Trading strategy for down market

roundnsurge

Publish date: Wed, 13 Sep 2023, 04:45 PM

Stocks in KLSE have been going down in the past 1 week, the allure of buying low can be irresistible at this moment. Especially if you are trapped in falling stocks. We're often tempted to seize the opportunity when prices seem cheap. Yes, yes, we all know don’t buy when the stock price is lower than before or we felt cheap & worthy to invest. But the problem is how!? We all know we have to buy low and sell high, all these gurus say it so easy, the price is trading at the support line! Then the price falls lower. Our indicators setup showing the price bottom! Then the price goes lower…

We all want a method that can find the bottom more precisely, don’t need to be perfectly bottom, but at least it won’t always disappoint us like support lines. We had the same problem like every investor in the market, until we discovered the golden rule of investment, TIMING! Since the 1st day of our investment, everyone is always asking what is the best entry price? What is the best take profit price? But the truth is, there isn't a best price for entry or profit. That’s why you will see investors are buying lower & lower & lower, because they are chasing the “BEST PRICE”.

Investment timing is important to retail investors, because we are not the market maker. We don’t decide or influence the price. Furthermore, we have limited capital, we want our money to compound as frequently as possible. Since then we never looked into “BEST PRICE” & started finding ways for best timing for entry & taking profits.

Before we dive into the practical of how to analyse the price & volume to find the bottom entry timing. Here are some important rules we need to follow, just like understanding the rules of football or badminton first, then step into physical training to win the game. Let’s jump into the first step of mastering the art of timing in the stock market.

1. The Power of Patience

Wait for the Right Timing: If you are finding a tool to make profits in the stock market, Patience is the number 1 powerful investment tool you need for money making. Whether it is short term trade or long term investment, you will never make profits without having patience.

Start training your patience, you might not get it at the bottom’s bottom, but at least you won’t get cutted by the falling knife.

