[GOOD NEWS] MOF - Tax Exemption on Foreign Income & Max RM1000 for Bursa Stamp Duty

savemalaysia

Publish date: Thu, 30 Dec 2021, 07:35 PM

Siaran Media MOF - Foreign Income & Bursa Stamp Duty

Tax exemption on income from foreign sources until 2026

KUALA LUMPUR: Income from foreign sources will be exempt from income tax for five years, from Jan 1 until Dec 31, 2026, says the Finance Ministry on Thursday (Dec 30).

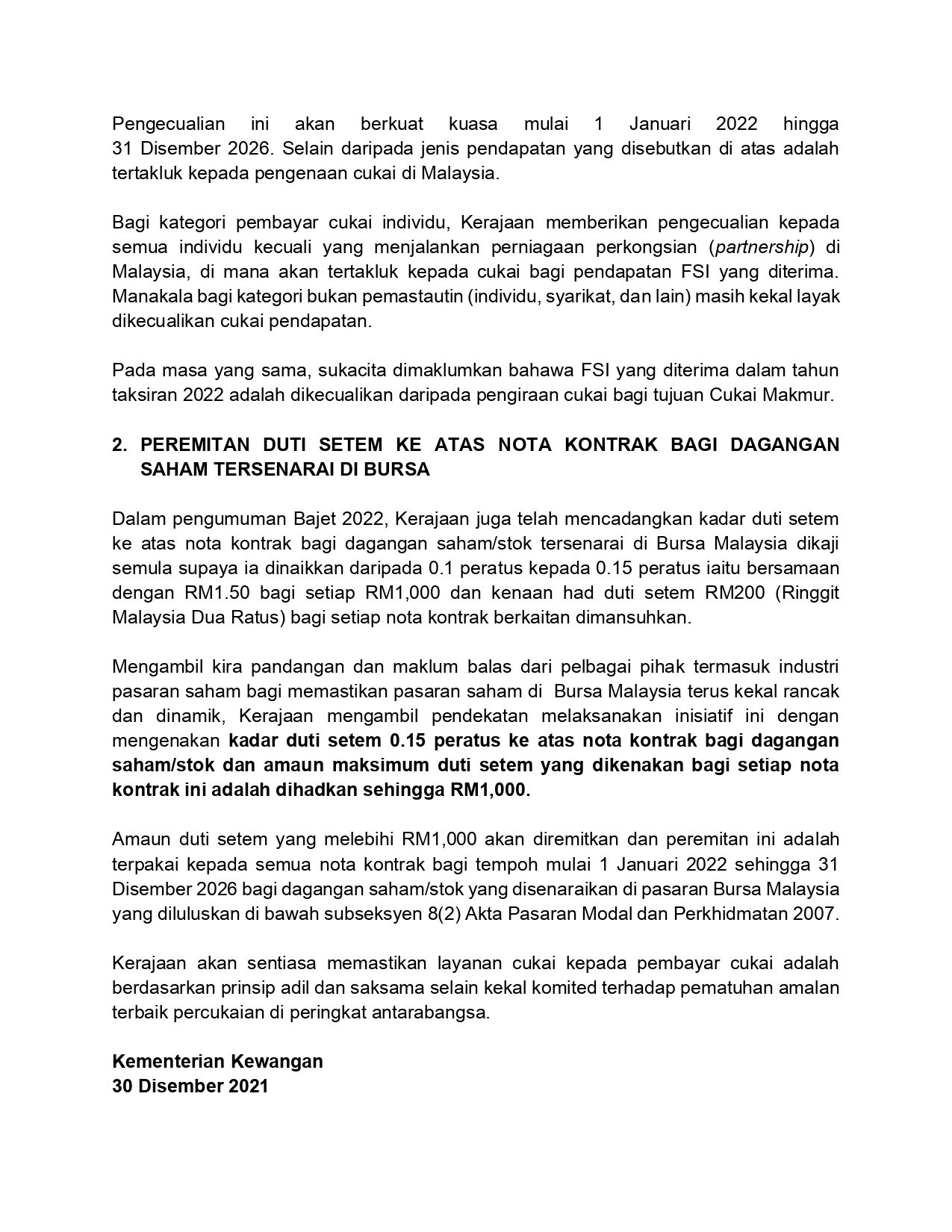

Tax exemption is granted on dividends to companies or limited liability partnerships, while individuals will be eligible for exemption for all types of income.

