Ringgit to USD – 3.5?

teoct

Publish date: Thu, 11 Jan 2018, 03:48 PM

Ringgit to USD – 3.5?

Tan Sri Lin See Yan (ex Bank Negara Deputy Governor) among many others has expressed that the Ringgit is undervalue; he mentioned it should be about RM 3.5 to USD 1 (https://www.thestar.com.my/business/business-news/2017/12/23/will-markets-in-2018-defy-predictions-again/).

Is this possible?

Oil price is always quotes in USD and I have omitted USD in the writing henceforth.

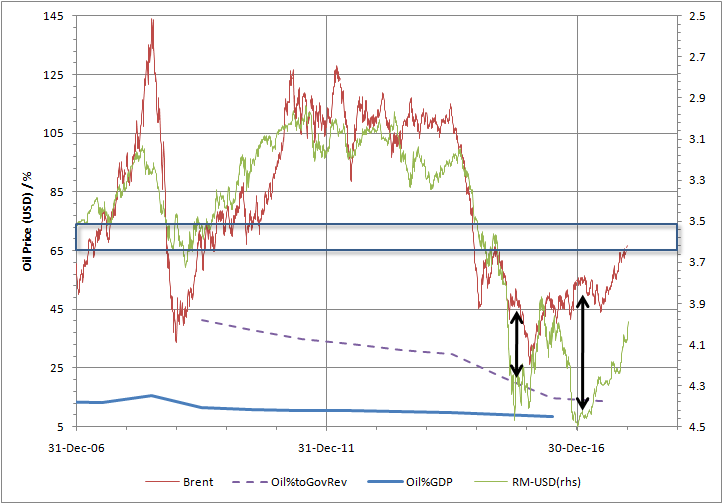

Sources – Bank Negera (exchange rate); EIA (oil price); oil % to Government Revenue/GDP – MOF

The chart shows the RM-USD compared with oil prices from 2006 to 1st week of Jan 2018. There is this close correlation between the movements of ringgit-usd exchange against the oil price movement.

Past records showed that when oil price trade at 65, Ringgit was around 3.5. Now oil price is back to 65 (11/1/18 is 69), shouldn’t the RM-USD exchange be 3.5?

There were two periods shown by the arrows (end 2014 and early 2017) whereby the ringgit appeared to have de-coupled from this close relationship.

This close correlation between the movements of ringgit-usd exchange against the oil price movement narration has been used umpteen times; and used recently again to explain why Ringgit had appreciated.

If one believes this narrative, then it should be at or near 3.5 now. But it is not, why?

Could it be the foreign workers remitting ringgit back to their home countries?

Let’s have a look. For discussion, let say there is 2,000,000 foreign workers in Malaysia, each earning RM 1,250 (average) per month making it RM 30 billion a year. They (foreign workers) repatriate 55%, i.e. RM 16.5 billion.

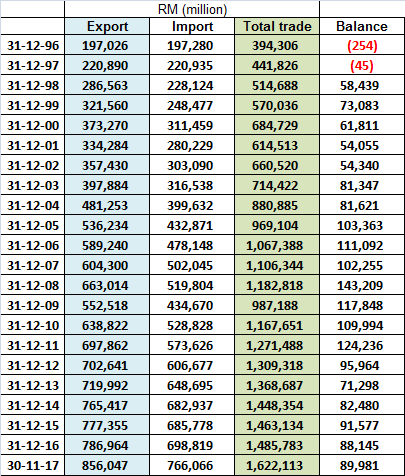

Source: Malaysia Statistic Department

Malaysian importers will need to send out RM 766 billion so what is RM 16.5 billion, a mere 2%.

We can safely conclude this is not the case.

Trade issues like balance of payment, competing with China - so must be lower than CNY, etc.

