Hibiscus - oil producer II

teoct

Publish date: Sun, 02 Sep 2018, 04:40 PM

Altering the course of rivers and moving mountains is easy. Changing someone’s character is impossible.

Chinese saying.

Summary

- A “bad” fourth quarter – oil sold is below expectation, but with good reason

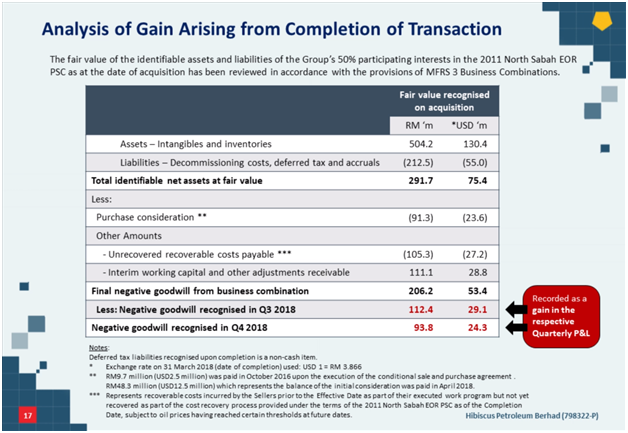

- A very good fourth quarter – surprised (more) negative goodwill – more on this later

- North Sabah (NS) production – 5,903 bpd > 5,500 bpd assumed (+7%); 623,544 barrels oil sold at USD 73.26 and opex dropped from 12.92 to 8.15 (reduce by 37%)

- Anasuria Cluster production – 3,375 bpd > 2,800 bpd (+20%); zero barrel sold; opex reduced from 23.96 to 16.39 (-31.6%)

- Anasuria Cluster reserve upgraded to 24.4 mmb (P2) from 20.2 mmb

Sitting at my desk looking at my laptop wondering how to write this after the big selldown on 30/8/18. I try ....

Investment / Speculation

Yes, if one narrowly looked at the fourth quarterly report, the “delayed” selling of oil produced in Anasuria Cluster was a shock to say the least. But there was a good reason for that and management has to be commended for it.

As an investor / shareholder of the company, I would want my asset to be safe and to keep producing oil (& gas) way into the future. So the decision to defer the off-take was a right one. Take a moment and imagine while oil is being transfer from the FPSO to the oil tanker and drilling rig encounter a blowout (this is the risk entering any well, especially an old well that was shut in, there may be gas buildup)

While gas will always be associated with any oil production and when there is a market for it, it is a bonus; from here on, only oil production figure will be considered and gas excluded, this also make the evaluation with an added margin of safety.

But one just cannot fault “investors” taking flight; evolution, yes evolution has caused this action once perceived danger is approaching. Malcolm Gladwell tells us in “BLINK” and many others. Millions of years, we are hardwired to run when danger approaches. It is in our genes. And it is hard to remain calm; I have learned this with many of my money “donated”. Investment made on a blink lost money while those with cold gaze and careful study make money.

Most investment bankers had gone through the quarterly report figures and it need not be repeated here.

Negative Goodwill / Reserve upgrade

Accountants do have a way with words. They have to be different else “cannot find food”. Negative, yes, straight away ones think it is no good, negative, conjure up, invoke lost / lose / not good, poor and so on.

When I started my business, had headaches trying to understanding accounting terms, credit, debit, balance sheet among others.

But it was good training to understand the going on of a business and dare say become a better investor too. I highly recommend this to all prospective investor to go start a business, small one also can, then one will know first-hand what all the terms in the Annual report / quarterly report meant. Nothing beat hand-ons learning.

So in this particular sense, Negative Goodwill is a damn GOOD THING.

It meant the company bought the North Sabah asset CHEAP. This is not paying peanuts, get monkey.

Imagine you buy Mid-Valley mall for a quarter of the current market price, good, no?!?

And reserve upgrade, well all this means is, just like Mid-Valley owner (IGB REIT), asset revaluation, the property / asset is more valuable now. Simply because it cost more to build another Mid-Valley, and producing oil reserve also more VALUABLE now as oil price is USD 70+, no longer at USD 30+ (much higher revenue).

HOW? Well like Mid-Valley, these lobbies, that open space, etc., can be turned into rental space for instance. Similarly, looking at flow rates from current producing wells may indicate slower depletion rate, newer better tools to evaluate seismic data could / would show up some pockets of reservoir not seen in previous evaluation and so on. This is a layman view of things, but an investor has to build this knowledge where value comes from, don’t just look at a word.

