Insider Asia’s Stock Of The Day: UPA (29/12/2015)

Tan KW

Publish date: Tue, 29 Dec 2015, 10:15 AM

This article first appeared in The Edge Financial Daily, on December 29, 2015.

UPA Corporation Bhd (![]() Valuation: 2.60, Fundamental: 2.50)

Valuation: 2.60, Fundamental: 2.50)

Given prevailing market uncertainties, investors are likely to gravitate towards more defensive stocks with high yields and, better yet, export exposure.

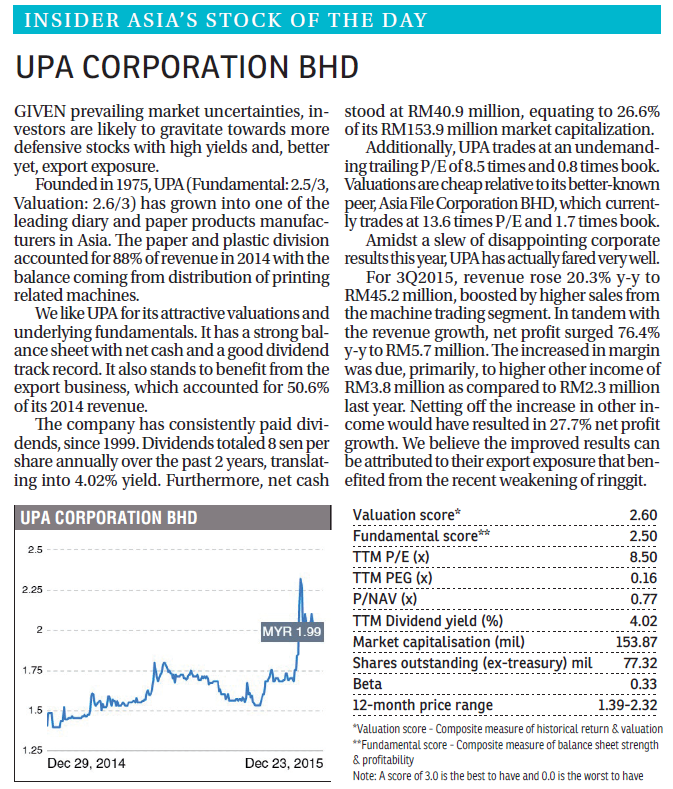

Founded in 1975, UPA (Fundamental: 2.5/3, Valuation: 2.6/3) has grown into one of the leading diary and paper products manufacturers in Asia. The paper and plastic division accounted for 88% of revenue in 2014 with the balance coming from distribution of printing related machines.

We like UPA for its attractive valuations and underlying fundamentals. It has a strong balance sheet with net cash and a good dividend track record. It also stands to benefit from the export business, which accounted for 50.6% of its 2014 revenue.

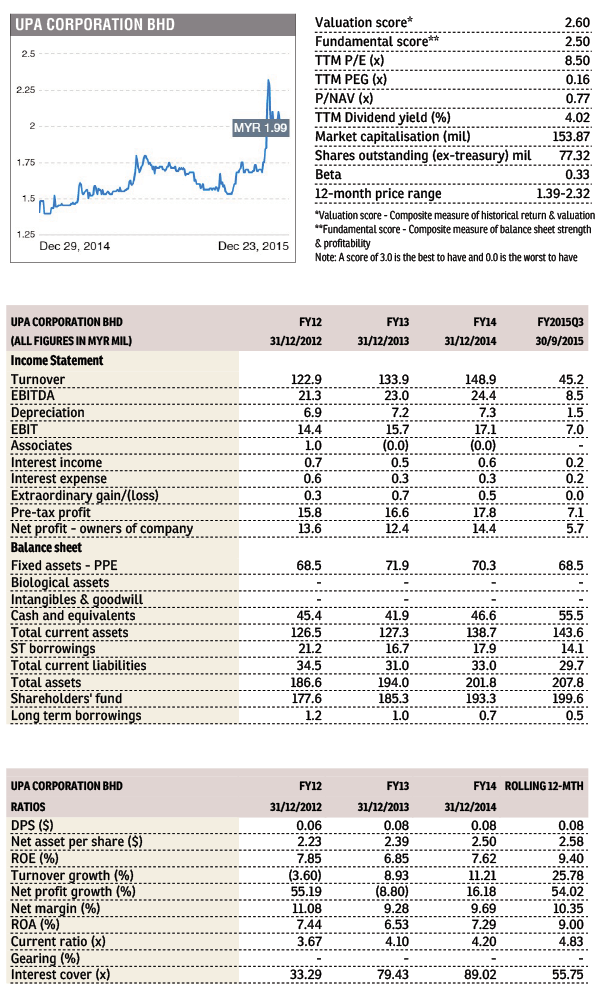

The company has consistently paid dividends, since 1999. Dividends totaled 8 sen per share annually over the past 2 years, translating into 4.02% yield. Furthermore, net cash stood at RM40.9 million, equating to 26.6% of its RM153.9 million market capitalization.

Additionally, UPA trades at an undemanding trailing P/E of 8.5 times and 0.8 times book. Valuations are cheap relative to its better-known peer, Asia File Corporation BHD (![]() Valuation: 2.00, Fundamental: 3.00), which currently trades at 13.6 times P/E and 1.7 times book.

Valuation: 2.00, Fundamental: 3.00), which currently trades at 13.6 times P/E and 1.7 times book.

Amidst a slew of disappointing corporate results this year, UPA has actually fared very well.

For 3Q2015, revenue rose 20.3% y-y to RM45.2 million, boosted by higher sales from the machine trading segment. In tandem with the revenue growth, net profit surged 76.4% y-y to RM5.7 million. The increased in margin was due, primarily, to higher other income of RM3.8 million as compared to RM2.3 million last year. Netting off the increase in other income would have resulted in 27.7% net profit growth. We believe the improved results can be attributed to their export exposure that benefited from the recent weakening of ringgit.

http://www.theedgemarkets.com/my/article/insider-asia%E2%80%99s-stock-day-upa-corporation-1

Insider Asia’s Stock Of The Day: UPA (29/12/2015)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)