WANT TO BE A SPARTAN?

DATE: 08 MARCH 2018

----------------------------------------------------------

THE STOCK : HIBISCS

Hibiscus Petroleum Berhad

----------------------------------------------------------

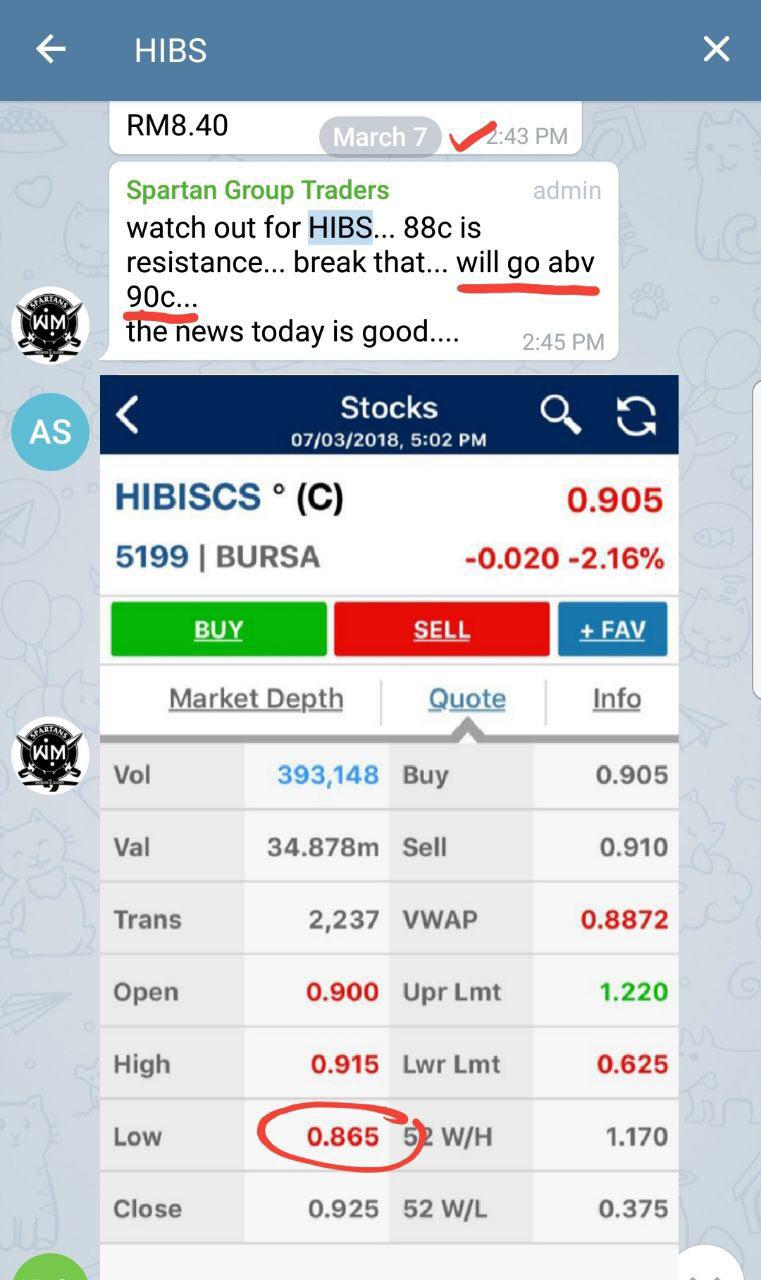

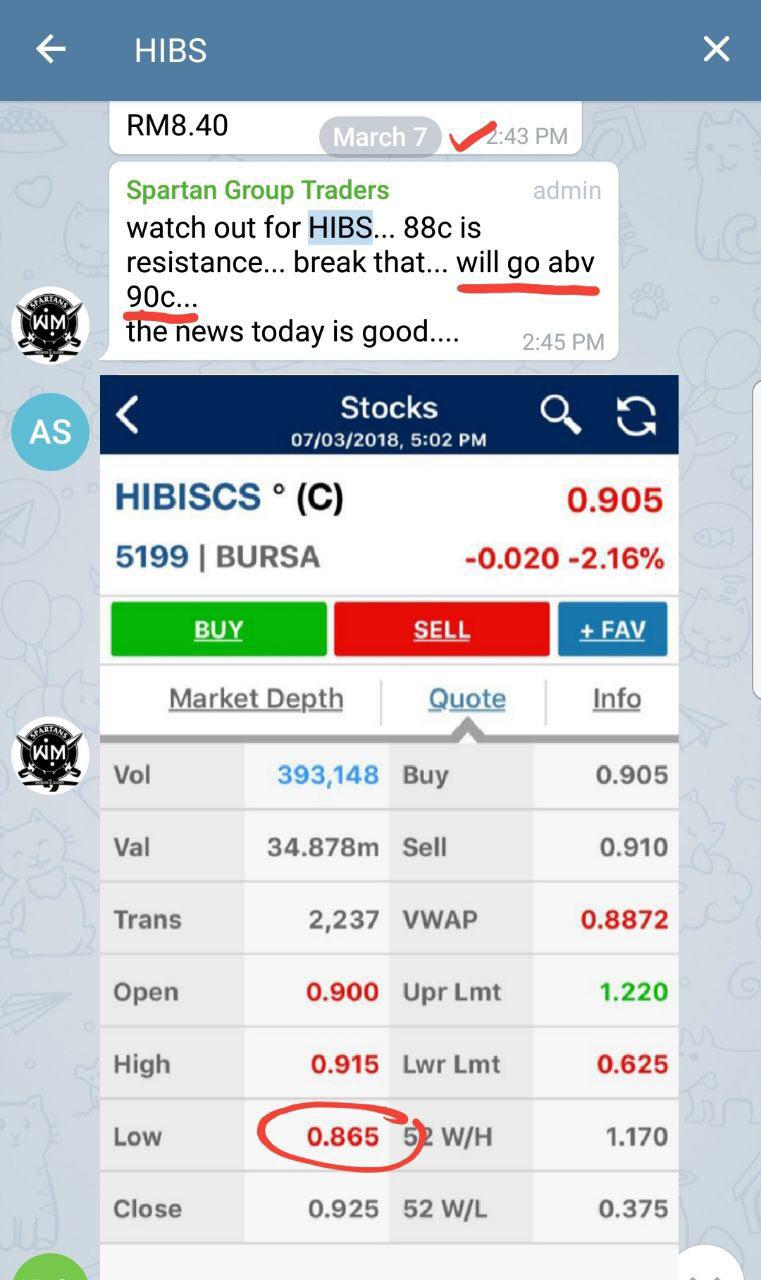

Current Price : 0.905 cts (SGT called 87c - 88c - 7/3/2018)

Target Price : TP 1 ( RM1.10) / TP 2 ( RM1.50)

Warrant : HIBISCS-CA ( 0.125 cts)

TP will follow mother movement.

This stock has been alerted and called again yesterday 7/3/2018 for our members SGT. Our call Entry Price (EP) is 87c - 88c as SGT channel screenshot below.

With this bearish market and cautious trading, I still forseeing this counter as a GEM. I also upgraded my personal target as stated above.

