Share Consolidation and Rights Issue “BUNDLE”? GOOD OR BAD?

swimwithsharkss

Publish date: Sun, 23 Jan 2022, 04:38 PM

Share Consolidation and Rights Issue “BUNDLE”? GOOD OR BAD?

I noted that the general market has quite an “interesting” perspective towards corporate exercises, and generally they are negative perspectives. Well, except for bonus issue and dividend, of course.

Today, we are going to take this company, AGESON BERHAD as our case study example on them on share consolidation as well as rights issue exercise.

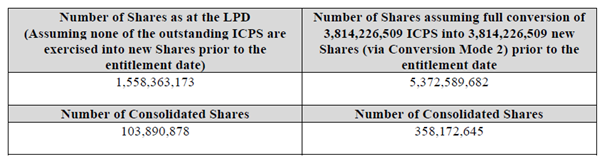

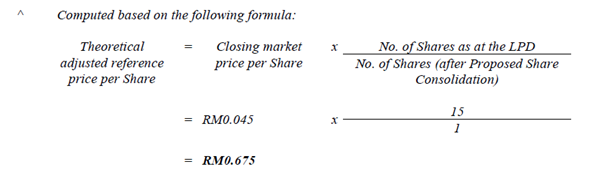

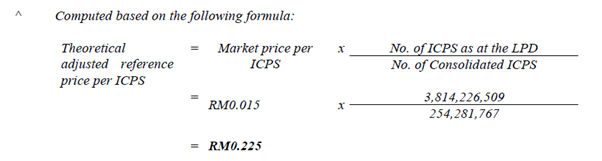

To begin with, the know that AGES will exercise a 15 to 1 share consolidation exercise. So, in other words, the company shall consolidate the outstanding 1,558,363,173 shares into 103,890,878 shares, and it goes the same for their remaining 3,814,226,509 ICPS, which will be consolidated into 254,281,767 shares.

I do not foresee any possible conversion of ICPS to the mother share now mainly due to the fact that the costs are high at the moment. Given that the closing price for AGES is 2.5 cents and the conversion price is 13.0 cents, we see no viable arbitrage opportunity at the current level to prompt investor’s conversion.

But why would a company choose to consolidate their shares?

On the surface, a company would say it is to improve the capital structure or to consolidate the number of shares, but the true reason behind the exercise is simple, which is to gain better control over the total number of shares.

You see, a larger share base usually means lower share price, which in turns there will be a larger shareholder pool.

Now back to the fundamental 101 of moving of share price, what do you think determine the movement of a share price? News? Results? Financial Performance? Prospects?

The answer is simpler than you think, it is plain simple demand and supply.

A consolidate and smaller share base usually means lesser number of shareholders, hence, that would mean a share consolidation can better control the supply of shares, especially on a 15 to 1 consolidation basis, which would further reduce the number of shareholders.

So, this is likely a sign of rising share price after the consolidation exercise end. But there is more to it.

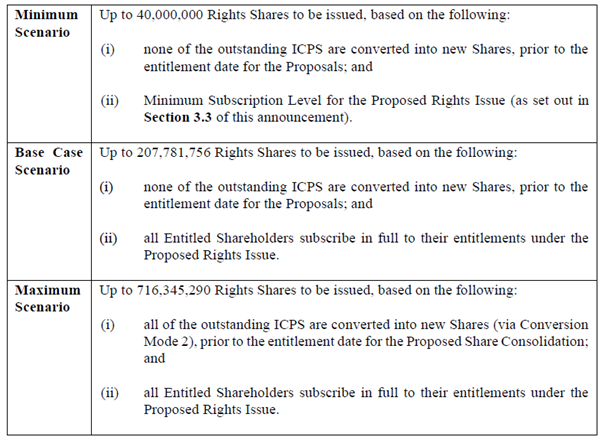

Upon the consolidation of the shares, AGES will issue 2 rights shares for every 1 consolidated share, where in order words, they could issue up to 207,781,756 new shares based on the base case scenario and as we mentioned earlier, there is low to none chance for holders of ICPS will convert into mother share at this current level, so the base case scenario would make the most sense.

However, if one would think deeper, this is actually an opportunity for the major shareholders to oversubscribe the shares and gain further control on the company. Remember what controls the true movement of share price? Yes, the supply and demand.

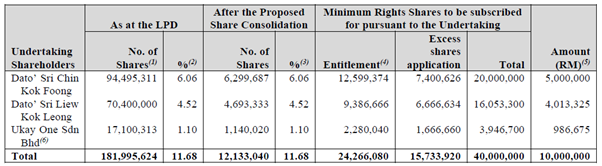

Doing that will effectively allows the management gain further control over the consolidated share base, where their total shareholding may increase from the existing 11.68% to a maximum of 36.24%, and this is excluding any potential proxy holding of shares.

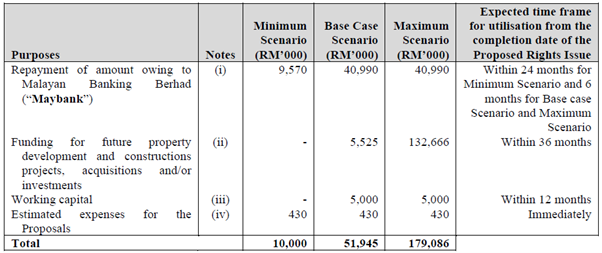

But anyhow, I felt like I’m also obligated to tell you what they are going to use the funds for. For starter, they would repay the outstanding legacy debt generated by the old owners of the company for Maybank, and the rest would be used for their future construction and property development activities.

As for those who followed the company closely, I’m sure you also noticed that they had exited from the not-so-profitable sand business once and for all. And by the action of repaying debts and realigning their focus and resources, I believe this should bode well for the company, especially when they have a highly profitable property development project on hand.

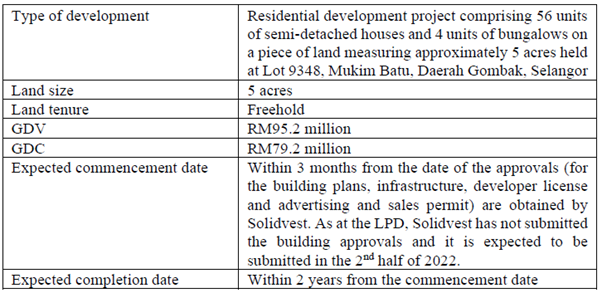

There is also balance of GDV from the Gombak development project.

So, all in all, what should you do for at the current level for AGES? I have determined a 3-way proposal for investors to act as their next step. You may refer to my advises but please buy and sell on your own risks.

For non-shareholder: You are in the best position to acquire the AGES shares at the current level, but that is not all, you MUST oversubscribe the current shares as there is a steep 36.3% discount on the subscription base on the price stipulated in the announcement. This will allow you to participate in a cheap cost and enjoy the ride alongside with the major shareholders.

For shareholder: You might be in a paper loss condition at the current level, and this is a very good opportunity for you to average down. Upon averaging down, you also need to oversubscribe your shares at the current level to collect as much low-cost shares to further pare down your costs per unit. This would allow your investment to breakeven at a much faster pace.

On the surface, this might look like a risky investment, but there is no free lunch in the world. I could only say that your risks are limited, but the upside potential is huge, maybe we are talking a 5 to 6 bagger at the current level.

More articles on Swim With Sharks

Created by swimwithsharkss | Feb 22, 2022

Created by swimwithsharkss | Dec 30, 2021