2. Understand the Market Cycle

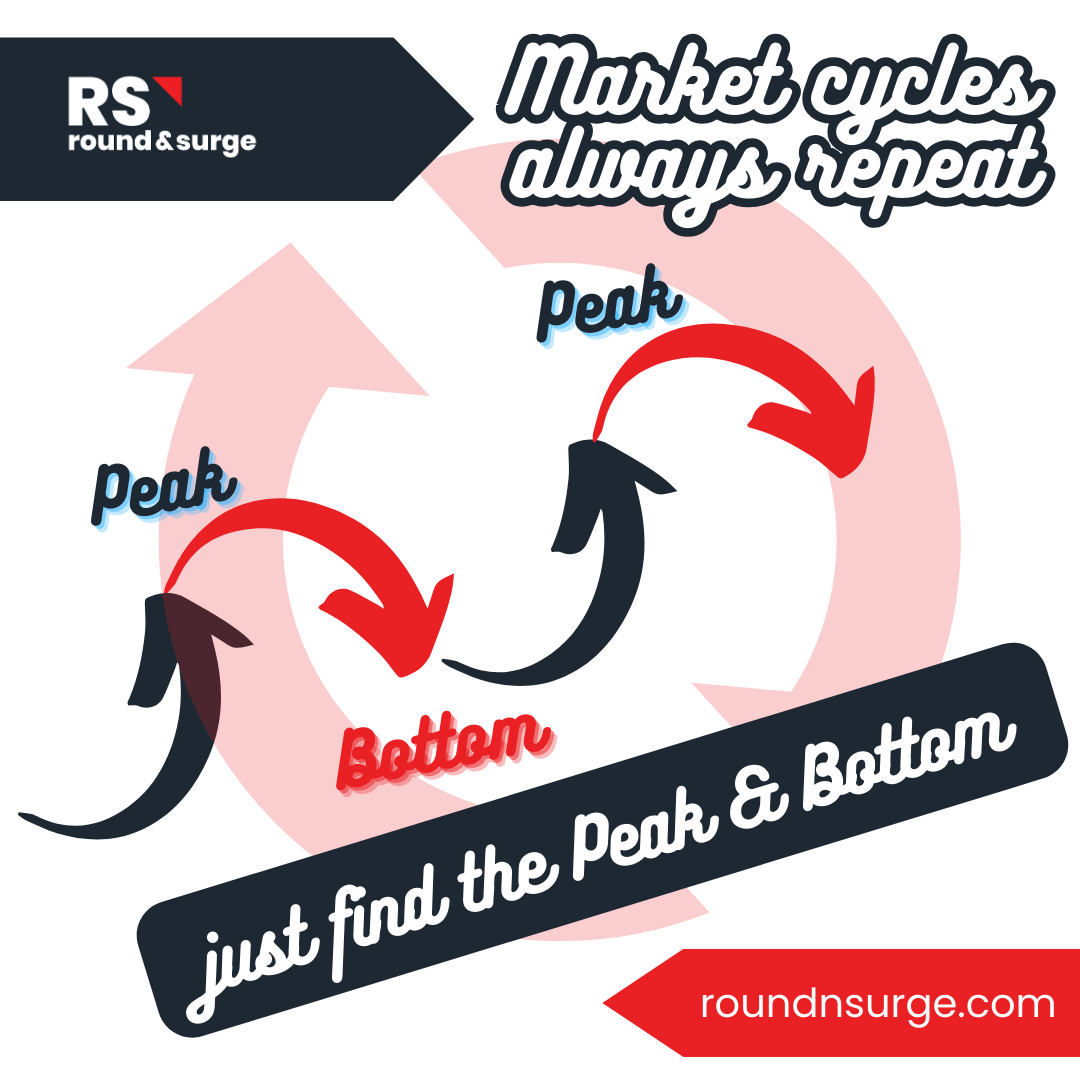

Market Cycles Repeat: Markets follow a cyclical pattern: up, peak, down, bottom, up, and repeat. To succeed, you must recognize the peaks and bottoms of these cycles.

3. Avoid Gut Feelings and Outdated Data

Don't Trust Your Gut: Judging the price bottom or top based solely on intuition or outdated data can lead to costly mistakes. Instead, pay attention to market dynamics and the actions of larger players.

The information we can source from the media is happening at the moment, which means the market has already reacted to it.

You might have your own thoughts of the future development of the industry, however, it will takes timeeeeeeeeeeeeeeeeeeeeeeeeeee for the market to react. The waiting will demotivate you on holding the investment, such as other stocks performing better, price falling, & so on.

Embrace New Approaches

Consider New Techniques: Using a 5-minute chart to time the bottom can be more effective than relying on laggy indicators or support lines. It's a fresh approach that can yield better results.

We will briefly share the analysis to find the short term price bottom below. If you're intrigued, don't hesitate to explore this strategy. Experiment, and if you find it working for you, consider delving deeper.