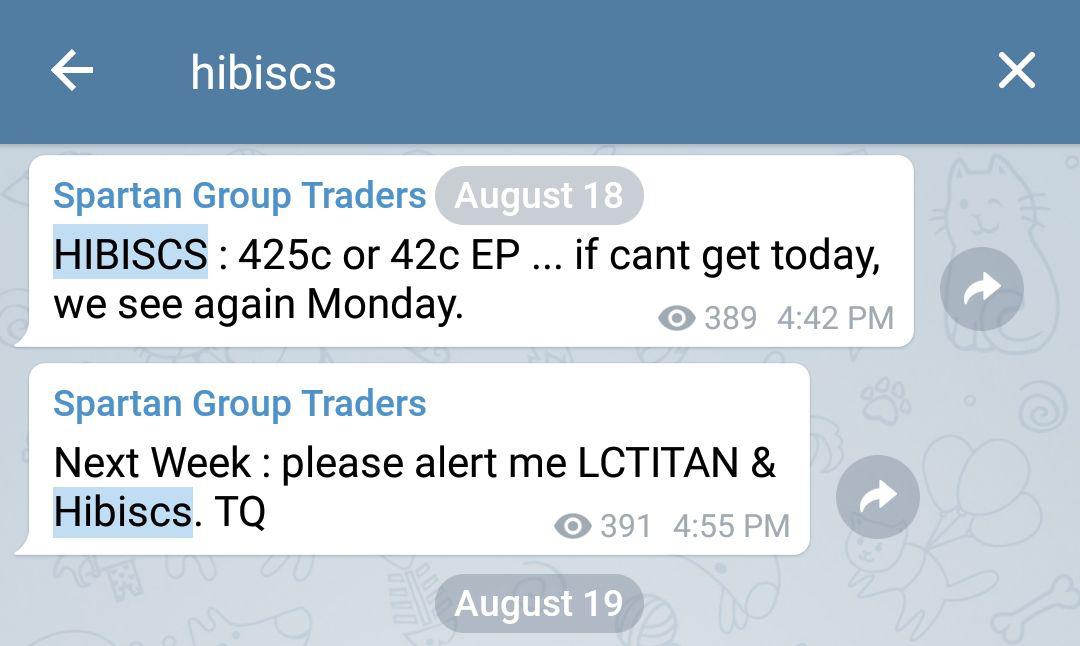

This stock also has been alerted and played since at 0.40 cts till now. You may refer screenshot below :

----------------------------------------------------------

WHAT KIM SAY?

----------------------------------------------------------

5 Keys that I look its promising and will be super counter soon :

1. "Next QR will show us the real HIBS. So not to late for invest at the current price" .

2. "The Anasuria Cluster may help them again stay in the black for the next quarters".

3. "Very intresting for me what the chairman said is the best thing to do is to ensure that the company is healthy, and demonstrate growth for the benefit of the shareholders. I like this sincerity".

4. "Hibiscus Petroleum Bhd's joint venture (JV) in Australia has been granted a five-year renewal term ending March 6, 2023 for the VIC/P57 exploration at the Gippsland Basin" .

5. "The group is also planning for the commencement of well drilling at its Anasuria cluster off the UK North Sea this May".

- Kim

----------------------------------------------------------

THE PROFILE

----------------------------------------------------------

Hibiscus Petroleum Bhd is a Malaysian oil and gas E&P company which developes small oil and gas fields in the South Asia, South East Asia and Oceania regions by Upstream oil and gas activities consisting of exploration, development and production of oil and gas resources. Hibiscus Petroleum Berhad was incorporated in Malaysia under the Act as a private limited company on 5 December 2007 under the name of Hibiscus Petroleum Sdn Bhd and converted into a public company under its current name on 20 December 2010.