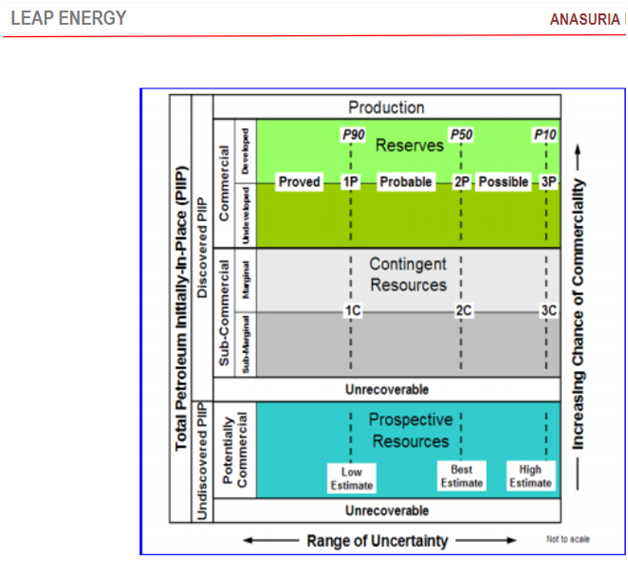

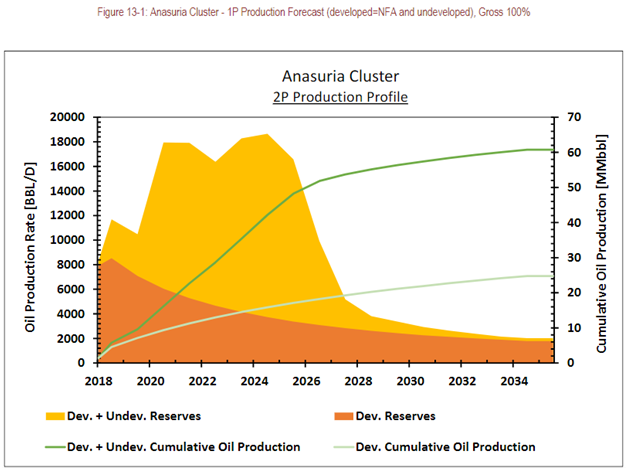

Of course, you are right, there is a big difference between a mall and a reservoir, one can see, the other is underground, for this one, also under the sea. That is why there is a range of possibility as shown in the graph: (P90 means at least a 90% probability that the estimated potentially recoverable quantity (from a technical standpoint) will equal or exceed the low estimate, on the assumption that development did proceed – from Guidelines for the Evaluation of Petroleum Reserves and Resources by Society of Petroleum Engineers)

An (independent) expert need to be employed to go through the data and an assessment made so that investor, shareholders have a feel what the asset is worth not based on what Management said.

It is just like going to see a doctor, get an x-ray / MRI / etc. and an “observation” made. Of course, a second opinion can be sought, are you willing to pay maybe RM 5 million for another reservoir assessment (I am guessing here)? Sometime, we just have to trust that DOCTOR.

LEAP (the independent expert) is conservative in their valuation too, oil price used is much less than the previous study.

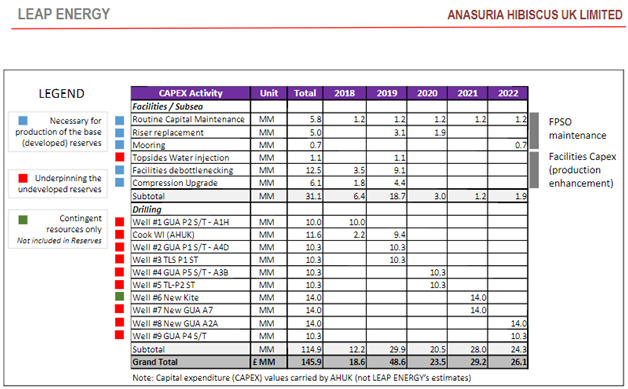

Management had been busy and had come up with a list of asset enhancement initiatives (AEI) as shown.

And with some of these AEI, the cash flow might be:

