Spring Tree Investment

Can DPI holdings deliver better result ahead?

springtreeinvestment

Publish date: Wed, 24 Jul 2019, 07:56 PM

key points

-The company, which is headquartered in Johor, is involved in the development, manufacturing and distribution of aerosol products for the automotive industrial and household markets, under its own brand names "DPI", "Anchor" and "Kromoto".

-Company also provides solutions for paint and lubricant formulation, raw and packing materials as well as aerosol packaging, under its private label manufacturing services.

-Raw material used by company-Empty aerosal cans,solvents and LPG.

-Entered into a memorandum of understanding (MoU) with the duo Chen Junxiong and Li Feng Ming to form a joint venture (JV) company in China.

-New factory, which will have four new fully-automated aerosol filling lines, it would also upgrade the production lines in the existing plant to become fully-automated.

-Production in the new factory is set to commence in the first half of 2020.

-This production line wil double its production capacity to 20 million cans per annum from 9.7 million cans currently with the construction of a new factory adjacent to its existing plant in Johor.

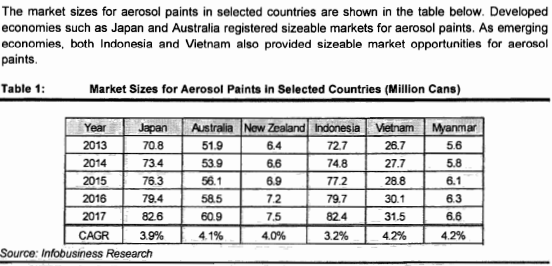

-Demand for aerosol paints in Asia Pacific countries was expected to increase with rising population, accelerated urbanisation and higher motorisation, indicating a potential uptrend for aerosol paints from the automotive segment.

-Zero borrowing with net cash 48.8 million vs market cap 90.05 million.

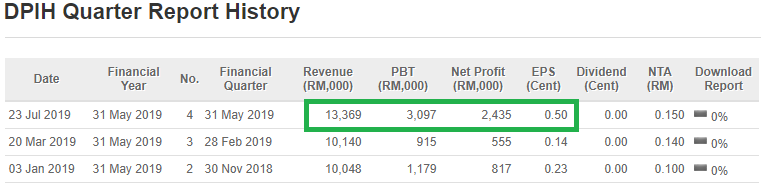

-Latest quarter net profit 2.435m.

-Market cap with RM140 million able to achive if company can make 10 million in profit and PE 14 given by market.

-Risk factor-raw material fluctuation and delay in expansion.

Technical points

-On 12 July volume start spike which mean market already predict ahead this quarter result will good.

-On 23 July volume spike on 2nd session of trading and on the same day quarter result released.

-On 24 July profit taking activity happen .

-In term of technical perspective, price cross 50 and 70 and 100 days SMA.

-Golden cross might form in near term.

-MACD and stochastic show buy signal.

-Next resistant 0.21

-IPO price is 25sen.

Start your investment journey with us by joining spring tree investment telegram channel and get more latest update/insight on stock market and economy related.

More articles on Spring Tree Investment

Forecast of Malaysia business performance for the 2nd quarter 2019

Created by springtreeinvestment | Jun 05, 2019

Discussions

Be the first to like this. Showing 1 of 1 comments

tm9999

FD alone already Rm35mil

Cash and bank balance Rm13mil

Total alr Rm48mil

Market cap now only Rm90mil.

Non brainer ?

2019-07-24 22:23