----------------------------------------------------------

THE KEYNOTE

----------------------------------------------------------

FEB 2017

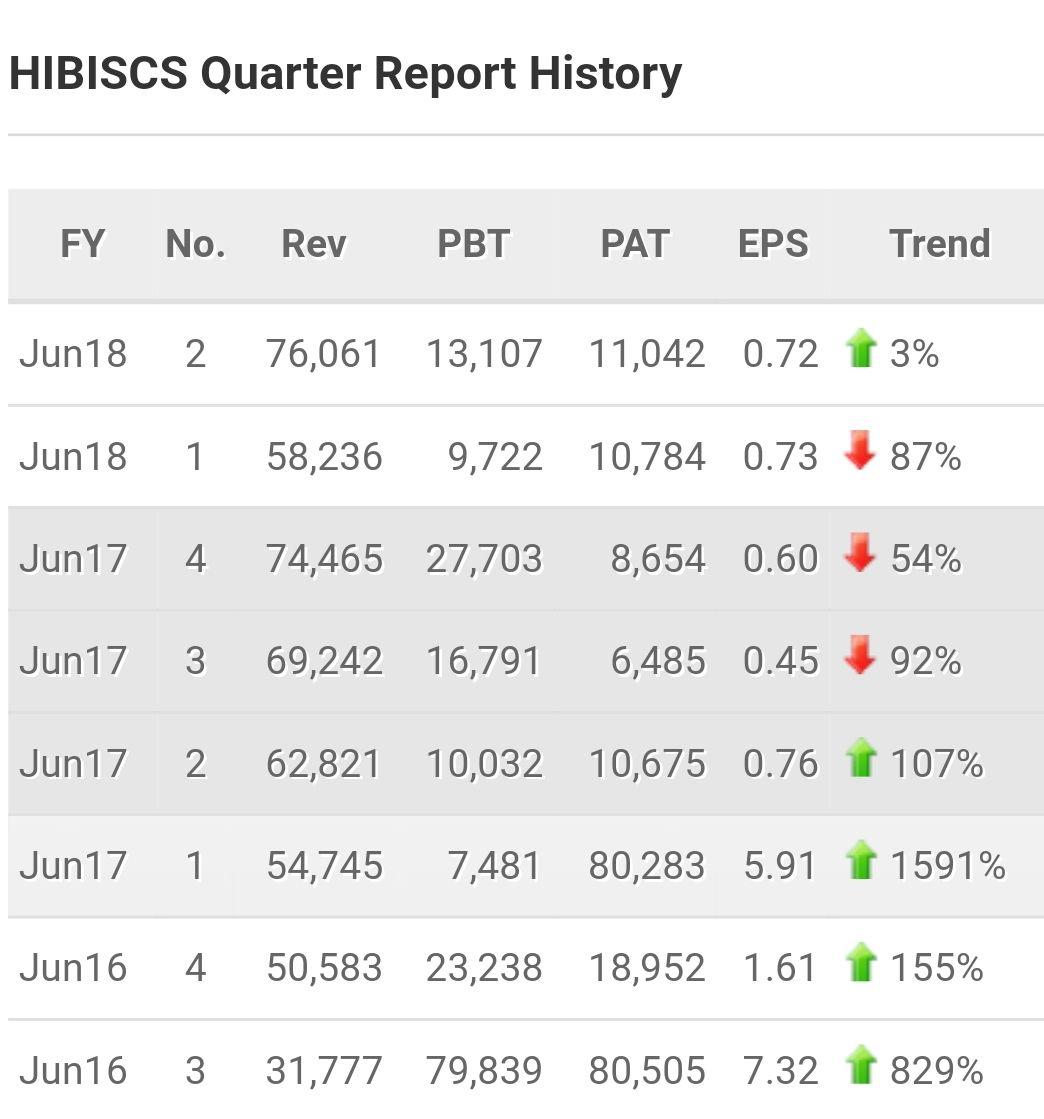

HIBISCS - Hibiscus Petroleum Bhd reported a net profit of RM10.68 million for the second quarter ended Dec 31, 2016 (2QFY17), versus a net loss of RM164.17 million a year earlier, on contribution from the North Sea's Anasuria Cluster. Hibiscus said revenue spiked to RM62.82 million, from RM955,000. Hibiscus' website indicates the firm and Ping Petroleum Ltd are joint operators of Anasuria.

MAY 2017

HIBISCS - Hibiscus Petroleum Bhd net profit for the third quarter ended March 31, 2017 fell to RM6.49 million from RM80.5 million a year earlier. Hibiscus said revenue for the quarter rose to RM69.24 million from RM31.78 million a year earlier. Earnings per share was 0.45 sen compared to 7.32 sen a year earlier. For the nine months ended March 31, Hibiscus posted net profit RM97.44 million from net loss RM78.91 million a year earlier. Revenue for the period jumped to RM186.81 million from RM32.98 million in 2016.

