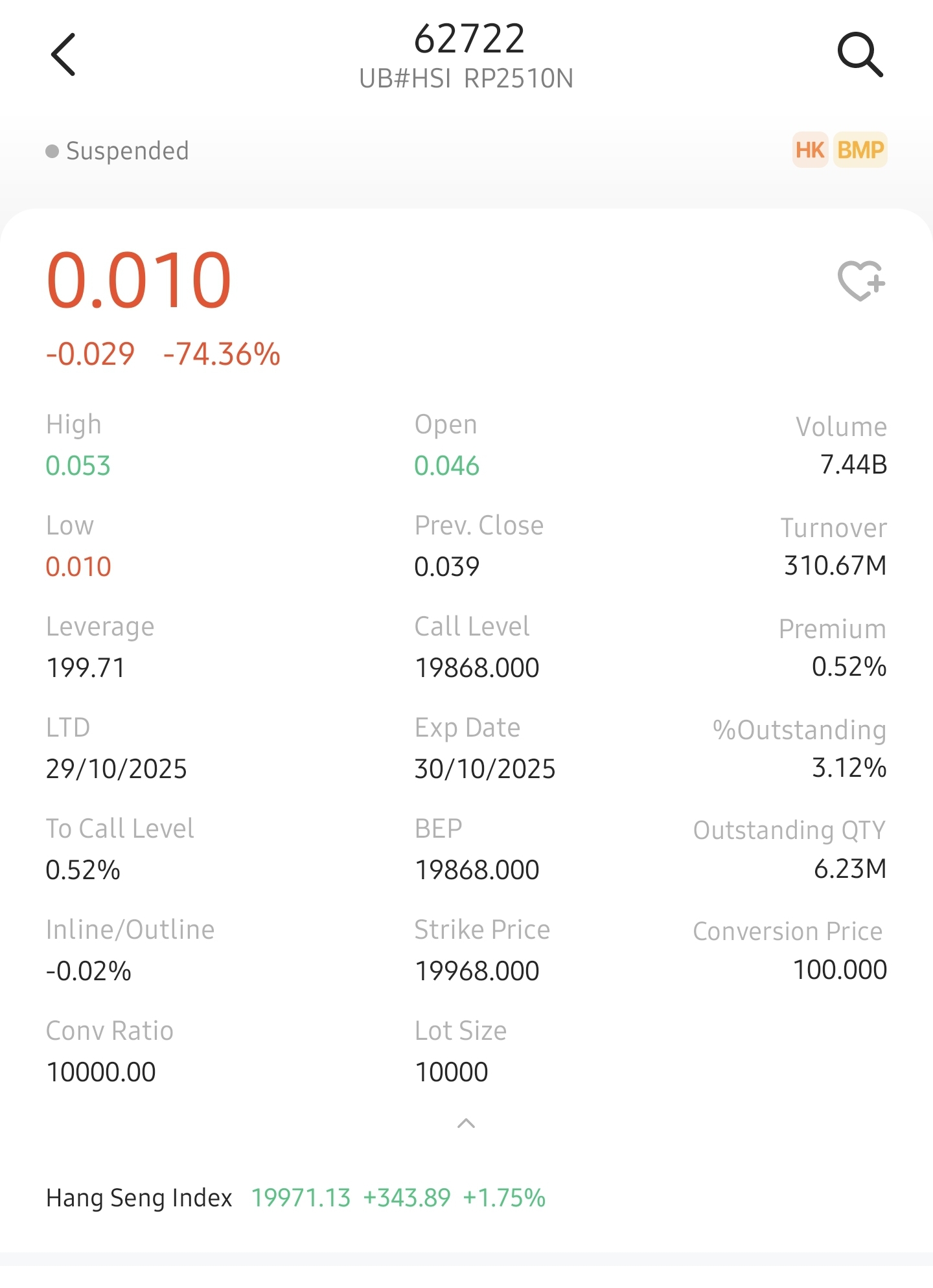

From the comparison of both Put CBBC & Put Structure warrant you can see the price of each fluctuation at the same time is different. We select the most responsive structured warrants based on the sensitivity & gearing for comparison.

HSI-HK9 moves only 2 ticks higher in the same period, while HSI-CBBC moves 5 ticks higher.

For instance, with a trading cost of RM2,950, HSI-HK9 is bought at 10,000 units, while HSI-CBBC is bought at 130,000 units (per unit in HKD 0.038, RM2,950 = HKD 4,980). Now, let's observe the difference in value.

HSI-HK9

Vlue : RM2,950

Per units : RM 0.295

Units : 10,000 units

Per 0.005 : +-RM 50

Price fluctuation : 2 ticks

Returns in this case : +RM100

HSI-CBBC

Value : RM 2,950 = HKD 4,980

Per units : HKD 0.038

Units : 130,000 units

Per 0.001 : +-HKD 130

Price fluctuation : 5 ticks

Returns in this case : +HKD 650 = RM350

In terms of value, CBBCs allow you to trade more, and their price fluctuation is more responsive to the underlying asset, HSI. In the same period and underlying movement, CBBC prices move 2.5X more than structured warrants and generate 3.5X more profit. From a profitability standpoint, CBBCs come out on top.

Pricing Mechanism:

CBBCs employ a transparent pricing mechanism, derived directly from the underlying asset's performance. This transparency provides traders with a clear understanding of the instrument's value. In contrast, structured warrants often incorporate additional factors into their pricing, which can make it more challenging for traders to evaluate their fair value accurately.

Leverage:

CBBCs generally offer higher leverage compared to structured warrants. This means that traders can amplify their positions using a smaller capital outlay when trading CBBCs. However, it's important to note that higher leverage also entails higher risk, and traders should exercise caution and implement proper risk management strategies.

Expiry and Knockout Feature:

CBBCs have a predetermined expiry date, after which they will be suspended. Moreover, CBBCs have a knockout feature, meaning they will become worthless if the Hang Seng Index price moves near to the CBBC strike price. In contrast, structured warrants do not have a knockout feature, allowing traders to hold their positions until expiration.

Trading Flexibility:

CBBCs offer traders the flexibility to profit from both rising (Bull) and falling (Bear) markets, as they are available in both long and short positions. Structured warrants, on the other hand, typically provide exposure to either long or short positions but not both.

Conclusion:

While both CBBCs and structured warrants provide access to the Hang Seng Index, understanding their differences is crucial for traders seeking to optimize their trading strategies. CBBCs offer a more direct and transparent approach, closely mirroring the performance of the underlying asset. On the other hand, structured warrants provide traders with more flexibility in terms of holding positions until expiration. Ultimately, traders should consider their risk tolerance, trading objectives, and market outlook when choosing between CBBCs and structured warrants on the HSI.

If you're ready to elevate your trading journey and unlock the full potential of CBBC, M+ Global is your ideal partner. Experience the thrill of explosive profits, supported by Kelvin’s expertise, daily sharing, and robust trading platform. Don't wait any longer—seize the opportunity to join M+ Global and start trading CBBC today!

Open your trading account with M+ Global now by clicking the following link: https://m.global.mplusonline.com/kh/status/entry/transit?lang=en_US&_scnl=MTUO

For any inquiries or assistance during the account opening process, feel free to reach out to Kelvin or message us. We're here to help you embark on a successful and rewarding CBBC trading journey. Happy trading!

Disclaimer: Trading in financial instruments involves risk, and it is important to conduct thorough research and seek professional advice before engaging in any trading activity. The information provided in this blog is for educational purposes only and should not be construed as financial advice.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.