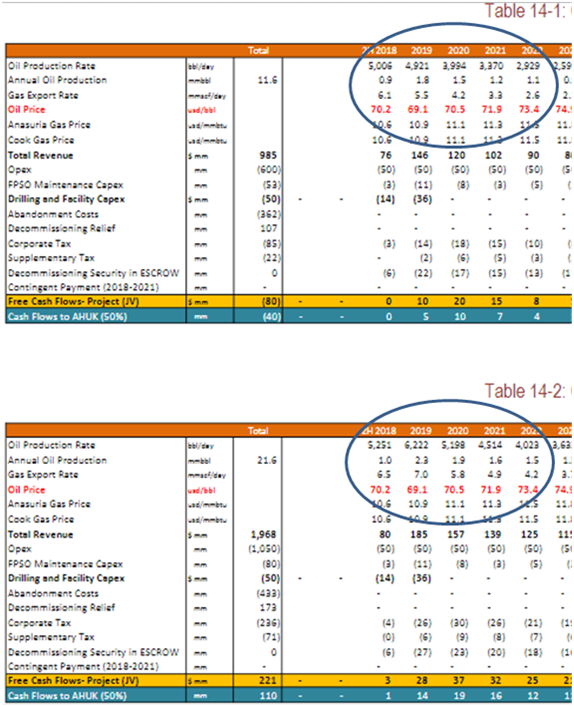

Sorry this is small; an enlarged one follows and please note the probable daily production and the oil price used.

Table 14.1 is for 1P that is developed while Table 14.2 is for 2P developed. The expectation is daily oil production could exceed 5,000 barrels per day.

Do note the conservative oil prices used.

Management had guided Anasuria Cluster production would be 5,000 bpd by 2020.

And this is the production profile predicted.

What do all these mean to an investor / shareholder – negative goodwill and reserve upgraded?

The company net tangible assets’ value is higher, much higher, and oil should be continuously produced at current rate and for many more years to come.

(That is why Saudi Aramco will not be listed as no reserve evaluation for 40+ years, so you believe worth USD 2trillion or whatever they say?)

The main concern should be oil demand; would it be destroyed in the years to come so that the oil price will tanked back to USD 30 to 40 per barrel?

In the near term (next six months), No, medium term (up to 2 years), NO! Longer term (beyond 2 years), also NO. EV, please read my post here - https://klse.i3investor.com/blogs/teoct_blog/158175.jsp

The main risk would be a recession – can you guess when? Whatever your guess is, you are right because there is no right or wrong in this.

But if all this is still too much risk then get out, probably, death care is a better business. People definitely die! Demand always there. Oil, one can opt out – bicycle, walk.

So what will the future be like for my, company?

Stock markets / exchanges are a wonderful invention by mankind.

One can participate in all kind of businesses. Banking, insurance, (electric) power producer, properties (all kinds too, from office buildings, malls to warehouses etc) and so on, think about it for a moment, WONDERFUL isn’t it, no need to get one's hand dirty.

So be business like, a great sifu said, you all know who said that, and the return will be taken care of.

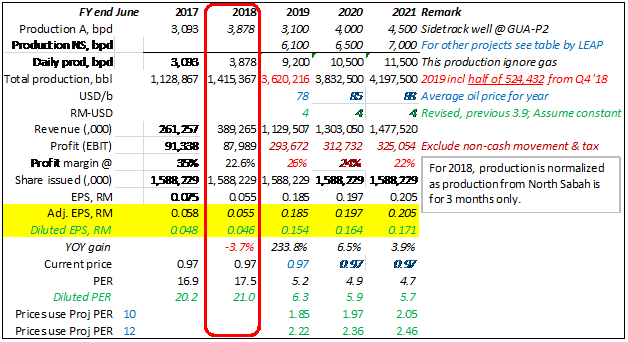

Here is the revised projection for 2019 to 2021.

The oil sold for Anasuria Cluster already confirmed (524,432 barrels) by Management. They implied that the price is good (hear the web-cast, please).

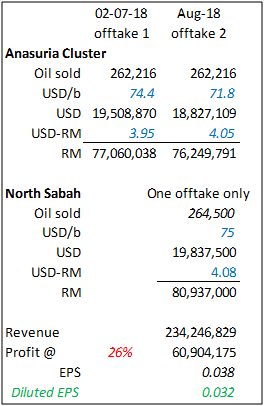

Normally, quarterly estimate is spurious. But for interest, due to the (Anasuria) production carried over to Q1 ’19, and in keeping with the off-take at N Sabah of previous quarters that alternate between large / low quantities sold, Q1 ’19 assume only about 264,500 (N Sabah) barrels sold.

Oil price is in keeping with that obtained from EIA but averaged while exchange rate is based on Bank Negara and also averaged.

This (profit) estimate ignores the reserve upgrade of Anasuria Cluster.

You may ask why the daily productions are less than those stated in the cash-flow done by LEAP. It is better to be conservative, margin of safety, one never know what the management may do, defer another off-take, things like that.

Conclusion

Hibiscus is going to double their profit in the coming financial year 2019.

The assets (both Anasuria Cluster & North Sabah) are more valuable. Net tangible asset per share is going to be about RM 0.90 this coming first quarter.