HIBISCS - Petroliam Nasional Bhd (Petronas) has given the greenlight to Royal Dutch Shell PLC for the sale of the latter's 50% stake in the 2011 North Sabah enhanced oil recovery production sharing contract (PSC) to Hibiscus Petroleum Bhd's indirect unit SEA Hibiscus Sdn Bhd. Hibiscus announced last October that it had reached an agreement with Shell for the US$25 million or RM104.63 million stake buy, subject to Petronas' approval.

HIBISCS - Hibiscus Petroleum Bhd proposed a private placement of up to 144.38 million shares or 10% of its existing issued share capital to raise up to RM64.97 million, mainly for working capital purposes.Hibiscus said it planned to spend RM64.67 million for expenses like business development, payment to trade and other payables, staff costs, repayment of borrowings (in future, if any), utilities and other operating expenses, and potential expansion and capital expenditure (if any).

JUL 2017

HIBISCS - Hibiscus Petroleum Bhd, which proposed in May a private placement of up to 10% of its share capital to raise some RM65 million, said it is considering and pursuing alternative sources of funding from financial institutions to meet its needs in the near future. These are being planned for implementation in the near future. The proposed private placement is an additional effort by the group to maintain a satisfactory buffer, over and above the group's recurring cash flows, to meet near-term payments and obligations, while the alternative sources of funding are being considered and pursued.

AUG 2017

HIBISCS - Hibiscus Petroleum Bhd’s net profit dropped 54% year-on-year to RM8.65 million in the fourth quarter ended June 30, 2017 (4QFY17) from RM18.95 million, despite a 53% spike in revenue to RM74.47 million from RM48.72 million. Its financial statements show higher taxation of RM19.05 million in 4QFY17, compared with RM4.29 million a year earlier. Pre-tax profit jumped 65% to RM27.7 million from RM16.79 million, partly because the previous quarter recognised negative goodwill of RM228.8 million from its Anasuria Cluster acquisition.

SEP 2017

HIBISCS - Hibiscus Petroleum Bhd has been granted major project status for the West Seahorse Project in Australia. Australian Manufacturing, an online portal specialising in manufacturing-related news, reported on Sept 8 that Australian Minister for Industry, Innovation and Science Arthur Sinodinos confirmed that the Federal Government had renewed its Major Project Status to the West Seahorse Project which is located in the Gippsland Basin, off the coast of Victoria. The project is undertaken by Hibiscus Petroleum unit Carnarvon Hibiscus Pty Ltd.

HIBISCS - Hibiscus Petroleum led penny oil and gas stocks higher in active trade on Wednesday, riding on fresh corporate news and the oil price rally, which was near its largest third-quarter gain in 13 years.

NOV 2017

HIBISCS - Hibiscus Petroleum Bhd shares rose 1.36% in active trade this morning after the company said it expects oil prices to remain high over the next few months, providing a "sweet spot" for the oil and gas group after undergoing challenging conditions in the last two years.

HIBISCS - Hibiscus hopes to increase oil production at Anasuria Cluster, its primary asset in the North Sea off the United Kingdom, by up to 56% over the next two years, to 5,000 barrels per day (bbls/day) from 3,204 bbls/day in its financial year ended June 30, 2017 (FY17). This was on the back of the recently completed project enhancements at three wells at the Anasuria Cluster of oil and gas fields, designed to improve short- and medium-term performance to compensate for the expected production decline of such a mature asset, while seeking to improve health and safety aspects.

HIBISCS - As a result of lower tax credit recognised, Hibiscus Petroleum Bhd’s net profit in the first quarter ended Sept 30, 2017 (1QFY18) was down 86.6% year-on-year to RM10.78 million, from RM80.28 million year-on-year (y-o-y). Hibiscus received a tax credit of RM1.06 million, as compared to RM72.8 million received in the corresponding quarter last year.

HIBISCS - Hibiscus Petroleum Bhdhas received consent from Petronas Carigali Sdn Bhd to acquire Royal Dutch Shell's 50% participating interest in the 2011 North Sabah enhanced oil recovery (EOR) production sharing contract (PSC). Currently, the PSC is operated by Sabah Shell Petroleum Co Ltd, in partnership with Shell Sabah Selatan Sdn Bhd and Petronas Carigali. The Shell units each own 25% stake in the contract. Under the terms of a conditional agreement signed in October last year, Hibiscus' indirect unit SEA Hibiscus Sdn Bhd would buy the 50% stake from Shell for US$25mil and assume the role of operator of the PSC.

