Debt – Good or Bad

teoct

Publish date: Sun, 14 Jan 2018, 04:01 PM

Debt – Good or Bad

This is an age old problem. Is debt good or bad?

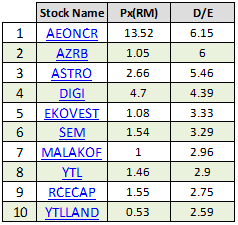

Mining Dynaquest database resulted in the following:

I used a debt to equity (D/E) range from 0.45 to 10 and this is the 10 counters that came out with the highest D/E ratio being 6.15, i.e. Aeoncr have debt 6x its equity. Going through the chatter at i3, most if not all of above are considered reasonable companies and one can invest in them (you invest at your own risk).

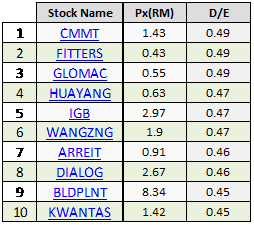

And the those nearer to D/E of 0.45;

Again, most if not all, one can invest in.

There are hundreds of companies in between and definitely some of them you will want to avoid.

This is just looking purely at one criterion, D/E.

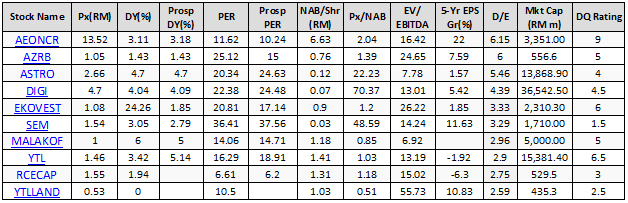

Now if we throw in other criteria, the picture changes:

( https://dqinfo.dynaquest.com.my – the link to Dynaquest if one want more info need to subscript)

- COMPANY RATING

Dynaquest Combined Company Rating Score

This is our overall/combined rating for each company derived by adding up our individual rating for Earnings/Dividend Stability, Financial Strength, Management Strength and Dividend/Earnings Growth in our original individual company reports. This “Combined * Rating” falls into 4 categories as follows

More than 7* = High

5* - 7* = Above Average

2.5* - 4.5* = Average

Less than 2.5* = Unclassified/Unclassifiable

The four categories of this overall rating roughly correspond to the four categories of distribution of overall (*) score. That is, approximately a quarter of the companies in the Stockbase fall into each category of the overall rating, with more companies in the middle two categories and fewer in the other two.

Now, with more information, the quality of the companies becomes different. For high D/E, four is just average with one unclassified / unclassifiable. One, Aeoncr, is ranked high even.

For (low) D/E from 0.45 to 0.49, four is ranked above average, five is average and one is unclassified / unclassifiable and none in the high category.

Of course, some of you have better way to assess, but by and large, what I am saying is:

It does not mean that a company with high D/E is lousy and heading for bankruptcy.

Good debts

If the debt is used to buy more manufacturing facilities or cash producing ventures / loans (of course produce more cash than required to pay loan installment), it is considered good.

Bad debts

If debt is used to pay dividend, alarm bells start ringing. And if it is used to pay staffs salary – well what can I say ……….

And there are many debts in between.

Malaysia Government debt

So is Malaysia Government debt good or bad?

The criterion to measure this is debt to GDP, below is the government debt since 1990.

Once, our debt was above 80% to GDP. Asian Crises forced it up in 1998 and come the 2008/9 Crises forced another round of debt. At around 53% (2017), some is tearing their hair out and foaming in their mouth. Die, Malaysia is going broke, etc etc…..

Depending whether you like to see suffering (Hayek) or some work is better than nothing (Keynesian), OK, this is simplifying it, but you get the drift. Debt was taken to create economic activities when crises strike. So generally, it should be good debt.

Equity is loosely GDP for government debt.