Understand the big boys operation

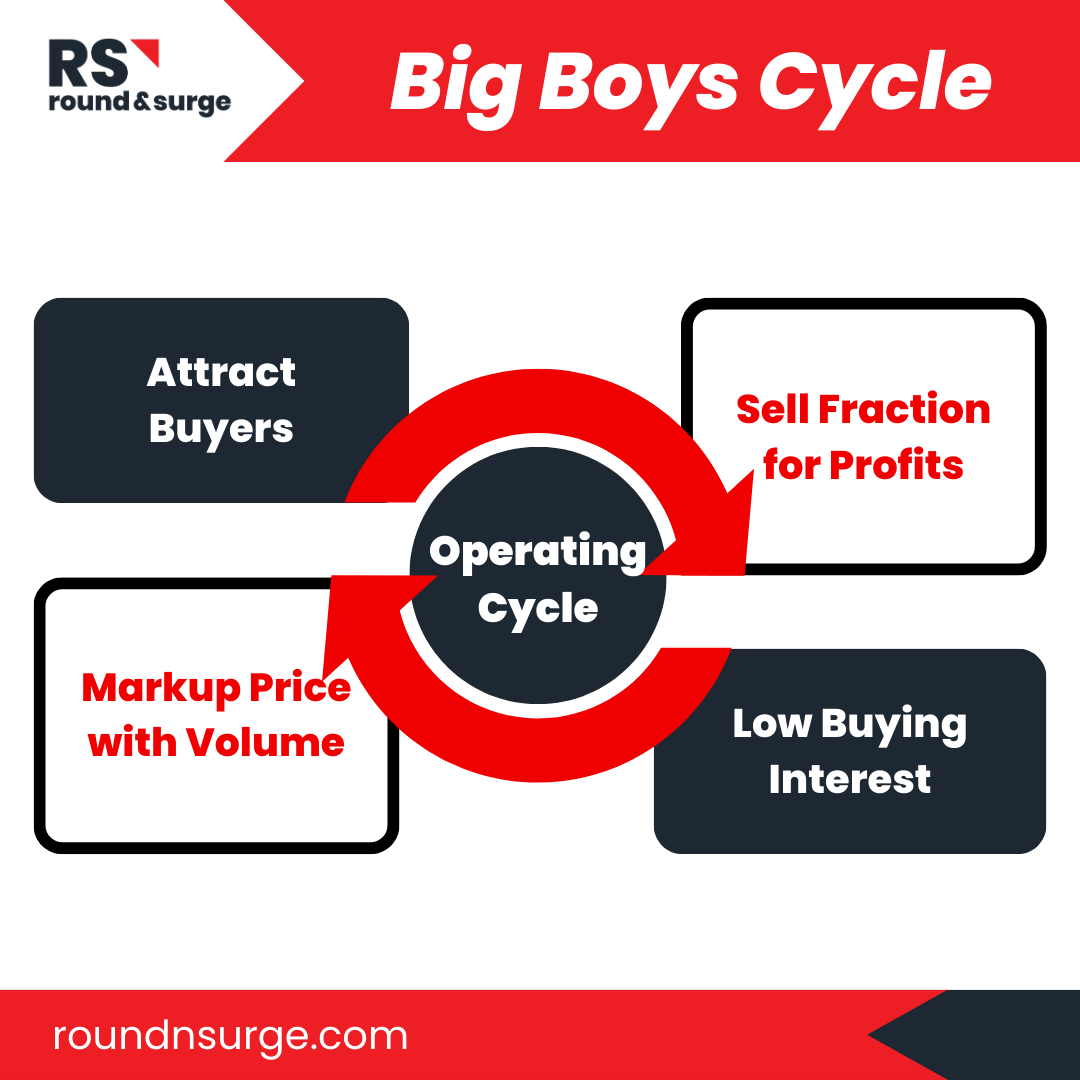

Stock prices are always influenced by the big boys based on their different intentions like the chart above. Big boys mark up prices to sell their shares at the higher price for profits, that’s why you will see stocks will always rebound after a retrace or sharp fall. This is because the big boys want to give buying confidence to the retail investors by marking the price up. Then retail investors will place their buy orders at the lower buy price (retail investors always follow their own best buy price).

Once they notice there are enough buyers queuing at the lower buy price, they will cancel their own buy orders & sell to retail investors who park their buy orders at the lower buy price.

When there are lesser buyers coming into their stocks, they then start to mark the price higher with high volume to attract the next round of buyers in. Repeating the cycle until they sold all their shares.

Now you know how they operate, as long as we don’t fall into the trap after the big boys mark up the price then we are safe. Next is to find the point of entry for our benefits, when the big boys mark up.

Follow their footprints

We all know numbers don’t lie, but we are not talking about the accounting numbers. But the transaction numbers, this is where they can’t fake their presence in the stock market. They can do many funny transactions to fool the retail investors. But when you know their intentions well, you will know which transactions are real & which ones are just a “show” to attract buyers.

Analysing the transaction might be too difficult to understand in words without live market demonstration. Let’s start with the easy way to find the big boys intention, by reading the 5 minutes chart.

One key metric to look at is volume. Price moves sideways after a high volume price fall doesn’t make sense at all right? High volume price fall often indicates strong selling pressure, why does the price still stay at the same level? When the price & volume shows illogical formation, this means that the price is bottom but is not ready to mark higher yet. We still need to wait for the big boys to make the call.

Sign of the beginning of next price up

After a price is bottom formed, it might take a couple of days for the big boys to mark the price up. So we will need to watch those stocks that form a bottom, whether their price movement in the 5 minutes chart is showing signs of closing higher. Once we identify the price is closed higher, then it is one of the signs that the big boys are going to mark the price up again.

Visit Our Blog: We've shared extensive insights on catching market bottoms using 5-minute charts. Explore our blog for in-depth analysis and practical tips.

Join Our Community: If you share our belief in the power of timing, join our Telegram group. Connect with fellow traders and be part of a community that values precision in trading.

Join in link : bit.ly/m/joinrns

Remember, in the world of trading, timing is often the difference between success and failure. Don't settle for buying low; aim to buy right.

Disclaimer :

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons do not warrant, represent, and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever. No reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for their own trading decisions. The author of this blog is not liable for any losses incurred from any investment or trading.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.