Follow Kim's Stockwatch!

TITAN RISE FROM ASHES!!! - THE NEXT "KABOOM STOCK"!!!

sparta

Publish date: Wed, 18 Oct 2017, 10:54 PM

Source by telegram (Real live trading). We have real live trading session at this handphone application Telegram which can download from GOOGLE PLAY

WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

----------------------------------------------------------------------------------------------------------------

DATE : 18th October 2017

Stock : LCTITAN RM5.35

Target Price : RM5.80 / RM6.20

THE INFO

"After read some covered stories past 1-2 month and some news on rumors. I would to see is stock may RISE higher as much it can in short-term! Watch and dont miss this opportunities". - Kim Spartan

THE KEYNOTES

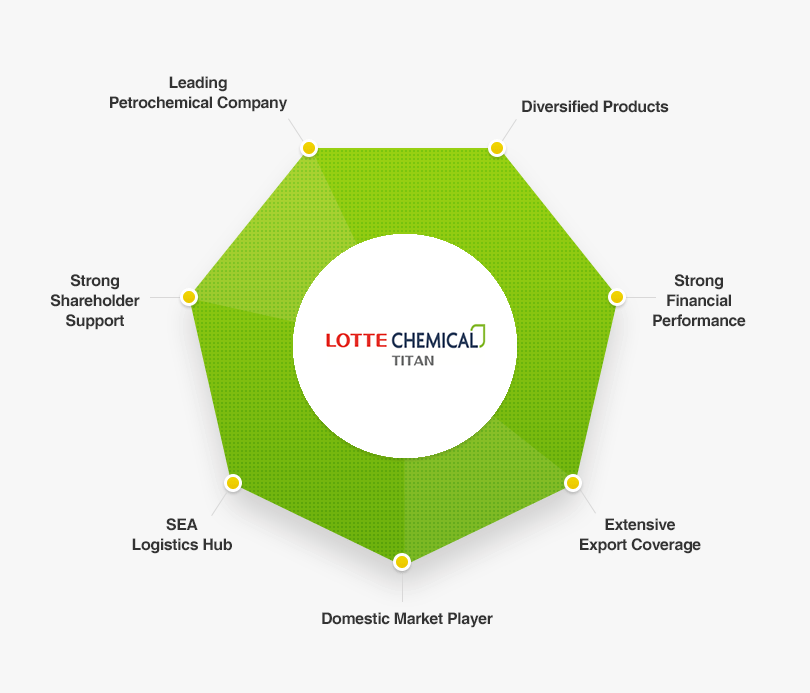

LCTITAN - (OCT 2017) - South Korea’s Lotte Chemical Corp sees the global petrochemical market remaining ‘stable to firm’ out to 2020 thanks to low oil prices, but its chief executive wants to diversify the company’s feedstock to help it cut costs. South Korea’s second-biggest petrochemicals maker has benefited from low oil prices as its main feedstock, naphtha, is derived from crude oil, which has a bigger influence on its business than supply and demand, Lotte Chemical chief executive officer Kim Gyo-hyun said at the Reuters Global Commodities Summit. “By 2020, petrochemical markets are likely to be stable to firm as oil prices are expected to remain stable at US$60,” Kim said in his first interview since starting as CEO in March. “Given that, the profitability of petrochemical makers with naphtha crackers, like us, is likely to change little.”

LCTITAN - (OCT 2017) - The Minority Shareholder Watchdog Group (MSWG) has slapped Lotte Chemical Titan Holding Bhd, the largest initial public offering on Bursa Malaysia this year, with a call to “seriously strengthen” its operational risk management to reduce their impacts on its corporate image and financial objectives. The call by MSWG was related the recent five-day stop-work order at its catalytic cracking reactor plant, which is part of its TE3 Project in Pasir Gudang, Johor.

LCTITAN - (OCT 2017) - The Department of Environment (DOE) had issued a stop-work order for Lotte Chemical Titan Holding Bhd’s (LCT) KBR Catalytic Olefins Technology catalytic cracking reactor within its TE3 project to mitigate and reduce odour emission and eliminate surface oil sheen/film discharge. Management is confident it will resolve this issue soon and the commercial commencement of TE3 remains on track for fourth quarter of 2017. To reiterate, TE3 has yet to be connected to LCT’s core operations in its Pasir Gudang (Johor) plant as it is undergoing a commissioning process. DOE’s stop-work order will require extra days before TE3 can start. LCT could also incur some additional pre-operating expenses due to the delays. The stop-work order is specific to TE3 and there is no impact to core operations. LCT should not be losing any production volumes due to this TE3 stop-work order.

LCTITAN - (OCT 2017) - Lotte Chemical Titan Holding Bhd (LCT) shares rose as much as 3.01% s as investors expect the petrochemical producer to quickly rectify the problem that prompted the stop-work order to be issued on part of its T3 project at its integrated facility in Pasir Gudang, Johor.

LCTITAN - (SEP 2017) - Maybank Investment Bank Bhd said Lotte Chemical Titan Holding Bhd shares may track costlier petrochemical, amid crude oil price gains. Maybank analyst Mohshin Aziz said Maybank maintained its ‘Buy’ call on Lotte shares, with an unchanged target price at RM7.85. He said the focus will resume to the recent surge in crude oil prices and the likelihood for petrochemical prices to track crude oil prices. He believe the share price will react positively, as Lotte is a direct beneficiary of higher petrochemical prices.

