Six months ahead (update 2)

teoct

Publish date: Tue, 24 Apr 2018, 03:31 PM

Six months ahead (update 2)

Last month, the oil price was revised from USD 70 to USD 75.

Recently, Saudi indicated they would like USD 80 to USD 100. And POTUS (Donald Trump) tweeted that this is not acceptable, oil price dropped about 1% and then recovered some.

Fundamentally, the demand is strong and supply is not keeping up.

On the supply side there are many dogmas:-

a) Shale oil will flood the market soon

b) Saudi (OPEC) just turn the taps and flood the market

c) Non-OPEC (especially Russia) is itching to open the tap to flood the market

Shale Oil

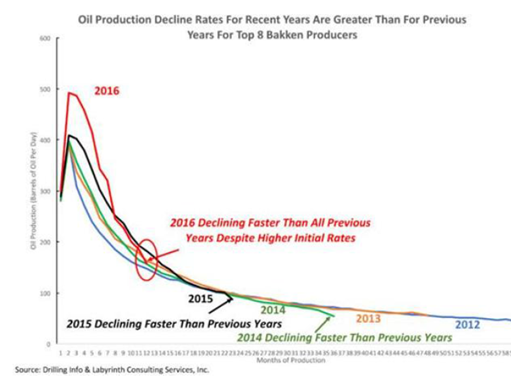

This is the typical profile of shale production. After about 12 months, production reduced to about half of initial production.

Also it appear that the new (drilling) technology only improve the initial (higher) production but not the ultimate (or total) production of the well.

For shale production to be maintained that means “drill baby drill”, need to drill more to replace the lost production. And the best acreage had already been drilled and they are moving to Tier 2 now.

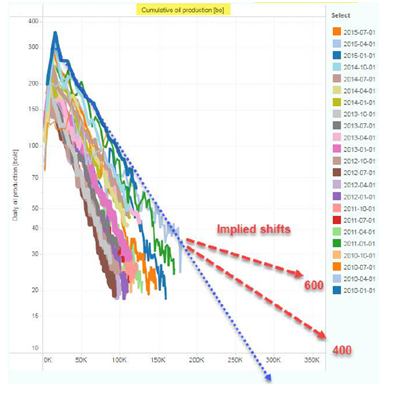

Source: ShaleProfile.com by Enno Peters

The above chart showed that the EUR (Estimated Ultimate Recovery) for shale to be much lower. So this is a challenge to continue growing shale oil at 1 mbpd year in year out. Going forward, the growth rate for shale oil will most likely decline.

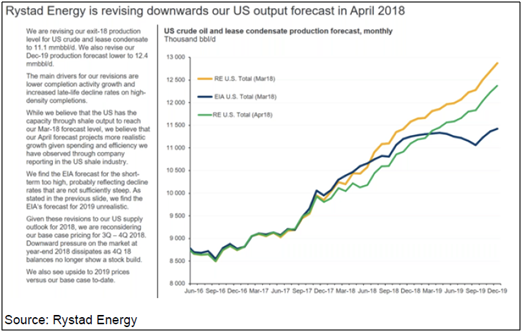

Rystad Energy, a reputable energy company has direct access to shale oil wells data had recently lowered their forecast as shown below.

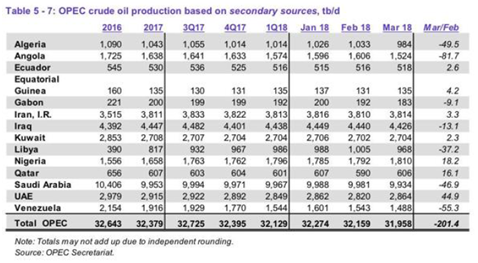

Saudi and OPEC

As can be seen from table, OPEC production figures had been decreasing since 2016 from 32.6 mbpd to 31.9 mbpd in March 2018. The biggest reduction is seen in Angola, Venezuela, Saudi, Algeria and Libya.

There are several reasons for this reduction:

1) Lack of maintenance (because of the low oil price from 2015 to 2017). Like all thing, production wells also need maintenance – leaking valves, flanges, well clogging, etc.

2) Lack of capital expenditure – no new fields coming into production due to low oil price

3) Natural depletion.

4) Reservoirs issues – like increase water production (water used - injected in the middle east to maintain pressure in the reservoir to push oil out)

This is the first time where cut-back compliance had exceeded 100% not because the countries really do not want to produce but they cannot produce (even if they want to).

Venezuela case, there is also lack of workers due to the economic situation. Oil workers have “run away”. This is a case of “Those who promise us paradise on earth never produced anything but a hell” – Karl Popper.

Non-OPEC

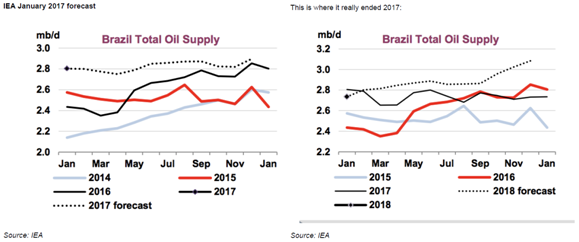

Brazil, one of the biggest non-OPEC producers has a record of over-promise. Here is their record.

