Why Traders Are Switching to CBBCs from Stocks, CFD Forex, Cryptocurrency, and Futures Contracts

roundnsurge

Publish date: Mon, 22 May 2023, 01:32 AM

In today's fast-paced trading world, finding opportunities to generate substantial profits is the ultimate goal for traders. If you're tired of traditional trading options like Forex, cryptocurrency, and futures contracts, it's time to explore a revolutionary trading instrument that has the potential to make your profits soar. Introducing CBBCs (Callable Bull/Bear Contracts), a game-changer in the trading arena.

Unleashing Huge Profits in a Day:

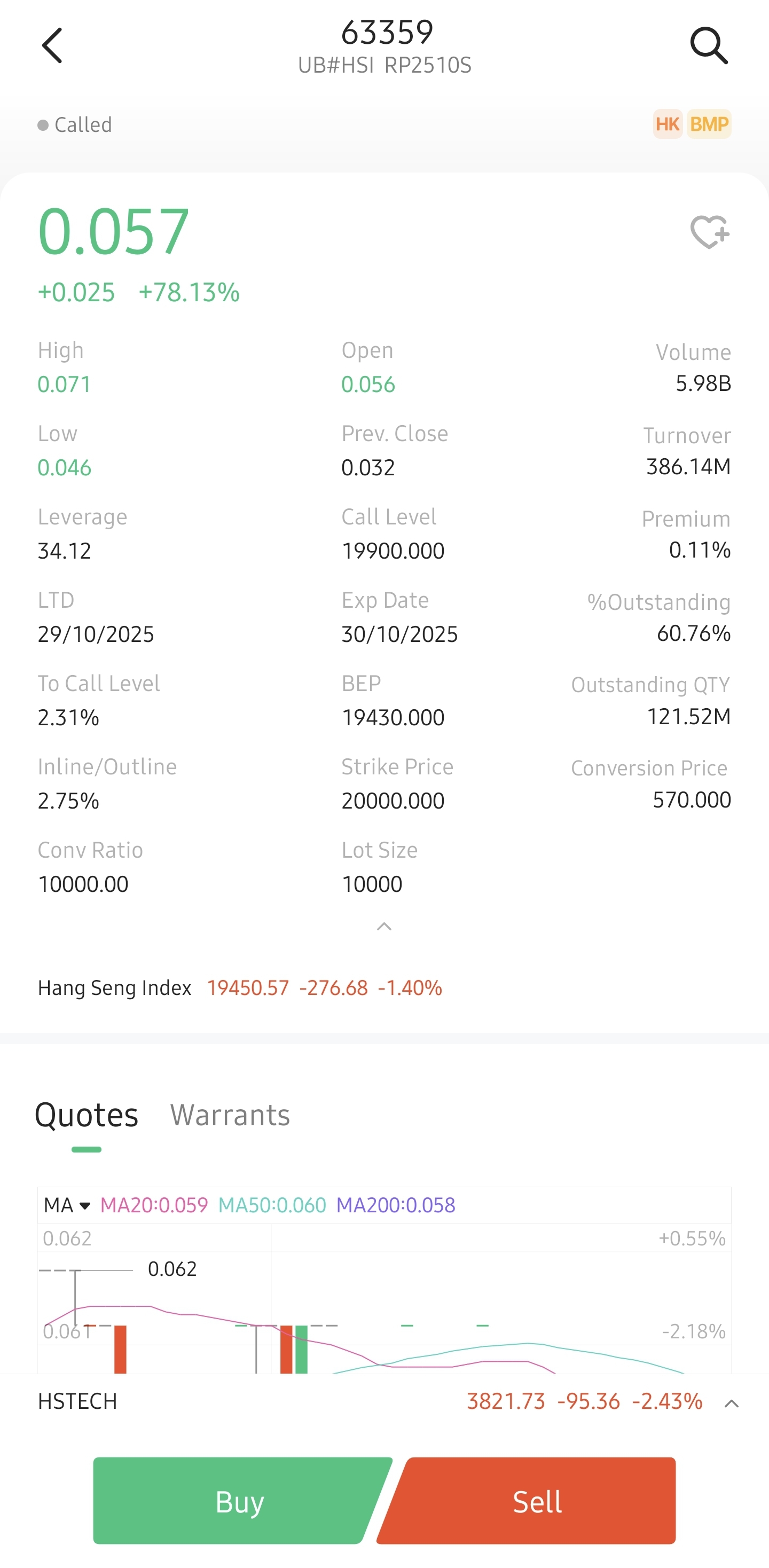

One of the most remarkable features of CBBCs is their ability to generate massive profits in a single day. Unlike traditional trading options that may require long holding periods, CBBCs offer the potential to achieve returns of up to 80% in a day! This incredible profit potential makes CBBCs an attractive choice for traders seeking rapid and substantial returns on their investments.

