SMA 3: Coming of EV?

teoct

Publish date: Fri, 25 May 2018, 12:42 PM

The coming of EV – when??

One hundred years ago, EV (electric vehicle) was the norm and the person who introduced mass (vehicle) production, Henry Ford, together with Edison was defeated by the superior efficiency of the internal combustion engine (ICE).

Here I want to introduce the concept of energy conversion – energetic.

An example: early farmers initially avoided horses because the energy generated from the increased harvest was less than the energy required to raise, house and feed the horse. It was not until improved harnesses were introduced that the “energy return on energy invested” (EROEI) swung positive and farming practices changed.

The adoption of major technologies throughout time all resulted in a more efficient conversion of energy than what existed before, thus, the adoption of EV should be no different.

Vaclav Smil’s book - Energy and Civilization, gives a good account of this energy conversion concept and EROEI. So far, in history, no inferior EROEI technology had displaced one with superior EROEI. Adoption of EV now would be a historical first.

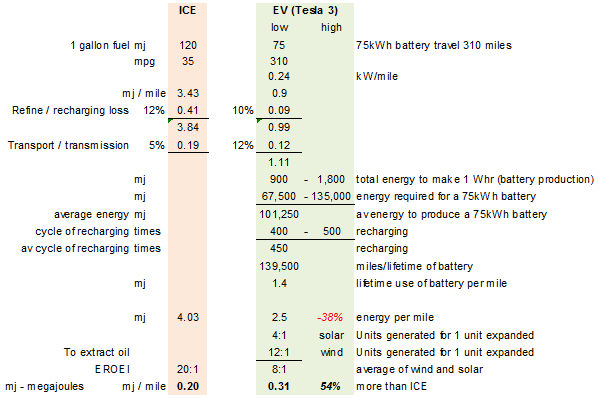

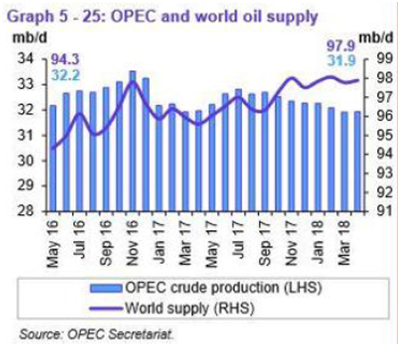

Let’s do a comparison of both ICE vehicle and EV doing a mile. For EV, it has to be powered by green sourced energy (solar, wind, hydro) and definitely not by coal.

Source: Goehring & Rozencwajg

There are many issues with solar / wind energy, the manufacturing of solar cells (requires more energy than it can produces over lifetime), transportation of big wind turbine for installation, volatility of energy produced (cloudy, no wind), to store energy produced or not, charging stations, etcetera.

Do not forget that these competing systems, ICE vs EV, are both improving their efficiency. It is not as if, ICE is standing still while battery technology or the conversion of solar / wind to electrical energy improve.

Adoption of EV will certainly take place once the cheap oil is all produced and marginal field like Canadian Oil Sand that requires an EROEI of 5:1 remains.

So ICE is here to stay for a long time.

Please also do not forget there are 1,200 millions ICE vehicles now and increasing at about 78 million per year. The world still needs oil for the foreseeable future! (Some guess for at least next 25 years.)