Norway just reported their March 2018 production at 1.9 mbpd, a -2.4% m-o-m, -10.5% y-o-y reduction.

All other producers are in the same boat as per the reasons (except point 4) given for OPEC.

And because of the lack of capital expenditure since 2016, do not expect production to “flood” the market next six months, this year nor next year.

Malaysia is no different as PETRONAS is just awarding maintenance contracts; result will come in about six month’s time (if any) for higher production. And new project just announced by Sapura Energy (but for gas). I have not read any (new project) from PETRONAS Carigali or other major producers yet.

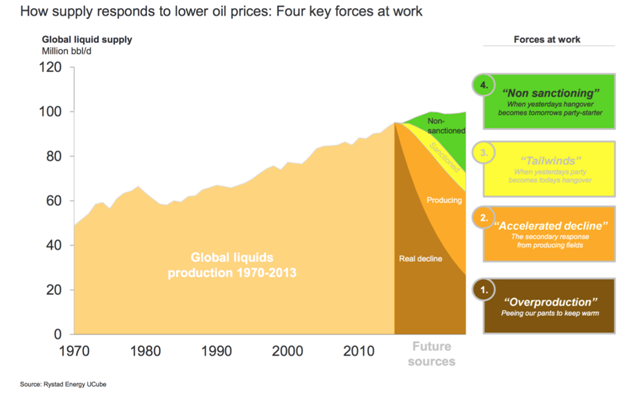

In general, the above could be summed up in this graph below:

So in conclusion, there will be no flooding of oil anytime soon because producers just CANNOT.

Demand

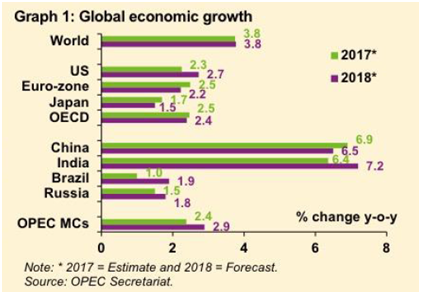

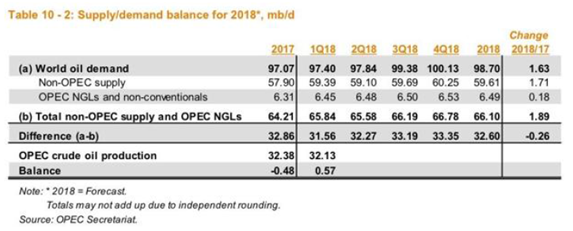

2018 should be seeing similar increase in oil demand as last year with world economic growth expected to be same as 2017.

The estimated world oil consumption (by OPEC) is as shown below.

OPEC recently states: strong growth in emerging markets, strong foreign investments into these nations, attractive (relative) growth in OECD nations and low interest rates have served to push economic growth and, in turn, global oil demand higher. The normalization of monetary policy could act as a partial offset to these items, but the view of the group is that global economic growth should total 3.8% this year, matching last year’s. Even though China’s growth is expected to slow, the US should grow by 2.7% this year, up from last year’s 2.3%.

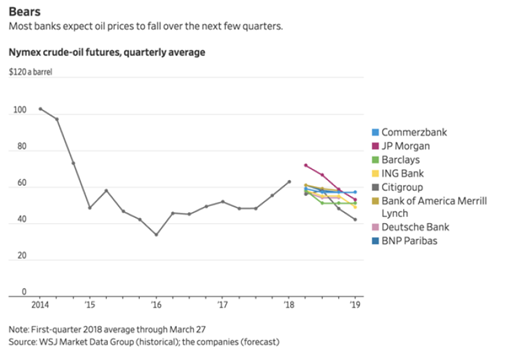

So why is the oil price not revised? I am a bit worry about the big investment banks that had bet against oil price increase as can be seen in the following graph.

They have the "ammunitions" to move the market or so I think, just being conservative.

What can derail this again; depend on POTUS (President of the United States),

– Iran nuclear deal, sit tight, May 12th is just round the corner; perceived supply disruption

– Tariffs (trade war); perceived slower economic activities leading to lower oil consumption

– Release Strategic Petroleum Reserve (US) which currently store 665.5 million barrel; perceived flooding oil market. This is an outlier, and US had done this for other commodoties, so why not oil?

So on balance, based on fundamental (max-out*) supply and strong demand, current storage around the world will see more draw-down and with current perceived shale oil, Saudi / Russia / non-OPEC flooding the market, a USD 75 seems neutral for the next six months.

Once perception changes to see actual situation on the ground in the coming quarter, USD 80 and higher would materialize.

Have a nice weekend.

*cannot increase anymore, will need sustain capital expenditure to clean-out wells, repair production facilities, etc to increase current production and this will take time.

p/s just today 24/4/18 read that Brent has breached USD 75.

More articles on TeoCT

Created by teoct | Jul 23, 2020

Jon Choivo

This is very insightful.

Thanks.

2018-04-24 17:00