Six months ahead

teoct

Publish date: Sun, 25 Feb 2018, 11:52 AM

In 2017, I watched the talk given by Datuk Cheah Cheng Hye (of Value Partners – Hong Kong) in Power Talk at Star TV (https://www.thestar.com.my/videos/2017/03/25/powertalks-march-2017-datuk-seri-cheah-cheng-hye/).

I came across Value Partners in 2004, but as usual dragged my feet (in those days, the world was not that connected – didn’t know how to move fund to HK to invest) in not investing in their funds. That is history let’s not deal in it anymore. Let us move forward.

The most important point I took out of that talk is “the need to think six (6) months ahead”.

Of course saying is so easy, one has to cultivate the ability to think or “see” six months ahead. But I am going to try and welcome all at i3 to join in so that we can “see” six months ahead (SMA).

By seeing SMA, then the next step is what are the stocks / counters / public listed companies (PLC) that will benefit / suffer if the predictions come to pass.

I will start with oil price and interest rate (OPR – overnight policy rate) as I think these two will affect the economy greatly, thus, the PLC business.

|

Months |

Oil price (USD) |

Interest Rate - % |

||

|

Predict |

Actual |

Predict |

Actual |

|

|

August 2018 |

70 |

|

3.25 |

|

|

September 2018 |

70 |

|

3.5 |

|

|

October 2018 |

70 |

|

3.5 |

|

Should the oil price come true at USD 70 per barrel, then the following PLC would benefit:

- Hibiscus

- Reach

- Sumatec

- Sapura Energy (but their service side complicate valuation)

But of course if you would like:

- Shell

- Esso

- BP

- Total

These are the companies I know, I am sure there are many more…

Please note these are companies that are in the business of extracting oil (and gas) ONLY.

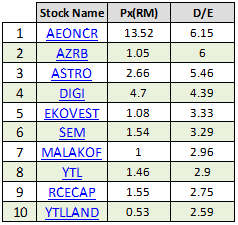

As for OPR hike, then the following PLC would be affected negatively:

For Aeon Credit (& RCECAP), the effect might be muted as they could pass the cost to their customers. For the rest, I am not so sure.

Have a good week ahead.

More articles on TeoCT

Created by teoct | Jul 23, 2020

limch

Hibiscus no more cheap after rising 5X from 17.5 sen in 2016. You stucked buying at RM 1.5-2?

2018-02-25 12:52