FEB 2018

HIBISCS - Hibiscus is currently in the midst of concluding its acquisition of a 50% participating interest in the 2011 North Sabah enhanced oil recovery production sharing contract (PSC) from Shell for US$25 million. The scheduled completion is end-March.

HIBISCS - The group is also planning for the commencement of well drilling at its Anasuria cluster off the UK North Sea this May,

HIBISCS - Hibiscus Petroleum Bhd saw its net profit for the second quarter ended Dec 31, 2017 (2QFY18) rise 3.4% to RM11.04 million from RM10.68 million a year ago, thanks to higher revenue and lower expenses, but offset by absence of foreign exchange (forex) gains incurred in the same quarter a year ago. Quarterly earnings per share stood at 0.72 sen, against 0.76 sen in 2QFY18

MAR 2018

HIBISCS - Hibiscus Petroleum Bhd's joint venture (JV) in Australia has been granted a five-year renewal term ending March 6, 2023 for the VIC/P57 exploration at the Gippsland Basin there.

----------------------------------------------------------

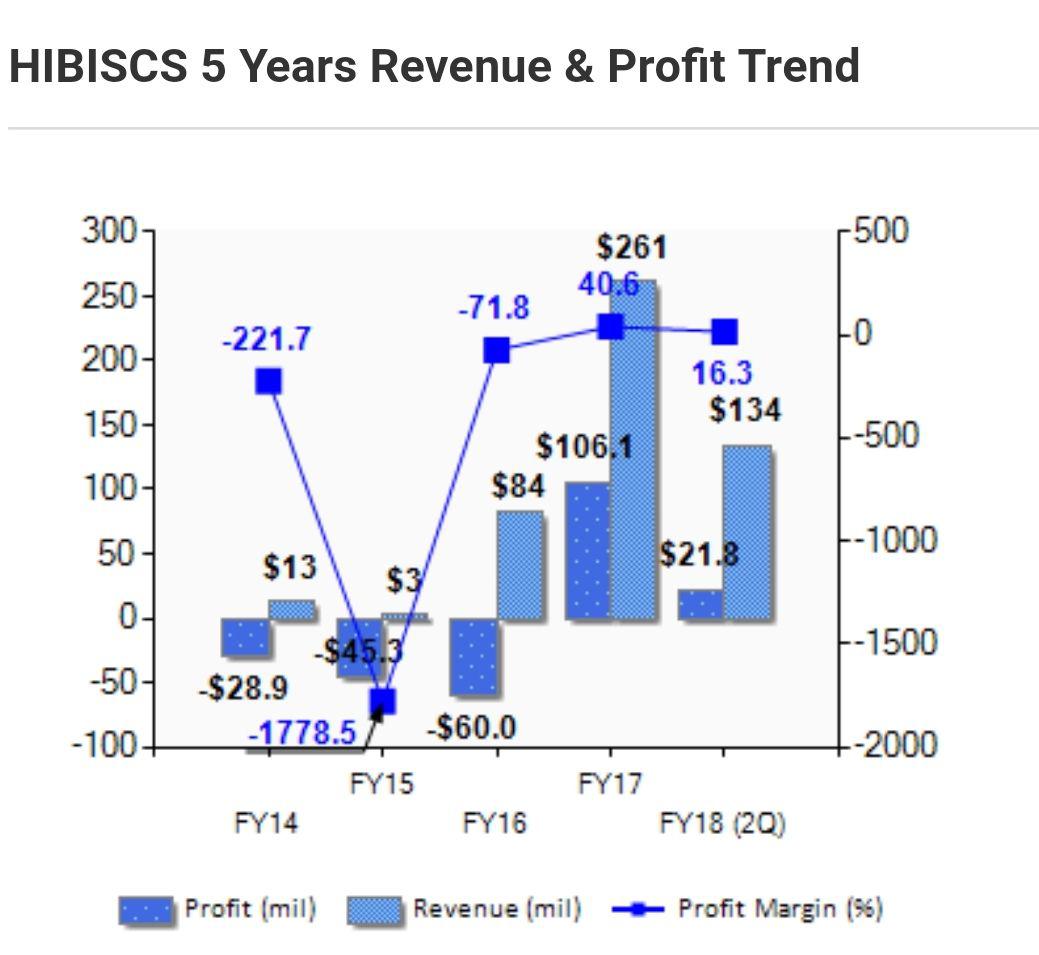

THE FINANCIAL

----------------------------------------------------------

----------------------------------------------------------

THE PROJECT PORTFOLIO

----------------------------------------------------------

UNITED KINGDOM

Asset Name: Anasuria Cluster, comprising:

-

Cook (38.6%) Producing Field

-

Teal (100%) Producing Field

-

Teal South (100%) Producing Field

-

Guillemot A (100%) Producing Field

-

Anasuria FPSO (100%) FPSO

Effective Interest:50% of Anasuria Cluster (Hibiscus is Joint Operator)

Asset Type: Producing assets with development and exploration potential based around the Anasuria FPSO

Location: ~ 175 km east of Aberdeen, UK North Sea

Water depth: ~ 94 m

Partner: Ping Petroleum Limited

Note 1: Joint Operating Company with equal ownership between Anasuria Hibiscus UK Limited (a wholly-owned subsidiary of Hibiscus Petroleum) and Ping Petroleum Limited.

The Anasuria Cluster comes with stable positive cash flow from current production with in-field future development opportunities and exploration upside. It represents an attractive, geographically focused package of operated interests in producing fields and associated infrastructure. The assets have a proven and producing resource base which provides a platform for further development. A number of incremental development and exploration opportunities exist within the licence areas which are expected to generate significant incremental value in the medium term.