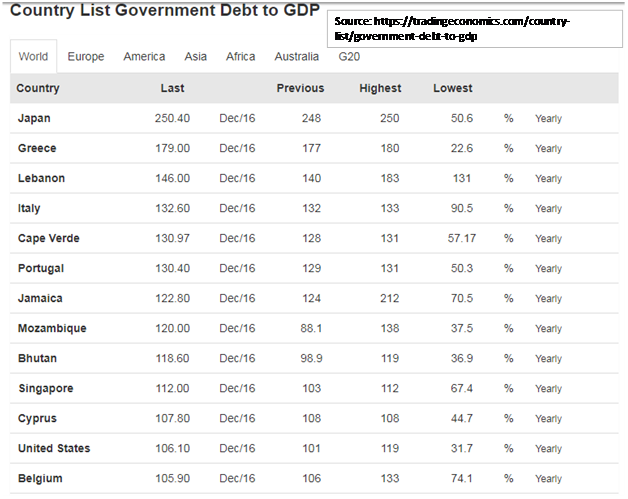

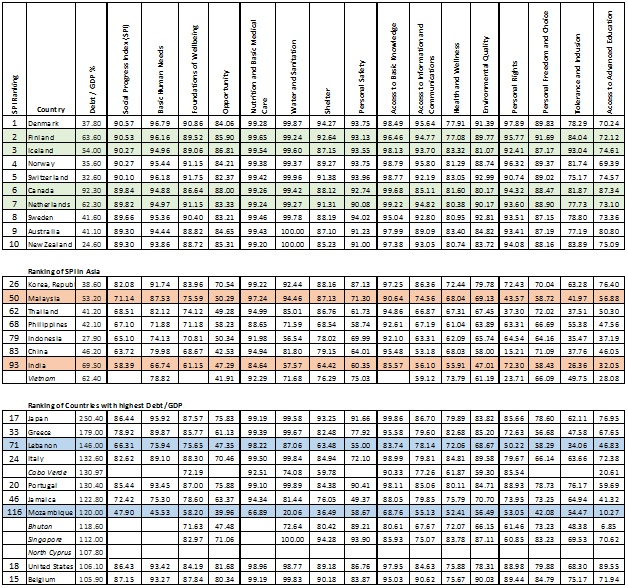

Other countries debt to GDP is as shown below:

So, is Japan going broke, Greece (I do not know, but they are still around). Singapore, gosh, 112%; US 106%? If they have not gone broke then I think Malaysia will not too.

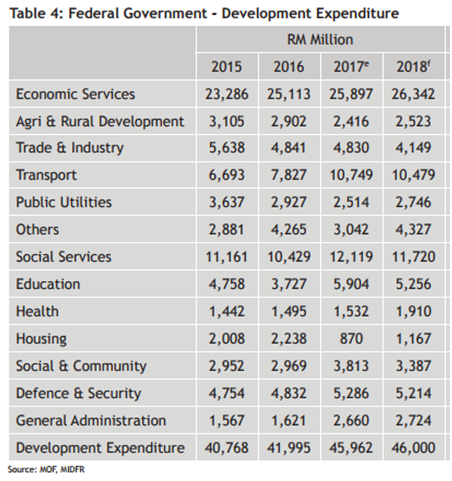

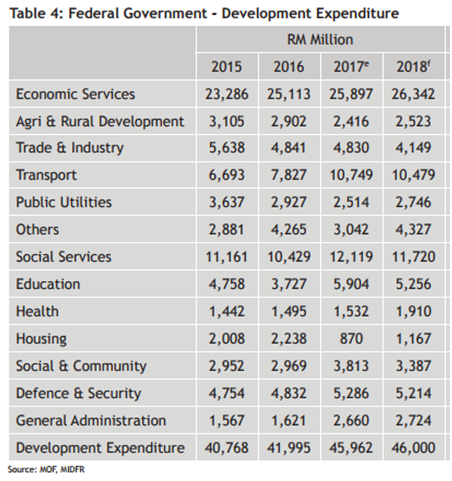

The last time I looked, Malaysia Government has been borrowing for capital expenditure – i.e. projects that improve economic activities / security – ports, public transport (MRT/LRT/Rapid), schools, hospitals, roads, etc.

Again if we look at other criteria, a different picture becomes apparent. These other criteria can be summed up as a Social Progress Index, SPI, (http://www.socialprogressindex.com).

I have inserted the Debt to GDP ratio and clearly any given debt level does not mean bankruptcy or the country is going to the dog. As can be seen, countries highly in debt also do well measure in other way. Malaysia is ranked 50 in the 2017 SPI.

Yes, all these are Western Ideas / Values, short of anything better, this will have to do for now.

Source: http://www.socialprogressindex.com, author inserted Debt/GDP from tradingeconomics.com

I think a more meaningful discussion can be had if we deal in one, two or more of the above criteria rather than just be fixated on debt.

Nevertheless, just to beat this Debt to death!

