Winners Of Lower Commodity Costs

ss20_20

Publish date: Tue, 04 Nov 2014, 01:46 PM

We foresee an extended period of soft prices of energy-related and other selectedcommodities, which will benefit key sectors such as utilities, aviation, plastic packaging manufacturers and construction. Key beneficiaries which rank among our top picks are Tenaga, Gamuda, as well as Air Asia, while other notable cheap beneficiaries include Scientex.

WHAT’S NEW

An extended period of price weaknesses for energy-related costs. Industrial commodity prices are down 5% ytd and 8% from this year’s peaks, while selected soft commodities have retreated by 12% from this year’s peak. In particular, the energy-related commodities – coal (-16% ytd) and crude oil (-22% ytd) - are likely to remain soft for the foreseeable future. Accompanying the lower energy prices is the fall in the global utilisation rates in the petrochemical industry, which points to lower plastic resin costs. In addition, international prices of steel are expected to remain in the doldrums.

Key beneficiary sectors – utilities, plastic packaging manufacturers, aviation and construction. Qualifying sectors need to fulfil two criteria:

a) benefit from lower commodity prices, and

b) good demand and revenue visibility (which eliminates cyclical sectors) and decent pricing power.

Apart from benefitting from falling input costs, some of these sectors also feature high revenue growth visibility, with the utilities and construction sectors enjoying firm domestic demand, and the regionally-oriented plastic packaging manufacturers servicing the relatively stable FMCG sector.

Scientex (NOT RATED) is a key beneficiary of declining plastic resin prices and is aggressively ramping up its production capacity in the consumer packaging segment with a RM300m expansion programme that will quadruple its capacity by 2017. Pegging the stock at 10x FY16 consensus PE, it would be valued at over RM8.80.

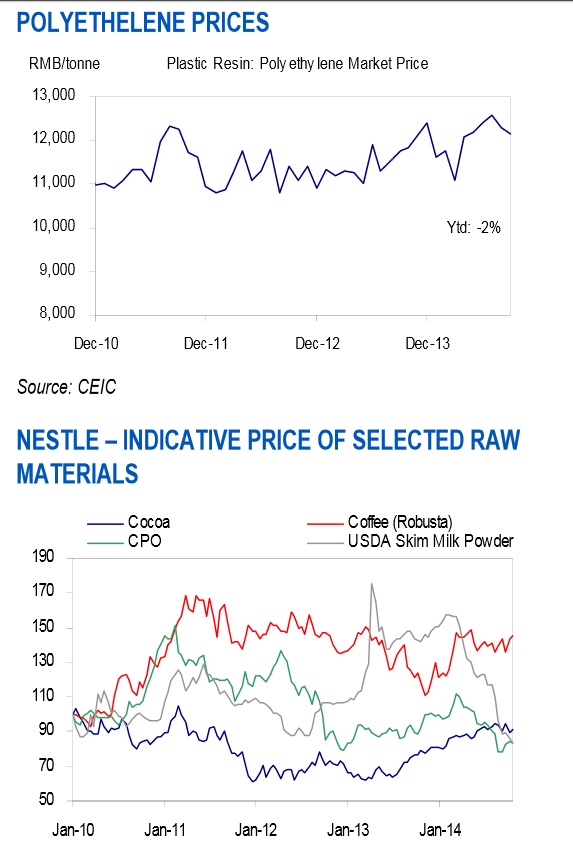

Plastic packaging manufacturers (notably, Scientex and Daibochi) will benefit from lower plastic resin prices (which are closely correlated to crude oil prices). Plastic resin, which accounts for 60-80% of their cost, has come off 3-5% in the last three months. In particular, we expect the consumer packaging operations to significantly benefit from lower plastic resin cost (given the operation’s modest margins) even after the producers pass on most of the cost savings under ‘cost-plus’ revenue model.

We like Scientex (NOTRATED), which will quadruple its consumer packaging capacity in 3-years. Its manufacturing division is poised to deliver 15-20% revenue CAGR over FY14-17. Meanwhile, although Daibochi recorded weak 3Q14 financial results, management is upbeat on the 2015 outlook with 15-20% top-line growth, underpinned by stronger sales to existing and new customers, as well as margin improvement from lower resin and electricity costs (after its recent installation of electricity-saving equipment). However, not all companies will benefit, eg SKP Resources fully passes on the raw materials savings to its key clients and will see aneutral impact from the fall in resin price.

The fast moving consumer goods (FMCG) sector is only a minor net beneficiary of easier commodity costs as some soft commodities have trended higher this year (see Nestle’s raw materials price chart overleaf). Nonetheless, the softer commodity costs allow for some margin improvement, and help stimulate demand as some cost savings will be passed on to consumers. While the glove industry may also be also a minor beneficiary thanks to declining nitrile prices, the build up in excess industry capacity may force producers to fully pass on cost.

To a lesser extent, the consumer sector is a beneficiary from a decline in selected input costs,although we note that not all soft commodity prices have retraced in recent months, with coffee (+16% ytd) and cocoa (+6% ytd) up sharply this year. That said, palm oil prices are down 12% ytd while indicative milk solids prices are at their lowest levels in over four years, and these has helped to lift Nestle Malaysia’s margins by 2.2ppt to 17% in 3Q14. We recently upgraded the stock to a HOLD (Target: RM62.36) due to its market leadership in the FMCG sector (enabling it to capitalise on resilient domestic demand) as well as decent dividend yields which will gain traction in 2015, but note its expensive valuations, trading at >25x 2015F PE.

UOB Kay Hian 04 Nov 2014

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

SCIENTX2024-11-19

SCIENTX2024-11-18

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTXMore articles on Scientex Bhd

Created by ss20_20 | Dec 23, 2015

Created by ss20_20 | Aug 06, 2015