With pending sanction on Iran by US, there will be less oil supply; Venezuela is in free-fall, the human tragedy unfolding is sad; Libya, civil commotion again flared up; Saudi, Saudi, Saudi, there is a school (of thought) that think they have this wonderful spare capacity where just turn the tap (like water tap) oil will just gushed out by the bucket full. The recent increased supply from Saudi, the other school thinks that it was from storage. OIL PRICE SHALL REMAIN ABOVE USD 70 FOR THE NEXT SIX MONTHS (baring a recession).

There is so much potential for production to be enhanced, that the probability for higher production is there.

Disclosure : I and my family own shares in Hibiscus.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Buy / sell at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

Rated as sell. Drilling expected to hit rock instead of oil. Intangible shall vaporized

2018-09-02 17:49

The article is informative. It’s rather confusing when the writer used EBITD to calculate EPS. No matter how, we have to use projected PAT for computation of EPS.

2018-09-02 17:52

Any reason why Hibiscus fell 14sen on the eve of Merdeka? Why the panick selling?

2018-09-02 18:28

Suddenly a lot of bloggers giving buy call, helping big boss for distribution?

2018-09-02 19:00

Bear in mind, North Sabah may have to pay export duty of 10% for petroleum crude oil export from Malaysia plus Income tax levied on PSC is 38%.

2018-09-02 19:12

North Sabah segment

For every 10% increase in crude oil price, the company may have to pay 4.42% of Export duty plus Income Tax. In the end the company can only enjoy 5.58% extra profit from every 10% increase in selling prices.

2018-09-02 19:17

oil price 75 - opex per barrel USD 15 = USD 60 - USD 10 (for admin/miscellaneous cost) = USD 50 x 55.8% = USD 27.9

USD 27.9/75 = 36% profit margin

that is exactly the same profit margin pbb and alliance DBS forecasted

2018-09-02 20:55

over a year

5500+3000= 8500 x 360 days x 4 exc rate x USD 75 = 918m

918m X 36% profit margin = 330m per annum

2018-09-02 20:57

Reality is cruel. The actual margin from Profit After Tax (North Sabah) is rather low at current crude oil prices unless we are expecting crude oil prices to surge another 20 to 30%.

2018-09-02 21:16

Hibiscus is good training ground for aspiring analysts / accountants....Ground where many of the them will be buried.

qqq3 hibiscus.....lets say, analyst very good...do a good cash flow projection.....buy or don't buy?...u still got a $ 1 billion intangible assets.....hundreds of million of provisions.....and 1. 6 billion shares to support......what I am saying is......this Hibiscus will show huge cash flows in future years....but all is a return of capital , not real profits....the last thing to do is PE...PE not a fair tool....but, market may use PE...so very confusing one.

qqq3 depleting asset with huge intangibles.....and hundreds of millions of liabilities at the end of it.

qqq3 PE ratio is for companies with hhuge terminal vallues at the end of valuation period.

this one got huge liabilities woh.

qqq3 PE ratio is for companies with huge terminal values at the end of valuation period.

this one got huge liabilities woh...............interesting to read the kind of mistakes analysts will do with this company....go la...go do Hibiscus....

u can make a name for your self if u go do a proper valuation on Hibiscus....what is it really worth based on current oil reserve.

2018-09-02 21:37

what is it really worth based on current oil reserve.

oil in the ground is carried in the Balance Sheet under intangibles...this needs to be charged out to PL later.

the bigger the intangibles at merger accounting date, the bigger the negative goodwill.......Big negative goodwill just means the oil in the intangibles carried at higher figure.

2018-09-02 21:41

orlando.....when u understand what I wrote....then u can achieve enlightenment.

2018-09-02 21:59

what is it really worth based on current oil reserve. ?

oil in the ground is carried in the Balance Sheet under intangibles...this needs to be charged out to PL later.

the bigger the intangibles at merger accounting date, the bigger the negative goodwill.......Big negative goodwill just means the oil in the intangibles carried at higher figure.

2018-09-02 22:00

since they do fair value merger accounting and shows u an NTA of 63 sen.....the oil in the ground is valued at a certain value in the Balance Sheet as intangible assets.....

a quick and easy valuation is......buy if market price is at a discount to 63 sen........lol.

2018-09-02 22:07

Postedby OrlandoOIL > Aug 30, 2018 05:26 PM |Report Abuse X

negative goodwill may n wil increase d cost of production in future

Tis point I highlighted it earlier thn u

U probably copied me

But u stil got it wrong overall

2018-09-03 07:51

@up_down, thank you for your comment on EPS derived from EBITD. It actually included depreciation and amortization and I have corrected the table.