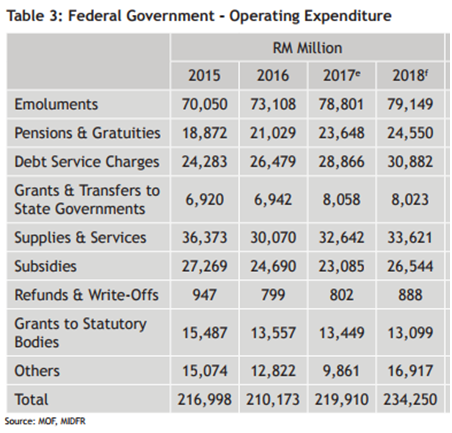

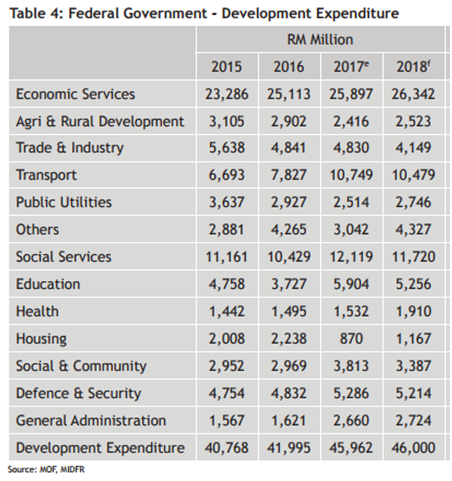

For operation, the government collects more than enough to cover this – please see Table 1 (all tables courtesy of MIDF). Table 2 and 3 gives where the income come from and where they go to while Table 4 show what the capital expenditure is spend on.

Right, all debts have to be repaid. I agree. Let us not just shout that the debts is increasing but, let us be productive citizen and suggest way to cut it, shall we.

The Debt Free Party manifesto:

We will make Malaysia Great Again - our party slogan.

- Cut tax so that the economy will speed up, GDP to grow above 10% (we can, Malaysia BOLEH), GDP should increase to 1.5 trillion by 2019 (we only take over in 2018 after GE14) and using the ratio of about 16% to GDP (normally 17% but we have cut tax remember), government revenue would be 240 billion (we are politician, so cannot tell you the new tax rates - it will be low, vote us first)

- Small government, cut government servants by at least 45% (emolument reduced by 28b – mostly lower rank cut mah)

- Like all new party, transparency, anti corruption, all the good things, save another 10b (pick which one you like to cut from Table 3)

- As we are anti-debt, stop HSR, stop MRT3, development projects only if there are balance from revenue less operating and LESS DEBT. Now 240 - 234(2018 opex) + 28 +10 = 44 b

- By the time we take over, government debt would be about 660 b. So we will enact law that no development allowed until debt paid. And development must only be carried out when there is balance – NO LOAN.

At the rate of about 44b balance (after less opex), about 15 years (it will take more as 2nd year, no more gain from cut in civil servant) all debt would be paid. I am 61, better than a 92, NO?

An idea! Maybe we can corporatize civil servants as much as possible to get their salary off the budget. Sorry you will need to pay out of your own pocket for all future government services (imagine when your house on fire, you will need to pay and show receipt to fire department before they send the fire engine).

And please do not compare to that small island south of Johor. To go from east to west only take at most 1 hour by road, try getting from the eastern most of Malaysian to the western most or north to south – small government indeed!

And no toll, no tertiary fees, no GST, watch EPL on RTM, subsidy for petrol, etc AND NO DEBT - how ah, are these people serious or what? How to reduce Debt? They take us for a MORON, so insulting.

So you think I am talking rubbish about paying down the debt, not possible to implement all the proposals, not even one! You want the development (otherwise your construction counters going to tank) but no debt also - they are contradictory.

I just do not understand, normal Malaysian buys properties and cars using loan, NO?

So, why this hysteria on government debt at 51% to GDP?

But on a serious note, HSR should be stop in exchange for proper public (bus) transport and roads to the heartland of Malaysia - this will really help improve the lives and economic well being of more Malaysian than HSR will ever do (it will ONLY benefit that small island south of Johor). I think, CONNECT THE HEARTLAND, is much better, improve social mobility (the movement of individuals, families, households, or other categories of people within or between layers or tiers in an open system of social stratification)! Think about it, bring the heartland to the morden world. Create more jobs for local construction counters than HSR will ever do.

Disclosure: I own Aeoncr, Ekovest, IGB and Malakoff shares; buy at your own risk!

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Nor am I employed by the Malaysian Government. I am a retired engineer musing ONLY.

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

This article talks alot but says nothing! Poor article. Zero value added.

2018-01-14 20:15

Undilah_DAP

Why AirAsia debts consider good?

2018-01-14 16:49