“For individual taxpayers, the government will give exemption to all individuals except those in a business partnership in Malaysia, whereby they are subject to FSI (foreign source income) taxation.

“For non-resident taxpayers (individuals, companies, and others), they remain exempted from income tax,” the ministry said.

The ministry also announced that foreign income received in the 2022 year of assessment is exempted from tax calculation for the purpose of prosperity tax.

The government had earlier announced in the 2022 budget that foreign income will be taxed from Jan 1.

The ministry also announced that the government will impose a stamp duty of 0.15% on share contract notes, up to a maximum of RM1,000. Any amount over that limit will be remitted, and is applicable for all contract notes from Jan 1 to Dec 31, 2026 for all stocks listed on Bursa Malaysia.

The plan to impose a stamp duty of RM200 for every contract note is thus abolished. - Bernama

https://www.thestar.com.my/news/nation/2021/12/30/tax-exemption-on-income-from-foreign-sources-until-2026

More articles on save malaysia!

Created by savemalaysia | Jul 22, 2024

Created by savemalaysia | Jul 22, 2024

Created by savemalaysia | Jul 22, 2024

Created by savemalaysia | Jul 22, 2024

Created by savemalaysia | Jul 22, 2024

Created by savemalaysia | Jul 22, 2024

Created by savemalaysia | Jul 22, 2024

Discussions

The effect of the increase in stamp duty tax

1.) Our KLSE is a very small market, there are very small in term of market capitalization.

2.) All the shares quoted in KLSE are dirt cheap, many of them are less than USD10 cents in their share prices.

3.) The new rule to increase stamp duty rate to 0.15% with capping at RM1,000 is not a good move by the government. This will reduce the volume of transaction in KLSE especially to the traders.

4.) Big foreign funds may not be interested to invest in KLSE again because the stamp duty tax at 0.15% is very high.

KLSE is already ignored by many fund managers, this increase will make the situation worse.

Thank you.

2021-12-30 21:00

OTB.. I disagree. No cap rule before was horrendous. This is a vast improvement.

2021-12-30 21:07

After 1998 most foreign investors (I believe mostly Sporean) has abandoned Bursa

Ever since then kaki goreng kaki song

2021-12-30 21:11

the latest move is a good one. There might be a lot of transactions by the same trader, hence, it helps him save a lot with the cap..

2021-12-30 22:22

MARKET OPERATOR IS RICHER SINCE THEY MAKAN MOST IKAN BILIS. THEY DONT MIND PAYING MORE.

2021-12-30 23:42

Still ok for big boys/institutions/operators as they are the main goreng kaki. Sure their goreng stamp duty exceed rm1,000.00 so makes no different to them. As long as big players goreng, market would maintain active. Of course not better than before. Market would be lacklustre if no big players/operators to goreng.

2021-12-31 07:41

Time of inflation, we cannot escape commodities including stock market, prices keep going up. So, Bursa have to balance up between the increase and more so the foreign investors.

2021-12-31 08:09

No choice lah. Gomen has to tax us. You can't expect the Gomen to tax those EPF contributors (46%) who have less than RM1,000 in their accounts, right?

2021-12-31 09:25

Bursa Malaysia ends sharply higher on last trading day of 2021 https://www.thestar.com.my/business/business-news/2021/12/31/bursa-malaysia-ends-sharply-higher-on-last-trading-day-of-2021

2021-12-31 19:36

trading2019

Tomorrow, KLCI gap up! Hahaha

2021-12-30 20:57