Where is the Malaysian Ringgit heading?

teoct

Publish date: Sat, 14 Jul 2018, 02:57 PM

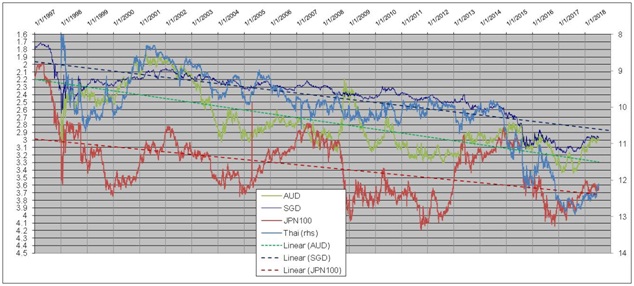

A picture paints a thousand words; here is the movement of our currency in relation to some of our Asian neighbors.

Source: Bank Negara

It is all been downhill since 1997. I do not have data earlier than 1997.

Singapore dollar was at 1.8 in 1997 and now 3. The trend is DOWN!

Thai Bath was 8 in 1998, now 12++. Something happened in 2015, Thailand got their act together?!?

Generally, my thinking is we are user only. We do not invent anything. Most of the products manufactured in Malaysia were invented elsewhere. It appears the need to de-value ringgit to compete with our neighboring countries to export. The never-ending needs of foreign workers also drive this de-valuation, especially in the plantation sectors.

Some in this forum wish the ringgit depreciate more so that listed exporting companies make more money in ringgit term – sad, real sad to make money this way instead of the products are sold because they are better made / higher quality or have higher usage.

Ladies and gentlemen, Australia (and Canada) is also a commodities and agriculture exporting country much like Malaysia, they have a minimum wage much higher than ours, they (manufacturers / commodities / plantation owners) have not gone bankrupt, and so plantation owners what gives? Manufacturers, if you do not want to automate, than stop, retire, else move up the value chain. Every day I read manufacturers asking for reprieve on foreign workers hiring this and that.

Since I graduated back in 1981, 37 years ago, there were already talk on IBS (industrial building system); 2018, still talking about IBS albeit with some adoption.

It is depressing.

When we go overseas, we obediently queue to buy F&B but in Malaysia, we must be waited upon. More foreign workers. It is safe to say 99% of coffee shops have foreign workers. Why the owners do not want to change their SOP to self-service?

I remember when the petrol stations changed to self-service, wow, big ballyhoo.

What is the future for Malaysia?

Extrapolating, RM 4 to SGD 1 in 2040 or thereabout.

AFTERWORD (16 JULY 2018)

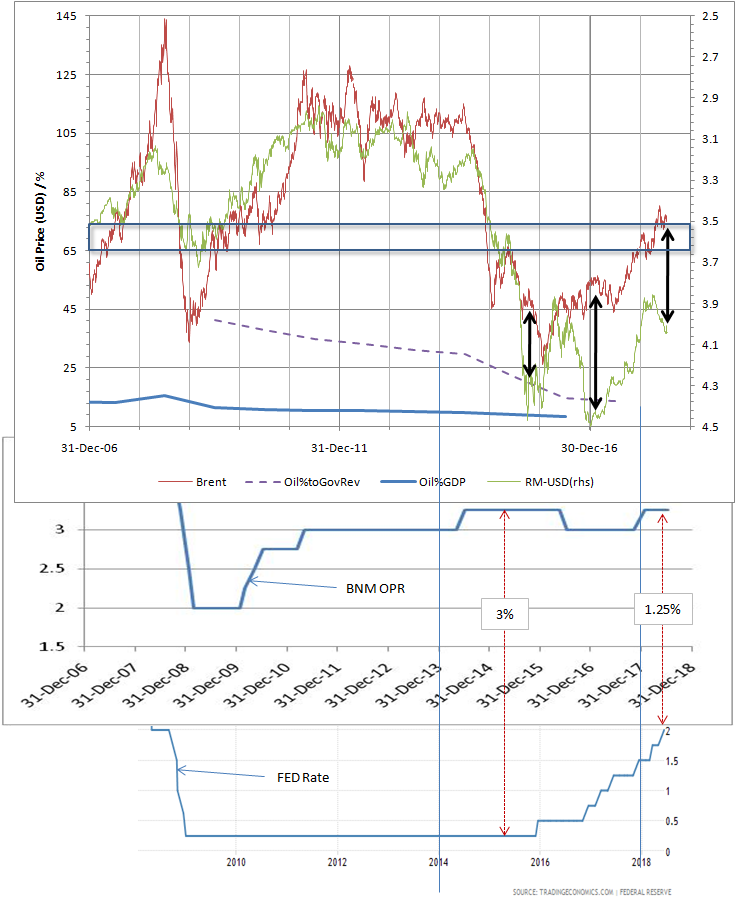

My earlier article on Ringgit, Ringgit to USD – 3.5? (https://klse.i3investor.com/blogs/teoct_blog/143978.jsp) was written on 11 Jan 2018. Brent was USD 70. And based on the past, the Ringgit should have been about 3.6, instead on 11 Jan 2018 it just broke 4 towards 3.9895 (as quoted in BNM middle rate at noon).

Since then, much has happened, especially GE14.

Now there appear to be two factors influencing the movement of the Ringgit vs the USD in the near term:

a) the FED raising the interest rate - The (interest) rates between Malaysia and US has narrowed from 3% to 1.25%. FED has indicated that US rate would be increasing further and the general consensus is 2.25 to 2.5% at the end of 2018. Should BNM maintain the OPR at 3.25%, then the "premium" would narrow further to 1% or less. This would therefore reduce the appetite of foreign fund in Malaysia soverign bond as well as equity.

Foreign fund had sold down equity to the tune of RM 11.3 billion (May - 5.6B, Jun - 4.9B, Jul till 16 - 1.3B)

b) the removal of GST and reinstatement of fuel subsidy causing a gap in the government revenue. While the restoring of SST would go somewhat to plug the gap, it is still not enough. This uncertainty add to the "way and see" attitude.

As usual the a picture paints a thousand words . .......

And now the Ringgit has de-coupled from the oil price again.

We are definately doing something "right" to ensure the Ringgit continue to depreciate. In the past rising oil price help the Ringgit appreciate, now it just make no different at all, worst, depreciate.

Is this structural?

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock (if any) is mentioned in this article.

More articles on TeoCT

Created by teoct | Jul 23, 2020

shortinvestor77

Ha Ha! Real things that Malaysians like subsidies.

2018-07-14 16:00