Why CBBCs Outshine Forex, Cryptocurrency, and Futures Contracts:

Limited Risk, Maximum Control:

CBBCs provide built-in risk control mechanisms that mitigate potential losses. Unlike futures contracts which require huge capital, which can also expose traders to significant risks and margin calls, CBBCs offer defined strike prices and known maximum risk upfront. With CBBCs like HSI CBBC typically priced within the range of 0.02 to 0.06 HKD, the risk is limited to the amount invested in the CBBC.This feature empowers traders with greater control over their investments and allows for effective risk management.

With minimum lot size, per trade for Hang Seng Index’s CBBC above is value around HKD 320/ MYR 185.

Price Responsiveness:

CBBCs closely track the price movements of underlying assets, making their pricing highly responsive compared to Forex, cryptocurrency, and futures contracts. While factors like implied volatility can significantly impact the pricing of other instruments, CBBCs are more immune to such fluctuations. This responsiveness enables traders to identify and capitalize on lucrative trading opportunities with potentially higher returns.

Regulatory Approval and Transparency:

CBBCs are approved by regulatory bodies and listed on reputable exchanges, providing traders with a regulated and transparent trading environment. Unlike offshore CFD brokers, which may operate in less regulated environments with opaque pricing structures, CBBCs adhere to strict regulatory standards. The transparent pricing of CBBCs ensures that traders have access to fair and reliable pricing information, giving them confidence in their trading decisions.

CBBCs can now be traded with a local licensed broker regulated by the Securities Commission (SC). This regulatory approval ensures a safe and secure trading environment for traders, giving them peace of mind knowing that their investments are protected by the regulatory framework. By trading CBBCs through a licensed broker, you can access transparent pricing, reliable execution, and adherence to strict regulatory standards.

To start trading CBBCs with confidence, I recommend signing up for a trading account with my trusted broker partner. By using the following link https://bit.ly/3OtYKFp, you can create your account easily and have a chance to receive 1 free US share worth up to RM 760 with a minimum RM 1,000 deposit (Promotion ends on 15th June 2023). [Share are given out randomly, available shares are TESLA, APPLE, GOOGLE, SHELL, Coca Cola, Manchester United, Krispy Kreme, & SNAPCHAT.]

This ensures that you receive optimal support, valuable insights, and the latest market information to enhance your trading experience. Take advantage of this opportunity and embark on your journey to unlocking the enormous potential of CBBCs with the guidance of Kelvin.

Small Capital Requirements:

Traders can start trading CBBCs with a small capital as low as RM 1000. However, we recommend starting with RM 2000 to provide some buffering. CBBCs like HSI CBBC often price between HKD 0.02 to HKD 0.05, allowing traders to participate in trading with a small amount. In the worst-case scenario, traders may only lose the amount they invested in CBBCs, minimizing potential losses.

Conclusion:

CBBCs offer an unparalleled opportunity to achieve substantial profits in a short period, with the potential to generate returns of up to 80% in just one day. Their limited risk, price responsiveness, regulatory approval, transparent pricing, and the ability to start trading with small capital make CBBCs a superior trading instrument compared to Forex, cryptocurrency, and futures contracts. However, it's crucial to conduct thorough research, understand the risks involved, and develop a sound trading strategy when venturing into CBBC trading.

To further explore the immense potential of CBBCs and learn how to maximize your trading returns, we invite you to join our upcoming webinar hosted by Kelvin, a seasoned trader with extensive experience in HANG SENG INDEX trading. In this webinar, Kelvin will share his insights, strategies, and practical tips on how to harness the power of CBBCs for profitable trading. Don't miss this opportunity to gain valuable knowledge and take your trading skills to the next level!

If you're eager to start your CBBC trading journey early and receive guidance from Kelvin, you can register a trading account with him. Kelvin's expertise and personalized support will help you navigate the intricacies of CBBC trading and make informed trading decisions. Open a trading account with Kelvin today and embark on a rewarding trading experience with the guidance of a seasoned professional.

Unleash the power of CBBCs and embark on a journey of massive profits and trading success. Get ready to revolutionize your trading experience and seize the incredible potential that CBBCs offer.

Date : 24 May & 28 May 2023

Time : 8:30PM

Register link : https://bit.ly/43in2GB

Disclaimer: Trading involves risks, and it's important to conduct thorough research, seek advice from a financial professional, and carefully consider your financial situation before engaging in any trading activities.

Join our webinar and register your trading account with Kelvin to kickstart your CBBC trading journey today!

More learning articles in our blog, YouTube videos, & our upcoming webinars.

Blogs : https://www.roundnsurge.com/news

Youtube: https://www.youtube.com/@RoundnSurge89/

Facebook : https://www.facebook.com/RoundnSurge89

Instagram : https://www.instagram.com/roundnsurge/

Webinars : https://www.roundnsurge.com/events

Disclaimer :

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons do not warrant, represent, and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever. No reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for their own trading decisions. The author of this blog is not liable for any losses incurred from any investment or trading.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.