AUSTRALIA

Asset Name: VIC/L31 (West Seahorse Field)

Effective Interest: 100% (Hibiscus is Concession operator)

Acquisition Date: January 2013

Licence type: Production License

Reserves: 8.0 MMbbls of 2P + 2C Oil Reserves

Asset Name: VIC/P57

Effective Interest: 78.3% (Hibiscus is Concession Operator)

Acquisition Date: January 2013

Licence Type: Exploration Permit

Water Depth/Size: Up to 150m/460km2

Hibiscus Petroleum holds substantial equity interest and is the Operator of two licences – VIC/L31 and VIC/P57 – in Australia via our wholly-owned subsidiary, Carnarvon Hibiscus Pty Ltd (CHPL). Both licences are located offshore, in shallow water, in the Gippsland Basin and are core assets to the company. As the Operator, we have a high level of operational and financial control and we are responsible for the entire planning and execution of all activities under these licences.

The VIC/L31 production licence includes the West Seahorse discovered field, whilst the VIC/P57 exploration licence comprises several geologically exciting prospects.

The development of the West Seahorse field has been a key objective of our company due to the near term visibility on the development and subsequently, production of this field. In the current low and volatile oil price environment, the Company has deferred the Final Investment Decision for the West Seahorse development project. As for the VIC/P57 permit, in accordance with our obligations under the terms of the permit, CHPL has recently drilled an exploration well in the Sea Lion prospect in the second quarter of 2015, demonstrating our ability to execute drilling operations offshore Australia whilst maintaining a good HSE track record.

OTHER ASSETS

Other assets under the Hibiscus Petroleum Group are held via its 35% owned joint venture company, Lime Petroleum Plc. These assets are located in Norway and the Middle East which are currently in the exploration stage.

Given the extended period of low oil prices, the Company intends to continue its review of investments in licences that are primarily exploration weighted against a new set of investment criteria. In the current volatile price environment, the Company’s agenda is to take secondary positions in exploration assets whilst the industry struggles to define its short term outlook. Assets which have a clearly defined path to near term production will however be prioritised.

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)