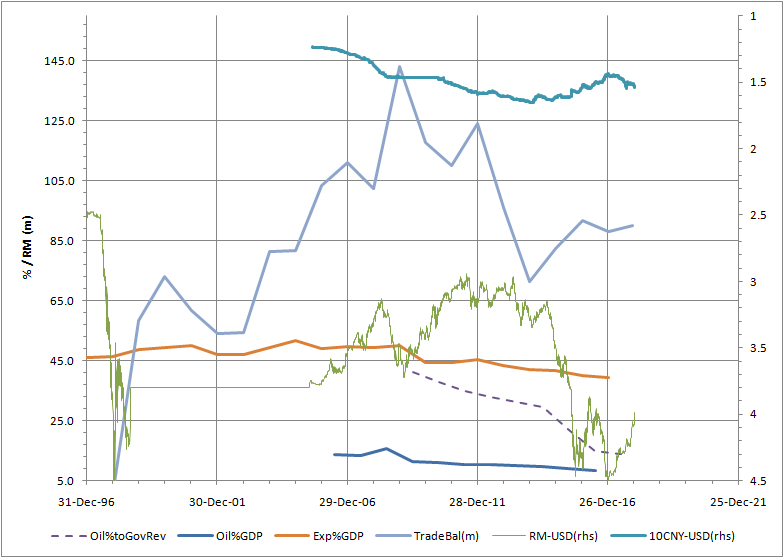

Source: MOF, Matrade, Statistic Department

a) Trade balance – When the trade balance dropped in 2012, the ringgit to US is around 3.3, now trade balance is higher, there appear to be no correlation, so no issue here.

b) Competing against China – i.e. both exports to same countries. CNY appreciated over the period when ringgit depreciated, so this should not be the case.

c) Exporting sectors – mining (read oil), agriculture (oil palm, rubber, pepper, cocoa), manufacturing (furniture, electrical & electronic, etc) is becoming less important in the GDP. The service sectors have become more important.

d) Oil is becoming a smaller component of GDP.

Depreciating ringgit so that we can sell more in the world, based on the above (especially against CNY), is a poor argument. If this is true, then our manufacturing sectors are very regressive and taking the easy way out. POINT 1

Oil productions make up 13% of Malaysian GDP in 2006 and have reduced to 9% by 2016.

Malaysian Government revenue from taxes (+dividend from Petronas) on oil production was 41% in 2009 and is estimated to be ONLY 14% in 2017.

Revenue from oil to the country and government has reduced in importance over the years.

Is this the cause of the lower exchange rate of the ringgit? POINT 2

POINT 1

Malaysia has many world class manufacturers / producers – rubber gloves, condom, furniture, oil palms and mills, etc. Many of them are listed and they have been known to be innovative so if they just wanted to sell their products to the world using a depreciated ringgit, I think it is an insult to them.

So this cannot be the case too, and I do not think this is the case. However, it did make them have extraordinary revenue / profits. Now it will show the man from the boys going forward.

POINT 2

Oil does not command the kind of importance to Malaysia like before. The market still gives much benefit / curse to this commodity. But it should not have moved as have done so over the last couple of years – definitely over sold.

So why oversold?

Malaysian has said and is still saying Malaysia is going broke, a failed state.

The above saying is self fulfilling and leads to even Malaysian world class manufacturers keeping their receipts in other currencies other than ringgit necessitating Bank Negara to act.

Malaysian themselves changing ringgit to other currencies.

Basically we Malaysian have lost confidence in our country (currency).

We have only ourselves to blame for the depreciation – Malaysian blaming Malaysian.

And we have the envious inflation rate of more than 2% that the developed world has been targeting for so long – come to Malaysia to learn.

So unless and until we, Malaysian, believe in Malaysia – the ringgit would probably never hit 3.5 again unless the oil price reach 100.

This is so sad – Malaysian blaming Malaysian.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Declaration – I do not own any counters producing gloves nor plantation but condom (world largest (producer) one, OK), yes.

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

Correct lor!

Malaysian ringgit is grossly oversold and very undervalue.

All should change back USD and other Foreign currencies to Undervalue Ringgit

1) 1MDB loan to IPIC all settled.

2) Growth at 5.2% is great in a world of sub par or no growth

3) Crude Oil going up means Petronas Revenue for Malaysia will improve

4) Malaysia is Top 5 for retirement home should draw in investments

Better switch early before Ringgit strengthens to Rm3.50 per USD

2018-01-11 19:25

vinc3362

You have just hit the nail on the head.

2018-01-11 19:19