MIDF Research has initiated coverage on security-based information communications technology (ICT) solution provider Datasonic Group Bhd – touted as a darling general election stock – with a “buy” call and a target price of 57 sen/share.

The research house deemed Datasonic’s valuation as justified in view of the group’s improved prospects, mainly in view of anticipated pent-up demand for travelling documents in tandem with the easing of travelling restrictions.

“On top of that, the management is confident to secure new contracts for the soon-to-be-rolled-out new generation MyKad as well as contract extension for solutions related to passport, MyKad, and i-Kad in addition to the national digital identity (ID) cards on the back of its readied technology,” MIDF Research pointed out in its maiden coverage of Datasonic.

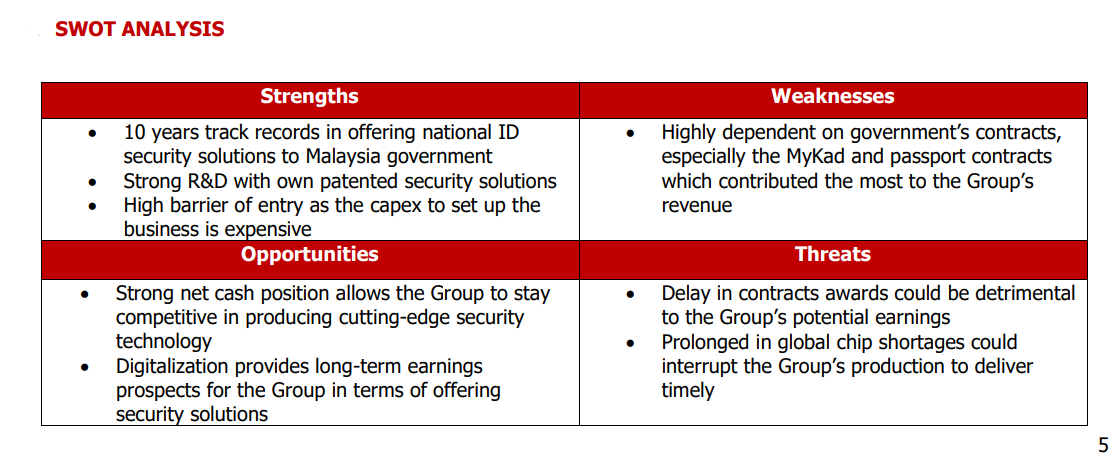

“All-in-all, we believe that Datasonic’s commitment to stay ahead of the security technology makes it much more appealing than its peers to continuously be selected as the national ID security related solutions’ vendor.”

Moving forward, MIDF Research expects Datasonic’s earnings to grow at a compound annual growth rate (CAGR) of 106.9% over the FY3/2022A-FY3/2025F period, driven by the pent-up demand for passports due to the lifting of travel restriction as well as outstanding expired and non-renewed Malaysian passports of circa 4.5 million units.

“We think Datasonic could deliver another 2.5 million to three million units of passports over FY3/2023F-FY3/2025F, converting into sales of RM175 mil to RM210 mil respectively,” projected the research house.

“We remain optimistic that the group could secure the new generation of MyKad contracts as well as the National Digital ID (NDID) projects which are expected to be rolled out soon given its sturdy order book, proven track record of winning government’s projects, and competitive advantage in terms of high quality security product features and services.”

On the hindsight, below are some key risks that Datasonic might encounter as envisaged by MIDF Research:

- Failure in contract bidding: The group is vulnerable to competition from other market participants as it is required to go through a rigorous bidding procedure via competitive tendering in order to secure or extend a contract from its clients;

- Global chip shortages: Datasonic, like other tech players, is not shielded from the ongoing global issue of chip shortages.

- Inflationary pressure environment: Inflationary pressures may impact the group’s revenue because people may postpone their planned trips thus reducing the demand for travel documents especially passport (both new issuance and renewal).

- Arrival of new variants which could spark another travel restriction: The likelihood of another COVID-19 variant or an unrelated pandemic that causes lockdowns or travel restrictions could deal a severe blow on the group’s business although the gradual re-opening of borders has tremendously aided in reviving the demand for passports.

At the close of today’s mid-day trading, Datasonic was up 0.5 sen or 1.06% to 47.5 sen with 954,800 shares traded, thus valuing the company at RM1.41 bil. – July 20, 2022