OIL PRICE

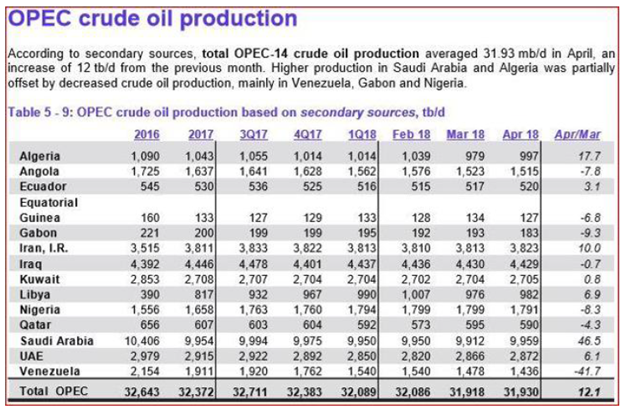

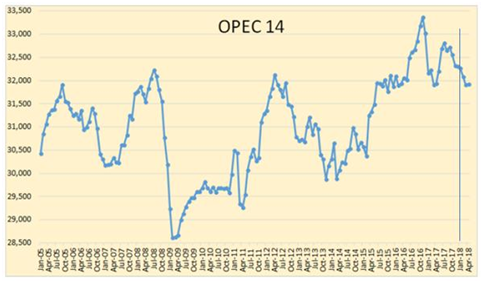

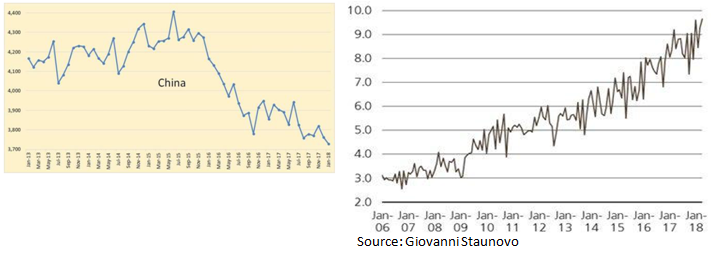

It can be seen that the production of OPEC is bottoming at around 32 mbpd.

If one prefers a graph, below is the graph of OPEC production since January 2005.

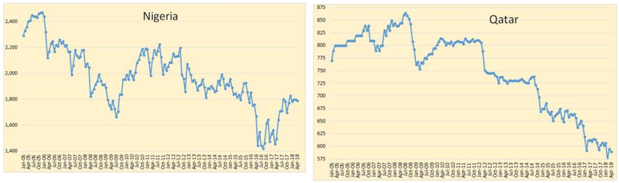

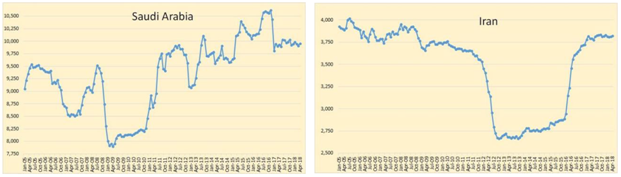

As can be seen from the above four countries, the trend for these producers are DOWN. They might be able to arrest some of this down-trend but without massive injection of fund, the production would not increase in the near term (i.e. 6 months to a year).

While the graph for Saudi shows a potential spare capacity 500,000 bpd, this maybe just enough (don’t forget Saudi also subject to natural depletion of about 5% per year as well as water production problem of carbonate reservoirs) to cover the drop of Venezuela as shown in last update, now look like plunging towards 1mbpd from 1.4mbpd now.

IRAN – the bogeyman. During the sanction years (2012-2015), production was only 2.7mbpd.

Now, Iran production is 3.8mbpd, a full 1mbpd more from 2012 to 2015.

Your guess is as good as mine as to what would be the production like post Trump sanction.

China production has peaked and they are importing a lot of oil.

With oil demand hover around 99 – 100 mbpd and world production at only 98mbpd, there is a shortage of 1-2 mbpd. Before long, current world storage would be very much depleted.

So based on normal supply and demand, the oil price is revised as shown. While current price has exceeded the prediction, one do not know what Trump will do – he may suddenly kiss and make up with Iran just like what he did with ZTE and China. And now suddenly not going to Singapore, with all this uncertainty, get ready for USD 100 per barrel.

OPR

With the change in Malaysian Government and promises being carried out (rightly or wrongly depending where you stand) there is no denying that there is a lot of pressure on Malaysia interest rates being created. With that in mind, the OPR is revised as shown.

|

Months |

Oil price (USD) |

Interest Rate - % |

|||||

|

Predict |

Actual |

Predict |

Actual |

||||

|

24/2 |

24/3 |

24/5 |

24/2 |

24/5 |

|||

|

August 2018 |

70 |

75 |

85 |

|

3.25 |

3.5 |

|

|

September 2018 |

70 |

75 |

85 |

|

3.5 |

3.5 |

|

|

October 2018 |

70 |

75 |

90 |

|

3.5 |

3.5 |

|

|

November 2018 |

|

|

90 |

|

|

4.0 |

|

Going forward, consumers are going to get hit and hit hard. Cost of production is going up, doing business is going to increase because transportation is going up, maybe not, because of subsidy (Malaysia only), heck, rating to go down, interest rate up some more, housing loans repayment will go up, less discretionary spending, less consumption, and so on, spiraling out of control maybe.

Have a good weekend.

More articles on TeoCT

Created by teoct | Jul 23, 2020