LCTITAN - (AUG 2017) - Lotte Chemical Titan Holding Bhd (LCT) rose 1.12% after CIMB IB Research initiated coverage on the stock with an “Add” rating at RM5.36 with a taregt price of RM8.50 and said LCT, Malaysia’s second-largest petrochemicals producer by end-2016 capacity, has a proven track record of creating value via strong operational efficiency. A potential key earnings growth driver is capacity expansion, with their projection of capacity expanding by CAGR of 11.6% in FY17-22F. Their forecast weak FY17F net profit due to the water shortage and planned shutdowns, but expect it to be a transitional year, entering into a high-growth period in FY18-19F.

LCTITAN - (AUG 2017) - After JP, HSBC, MAYBANK covered then another more Citi analyst Horace Chan initiated coverage of Lotte Chemical Titan Holding Bhd with a recommendation of buy. Chan predicted Lotte Chemical Titan Holding will trade at 6.10 ringgit within a year, implying a 21 percent increase from the last close. The new target is 13 percent below the consensus average of 6.99 ringgit and is at the low end of forecasts ranging from 6.10 ringgit to 7.85 ringgit.

LCTITAN - (AUG 2017) - Lotte Chemical Titan Holding Bhd (Lotte) rose 7.4% after Maybank Investment Bank Research initiated coverage on the company with a “buy” rating and target price of RM7.85. The petrochemical manufacturer rose 35 sen, or 7.45% to RM5.05 on active trade. Maybank said this year was a transition year for Lotte due to scheduled maintenance shutdowns but production should normalise by 4Q17. They forecast lower FY17 core net profit (-14% YoY) and for growth to resume in FY18 (+30% YoY). Pegging to global peers’ 2017 EV/Ebitda of 8.2 times and derive a valuation of RM7.85 per share

LCTITAN - (AUG 2017) - Lotte Chemical Titan Holding Bhd’s (LC Titan) share price staged a rather strong rebound yesterday after HSBC Equity Research and JPMorgan Chase & Co initiated coverage on the petrochemical group, whose share price has been battered down due to disappointing quarterly earnings. LC Titan is the fourth-largest producer of polyolefin products in Southeast Asia, cornering [a] 10% share in capacity as of 2016 with leading market positions in Malaysia and Indonesia. Asean Free Trade Agreement has removed intra-regional tariffs for imports and exports to markets within Asean, which has allowed LC Titan to enjoy an edge against non-Asean based players, for example the Middle East imports have a 10% tariff. JP Morgan forecasts that LC Titan will experience a compound annual growth rate of about 11% on its earnings per share over two years (financial year 2017 [FY17] to FY19) given its 40% capacity growth, offsetting the likely weakness of polyethylene.

LCTITAN - (AUG 2017) - JPMorgan Chase & Co analyst Ajay Mirchandani initiated coverage of Lotte Chemical Titan Holding Bhd with a recommendation of overweight. Mirchandani predicted Lotte Chemical Titan Holding will trade at 7 ringgit within a year, implying a 61% increase from the last close. The new target is 3.3% below the consensus average of 7.24 ringgit. Then, another one more coming is HSBC analyst Dennis Hyunchul Yoo initiated coverage of Lotte Chemical Titan Holding Bhd with a recommendation of Buy.

LCTITAN - (JUL 2017) - Lotte Chemical Titan Holding Bhd’s (LCT) share price dived to its new low after the announcement of a 72% plunge in its net profit for the second financial quarter ended June 30, 2017 (2QFY17). Shareholders were caught off guard by the unexpected sharp earnings contraction that was mainly caused by an unplanned water supply disruption at its plant in Johor. On its prospects, the group said it expects the petrochemicals market to continue to be resilient in the near term, as demand growth outpaces the rate of new supply additions in the region. LCT added that its production output is expected to normalise in the second half of the financial year with the completion of the turnaround of its NC1, NC2 and downstream plants, while its TE3 project will be coming online in the second half of the financial year.

LCTITAN - (JUL 2017) - Lotte Chemical Titan Holding Bhd expects to strengthen its position as the region's leading polyethylene producer following a breakthrough in the mass production trial of metallocene linear low-density polyethylene (mLLDPE). With this new development, Lotte Chemical Titan said it would be the first producer of mLLDPE in Malaysia and Indonesia, supplying to the domestic market demand of about 150 kilotonnes per year. The company targets to begin distribution of mLLDPE within Q4 2017.

THE SUMMARY

"After read some covered stories past 1-2 month and some news on rumors. I would to see is stock may RISE higher as much it can in short-term! Watch and dont miss this opportunities". - Kim Spartan

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Or Join Elite Spartan Group Traders (SGT) by contact via phone number.

More articles on Follow Kim's Stockwatch!

MY GEMS GOING TO SKYROCKET!!! - DATA CENTER'S NEED RENEWABLE ENERGY PRODUCER

Created by sparta | Jul 12, 2024

THIS ANOTHER GEMS READY TO SKYROCKET!!! - MAJOR DEVELOPER IN PENANG

Created by sparta | May 08, 2024

THIS STOCK READY TO SKYROCKET!!! - THE POWER & WATER SUPPLY SERVICES

Created by sparta | May 07, 2024