Berjaya Auto Bhd - Reviews & Target Price

ss20_20

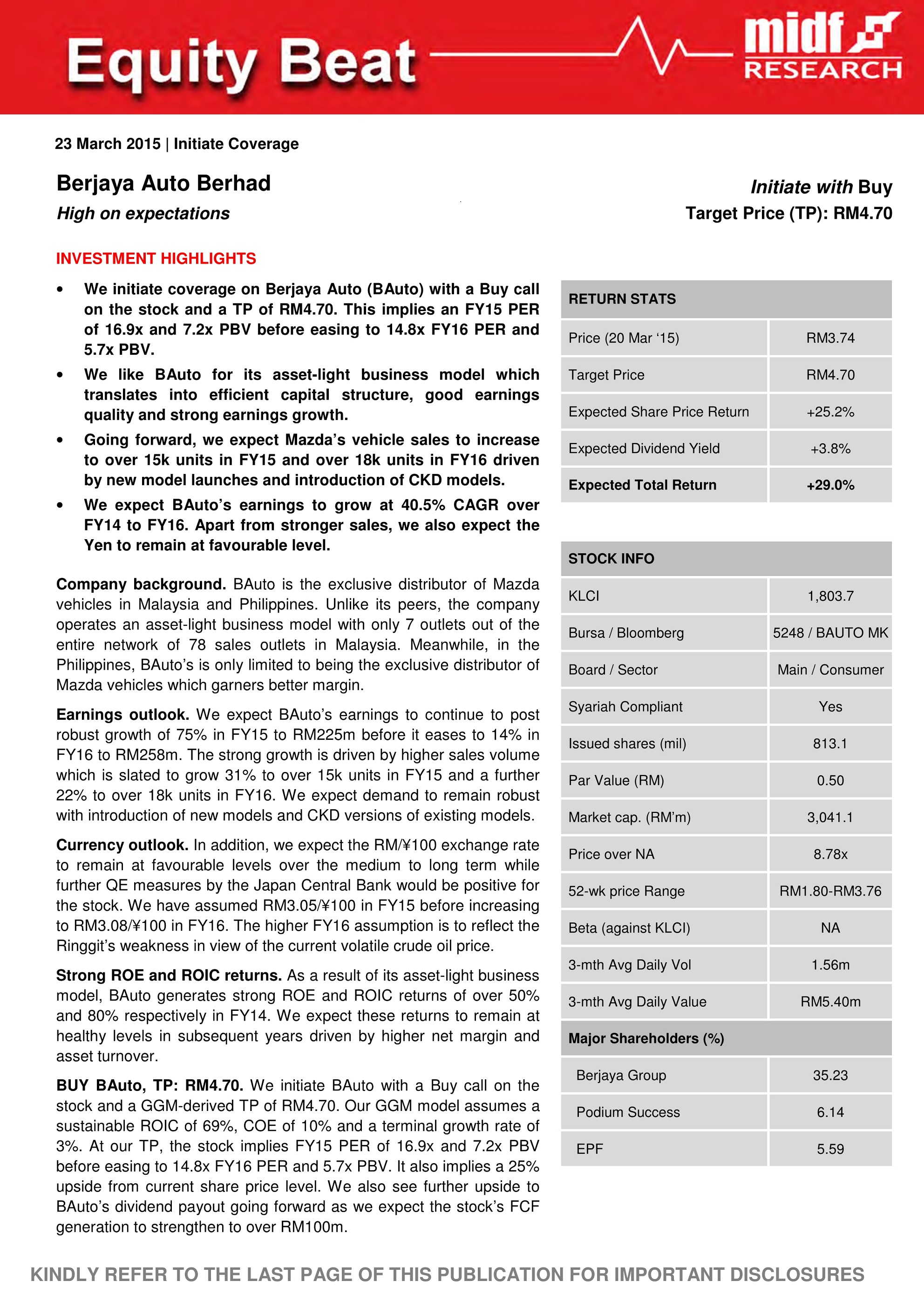

Publish date: Tue, 24 Mar 2015, 12:35 PM

持3.2億現金‧資本開銷低‧成功汽車或增派息率

(吉隆坡12日訊)成功汽車(BJAUTO,5248,主板貿服組)全年淨利按年增長65.5%至2億1千710萬令吉,分析員認為其銷售受消費稅(GST)與經濟前景低迷衝擊較低,並認為手握3億餘令吉淨現金和低資本開銷,有增派息率和併購契機。

