MY LATEST GEMS GOING TO SKYROCKET!! STILL LAGGARD!!

sparta

Publish date: Fri, 24 Feb 2023, 01:38 AM

LETS JOIN WALLSTREETKIM?

24 February 2023

STOCK NAME : WONG (7050)

WONG ENGINEERING CORPORATION BERHAD

Wong Engineering Corporation Berhad, an investment holding company, is engaged in the manufacture and sale of high precision metal stamped parts, high precision turned metal components, and automated equipment in Malaysia. The company is also engaged in trading, marketing, and retailing of industrial and consumer products. In addition, it designs, manufactures, and supplies welded frame structures, and related modules and systems. The company serves industries in the telecommunication, computer, electronics, automobile, audio, video, and semiconductor sectors. It sells products primarily in Asia, North and South America, and Europe. The company was founded in 1982 and is based in Kulim, Malaysia.

KIM'S TARGET PRICE

Current Price : 0.41 sen

TP1 : 0.80 sen

TP2 : RM1.50

Warrant : WONG-WA (0.10 sen)

TP : More than 0.30+++ sen & 0.50++ sen

Maturity : 4 years

WONG CHART

WONG - 1 YEAR CHART

WONG - 2 YEAR CHART

WONG PROSPECTS

- Customer orders and fluctuations in input cost begin to stabilise.

- Manufacturing segment’s near-term outlook is expected to remain positive.

- The Group has increased its manpower resources and will also be receiving delivery for its new sheet metal machines in the coming quarter; offering a boost in capacity as well as capability to fulfil existing customer orders besides capturing new markets and industries to diversify and increase our customer base.

- The Group remain highly cognizant of signals of a slowdown in demand from the technology sector besides the foreign exchange risk due to the recent rapid reversal of US Dollar appreciation against Malaysian Ringgit and the persistent constraints in the global supply chain affecting material availability and lead times.

- For Construction & PD segment, the Group will cautiously seek out new projects and opportunities for expansion.

- Associate company, Broadway Lifestyle Sdn Bhd (BLSB) is in the midst of planning for the proposed development in Sepang, Selangor on a parcel of land it acquired back in 2020. Premised on the above and barring further unforeseen circumstances.

- The Group remain cautiously optimistic of the Group’s financial performance and prospect for the coming quarters.

KIM'S KEYNOTE

- Laggard stock behind CORAZA (Market CAP 424M).

- WONG (Market CAP 103M) very light float, once its start flying, easier more than 10-20% per day.

- Increased in capacity in current quarter to improved manpower resources and the delivery of new sheet-metal machines.

- Dividends paid company.

- Last final quater (4Q22), recorded a 2% year-on-year (YoY) rise in revenue to RM20.87mil on sales growth in the manufacturing segment as demand for metal fabricated components remained healthy.

- Increased capacity will boost its capability to fulfill existing orders and provide an opportunity for the group to capture new markets and industries to diversify and increase its customer base.

- Forecast incoming quater's very good.

- Reason Undervalued / Laggard.

- 14-days Strong momentum and accumulation.

WONG FINANCIAL HIGHLIGHTS

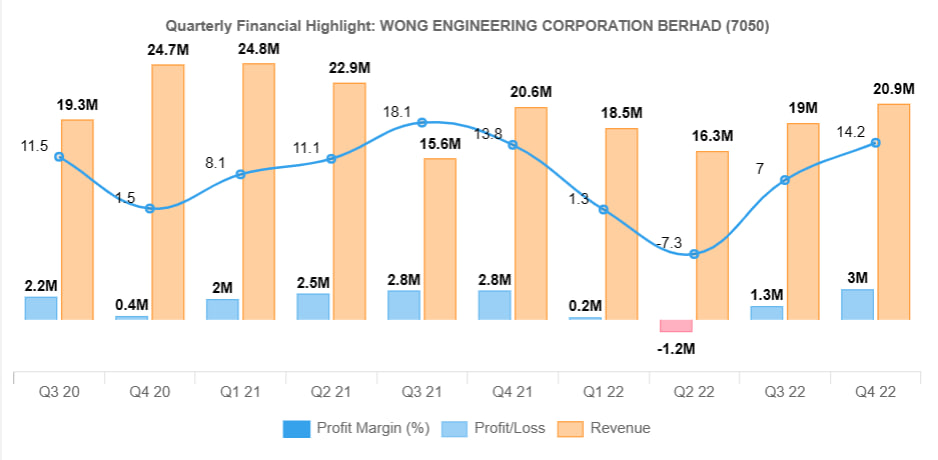

WONG - QUATERLY

WONG - ANNUALY

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advise.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Follow Kim's Stockwatch!

Created by sparta | Dec 06, 2024

Created by sparta | Jul 12, 2024

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024