Reason why I am just looking at just EBIT is because I wanted to check the performance of the management with regards to activities that produces CASH only.

And taxes was excluded because UK and Malaysia tax on oil & gas companies are very different and I am not a tax expert and how well this is managed by management is not so important as oil production and cost of production.

Also, government will try to tax progressively (that is encourage investment activities) rather than regressive (that is discourage investment) more often than not. Otherwise, why invest (CAPEX) to get more oil out of the ground if the gain is so low (after tax that is). Nonetheless, your tax computation maybe correct or not - this I will leave it to tax expert.

Have a good week ahead.

2018-09-03 12:09

@stockmanmy, @qqq3, @OrlandoOIL, thank you all for commenting. Yes, the oil (& gas) reserves are intangible assets for obvious reason. Nothing to be fearful about. And like fixed assets (equipment and the likes) are depreciated. For intangible assets it is called amortized. For 2017, the amortization is RM46.5m while 2018 is RM58.2m, that is about RM 41 (USD 10.30) for every barrel sold.

The implied intangible assets "will turn to liabilities", I am not sure how this come about. The non-current liabilities of decommissioning is normal while differed tax is also normal in the cause / course of doing business.

Obviously to be able to buy Hibiscus below 63 sen now would be out of this world. With the Anasuria Cluster reserve upgrade, the book value is already about 90+ sen (rough calculation). So today price of RM 1 gives a price to book of 1.11

Royal Dutch Shell price to book is 1.376 (31/8/18) while Exxon is 1.8. OK, Hibiscus is a very small company, so 1.11 is fair?!?

Mr. Google says that valuation of oil companies uses price to cash flow. Now I had a quick look and concluded that just 2 years of oil production is not long enough for this valuation.

Still at the end of the day, Hibiscus is a young company (don't forget they had blown RM 200+m over exploration and still debt-free), so keeping an eye over the cash producing part of the business (i.e. get the oil out and sell it) is the way forward and that is what I have done to see how efficient this is being carried out.

With the higher revenue, investment can be made to improve productivity as well as to add new production within the current two assets. To buy new production asset (at Anasuria / N Sabah kind of prices) cheap, well the window has closed. Now is to quickly do the maintenance or drilling, etc. while it is still at reasonable cost before everyone wants to do it and fight over the limited resources.

So in financial year 2019, barring any catastrophe, production should be 3.6 million barrels, a 2.6 time more than 2018, EXCELLENT (please tell me which other companies can do this), and the world is willing to pay more for the oil!

Have a good week all.

2018-09-03 17:10

The company just announced (@5+pm, check Bursa) that the side-track drilling at Anasuria Cluster is completed. Rig is being de-mob now. Flow test showed 4750 bpd, net to Hibiscus is 2375 bpd. This is extremely good news.

As the announcement mentioned, different choke size will be tried (how wide the tap is open) to ensure smooth flow by the end of this week.

Need to re-look into my (production) estimate now.

2018-09-03 20:24

Reserve report wit more reserve released b4 qtr 4 result but tell me where did u see d NTA increased to 90+ in d qtr 4 report??

So misunderstood tis Intangible Asset

With the Anasuria Cluster reserve upgrade, the book value is already about 90+ sen (rough calculation).

2018-09-04 07:56

@OrlandoOIL. The Anasuria Cluster reserve upgrade was dated 1/7/18; thus the new valuation of USD 401 m (2P) will take effect in Q1 '19 compared with previous valuation of USD 208 m (June 2016). Thus the increased value of USD 193 m (RM 772m) and deduct "this" and "that" (being conservative), let say use only RM 540m/shares issued = 0.33

So add to 0.63 (from Q4 '18, this only included the -ve goodwill of North Sabah) gives 0.96 (it should be more I think).

Hope this explained. Really appreciate your query, so we all learn along the way.

2018-09-04 09:17

If u mean d nta in d account wil go up due up in reserve I can say u r wrong

2018-09-04 10:29

OMG it seems I OrlandoOil is d only one who know what is d intangible assets in Hibiscus account

2018-09-04 10:32

@OrlandoOIL, ok if you say so. Most grateful if you will teach me what goes into the intangible assets and how the recent Anasuria reserve upgrade be accounted for.

Thank you very much.

2018-09-04 11:46

It is ok that u don't know cos d intangible here is quite a concept

Tis accountant stockmanmy qqq3 oso obviously don't know

Ask n see if tat young accountant Jon fella if he know or not?

2018-09-04 12:36

OrlandoOIL, oh, what a shame. I was looking forward to learning from a Master.

2018-09-04 12:56

JayC

you are a very good analyst. TQ for your insight

2018-09-02 17:02