馬銀行研究說,基於上財政年有2億8千100萬令吉現金在握和低資本開銷,提高其派息政策,由40%調高至50%。

大馬研究說,成功汽車有未使用淨現金達3億2千萬令吉,低資本開銷有調高派息率之空間。

馬銀行認為成功汽車有潛在併購機會(如增持Inokom、馬自達馬有限公司和菲律賓成功汽車股權),或者擴展印尼車市和馬自達噴漆廠投資,為未來成長鋪路。

“長遠基本面穩固,入門價低,即從52週最高的4令吉20仙折價15%,目標價為4令吉90仙。”

受消費稅衝擊不大

亮麗業績激勵週五股價一度飆24仙至3令吉79仙,閉市揚20仙或5.6%至3令吉75仙,為第二大上漲股。

肯納格認為成功汽車將少受消費稅(GST)衝擊,主要是其客戶多為中高階層,日圓兌馬幣目前仍走低,潛在推出的CX3和MX-5可吸引買氣。

MIDF研究說,管理層定下2016財政年1萬6千輛銷售(前為1萬4千至1萬5千輛),預計 推動銷售增長是跨界小休旅的CX3,也可能受新潛在推展的稍低檔次組裝CX5之惠,和高賺益的馬自達2所助;基於營運環境嚴峻,競爭者採取高折價,維持 2016財政年1萬4千輛銷售目標。

2015全年(財政年4月截止)淨利受馬自達2與CX5(國內組裝)強勁銷售拉動,上述兩款車分別於2015年1月和2013年6月推展;此外,馬自達3在菲律賓市場受落;同時也從日圓走疲和一些整項進口車(CBU)低稅率受惠。

“賺益擴張2.81%至11.9%,主要受弱勢日圓所拉動。第四季淨利按年揚13.5%、揚季漲22.2%至5千550萬令吉,外匯賺益達26萬4千令吉。第四季建議每股派息2.75仙、特別股息3.25仙,2015財政年總股息達14.60仙。

聯昌研究披露,成功汽車大馬銷售按年揚28.6%至1萬2千209輛,主要受馬自達2和3和 CX5貢獻,今年1月推展的馬自達2飆648.4%至1千504輛,Biante按年飆188.6%至1千零13輛,馬自達3按年增93.2%至966 輛,CX5揚34.4%至1千657輛。

“菲律賓總銷售按年飆56%至3千561輛,其中馬自達3按年增204.4%至1千537輛、馬自達2揚49.0%至858輛。”

5 配 2 發紅股計劃的享有日為 6 月 23 日,聯昌認為料驅動投資者(特別是散戶)買氣;肯納格認為其流動率增加,對此展望正面。

星洲日報 | 財經 | 張啟華 13 Jun 2015

Berjaya Auto - Proposes 2-for-5 bonus issue

| Source | : | MAYBANK | ||||||||

| Stock | : | BJAUTO | Price Target | : | 5.00 | | | Price Call | : | BUY | |

| Last Price | : | 3.95 | | | Upside/Downside | : |

|

||||

- Bonus issue will lift share base by up to 40%, to c.1.14b shares. Expect this corporate exercise to improve liquidity.

- Remains of our preferred picks on suppressed JPY/MYR forex and exposure to high growth Philippines car market.

- Reiterate BUY with a higher TP of MYR5.00 (+19%) having rolled forward valuation to 12.5x CY16 (from 13x CY15).

What’s New

BAuto has proposed a 2-for-5 bonus shares issue of up to 326m new BAuto shares of MYR0.50 par. The bonus issue, worth MYR163m in share capital value, will be distributed from its share premium account. The entitlement date has yet to be determined as the proposal is pending approvals from the relevant authorities and shareholders. This exercise is expected to complete mid-2015.

What’s Our View

The 2-for-5 bonus issue has no impact on our earnings forecasts. Our EPS forecasts and target price are unchanged for now pending completion of the corporate exercise. However, the bonus issue would enhance BAuto’s shares trading liquidity and improve its perceived affordability. Its total number of shares will be lifted by up to 40%, from 813.5m to an enlarged share base of between 1,139k and 1,141k (depending on the exercise of ESOS options amounting to 1.3k shares).

This is BAuto’s first bonus issue since its IPO in Nov 2013. We continue to like BAuto’s earnings growth prospects from: (i) attractive new launches (i.e. Mazda3 CKD, Mazda6 FL, CX-5 2.5L FL CKD, CX-3), (ii) cost exposure to the suppressed JPY/MYR forex and (iii) presence in high TIV growth market, the Philippines (2M15 TIV: +21% YoY). Also, with its strong net cash position (MYR319m as at end-Jan 2015), we do not rule out the possibility of a special dividend or acquisitions (i.e. raising stakes in Inokom/MMSB/BAP).

Source: Maybank Research - 30 Apr 2015

MIDF | 24 Mac 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-16

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO2025-01-10

BAUTO