1 Trillion Conundrum

teoct

Publish date: Sun, 27 May 2018, 05:14 PM

1 Trillion Conundrum

This past week had been most educational.

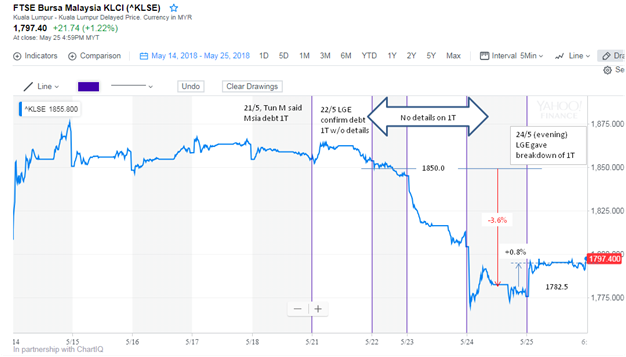

Here is the KLCI of the past week with the various pronouncements made.

The pronouncements made on 1MDB being bailed out by Khazanah / Bank Negara / EPF were not included, but would also have affected the sentiment of the market.

In two days, 23 and 24 May, KLSE lost about 3.6%. Clarification of the composition of the 1 Trillion was given on of 24 May. Whether it was made in the evening after market or during the day could not be ascertain with certainty. The Star online published the news and timed it 7:18pm (https://www.thestar.com.my/business/business-news/2018/05/24/debt-to-gdp-ratio-above-80pct-says-lim/). Other websites do not provide time.

Nevertheless, the market recovered 0.8% on 25 May. The recovery of the market would be due to many reasons:

a) Oversold situation of the previous 2 days

b) Sentiment concluding that the 1 Trillion debt breakdown had been reported before, just different groups deciding to adopt the different definition of what constitute (Federal Government) debt (like the boy that cried wolf or like no WMD found in Iraq; a relieve)

c) Or market appreciating the honesty of the new government on debt calling “a spade a spade”

The market was definitely rankled by the 1 Trillion debt pronouncement.

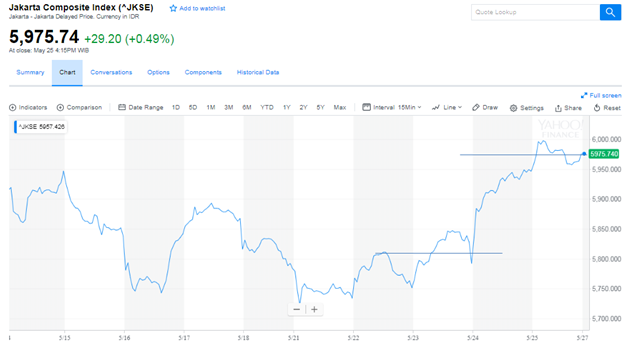

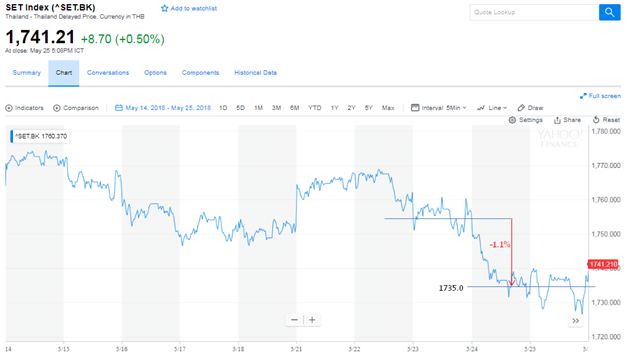

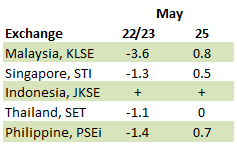

To say that the loss of 3.8% was similar to what happen in the regional markets, let’s have a look:

Singapore lost only 1.3% and then gained 0.5%.

Jakarta did not see any loss but instead gain over the same period.

Philippine lost 1.4% and gained 0.7% on Friday 25 May.

Thailand lost 1.1% and has not recovered yet.

Summarizing, Malaysia dropped the most and definitely did not follow the regional markets. While Malaysia appreciated the most compared with its regional Peers, it is only 0.1% more than the next highest is no big deal really.

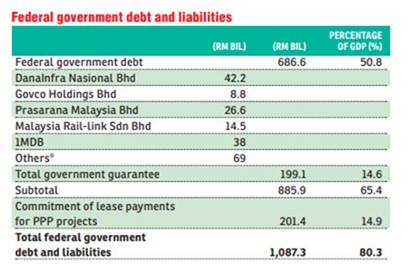

Now we all know what made up the 1 Trillion (to be precise, 1.0873 Trillion); whether some of them should be considered debt or not, is MOOT really.

Source: The Edge Daily 25/5/18

Another point, the pronouncement was given prominent front page in big font size while the clarification was relegated to some side column with much smaller font sizes. This (font sizes) may not amount to much but confirmed that most (if not all) of the figures were known already. Give whatever excuses, it is rather sheepish.

So this rhetoric / melodramatic pronouncements are rather unforgivable; even Kadir Jasin had to come out to say so (https://www.thestar.com.my/news/nation/2018/05/26/transform-talk-into-action-no-posturing-needed-kadir-jasin-tells-pakatan/).

And on 25 May, said that Malaysian economy is strong!!

If I can determine how my tax money is being spent by the government, then I wish that it will not go to pay the Finance Minister’s salary for the month of May, 2018.

p/s The Federal government debt is 705 Billion at Q12018 and I project it to be RM755 Billion at end 2018.

More articles on TeoCT

Created by teoct | Jul 23, 2020