TOMEI CONSOLIDATED BHD (7230) - Powerful Trade Setup Identified!!

TheAlphaTrader

Publish date: Wed, 20 Oct 2021, 06:06 PM

Today we will look at TOMEI as a proxy to the strong upward seasonal trend in Gold prices that typically runs for 4 months from November to February.

WHY BUY GOLD?

- Gold is entering Upward Seasonal Trend

As observed from the chart above, an entry on 1st of November every year and holding the contracts till end of February (for a duration of only 4 months) would yield a successful trade in 6 out of 8 years! That is an amazing success rate of 75%, which is very high in the world of seasonal trading strategies.

There could be several reasons for this trend to happen but as macro traders we only know that this has a high probability of success, and we want to capitalize on the trend.

2) The Big Picture for Gold

From the chart, we can clearly see that gold is in a multi-year bull market.

After hitting an all time high of USD 2,089 on 7th Aug 2020, gold has basically been in a short-term correction within a bull market. If we assume that the near-term bottom was in March 2021 at USD 1,673, the gold price has been slowly trending upwards and last trading at around USD 1,775 . However, a break above the critical USD1,800 resistance would be very bullish for prices and sentiment. This could very well happen within the next 4 months!!

3) Hedge against Accelerating Inflation in Malaysia

Since the start of the pandemic, food prices have been going up steadily. Same goes for commodity prices such as crude oil, steel and especially palm oil.

In Malaysia, Crude Palm Oil prices have hit an all-time high of RM5,000 and showing no signs of retreat.

All these point that inflation could stay high in the near future!

The case for TOMEI BHD

To participate in this seasonal gold trade, one can buy an ETF or go long on the Futures contract. However, an easier way is to buy into TOMEI!

Fundamentals

TOMEI is an integrated manufacturer and retailer of Gold and Jewellery. It operates through 2 business segments i.e. Manufacturing & Wholesale and the Retail segment

TOMEI offers great value from a fundamental perspective.

Currently trading at a PE ratio of only 3 times and NTA of RM1.83 per share (0.51 P/B) with a dividend yield of 2.15%! In the latest quarterly report announced on the 18 August 2021, TOMEI still managed to report a profit of RM1.36 million, despite the nationwide lockdown!

With the full reopening of the economy, we could see a surge in demand for jewellery purchases ie. weddings, gifts - that were put off during the MCO period as well as renewed buying interest for the upcoming festive season.

There could also be some price catalyst when the proposed listing of its subsidiary, YXPM, on the ACE market is approved.

Technicals

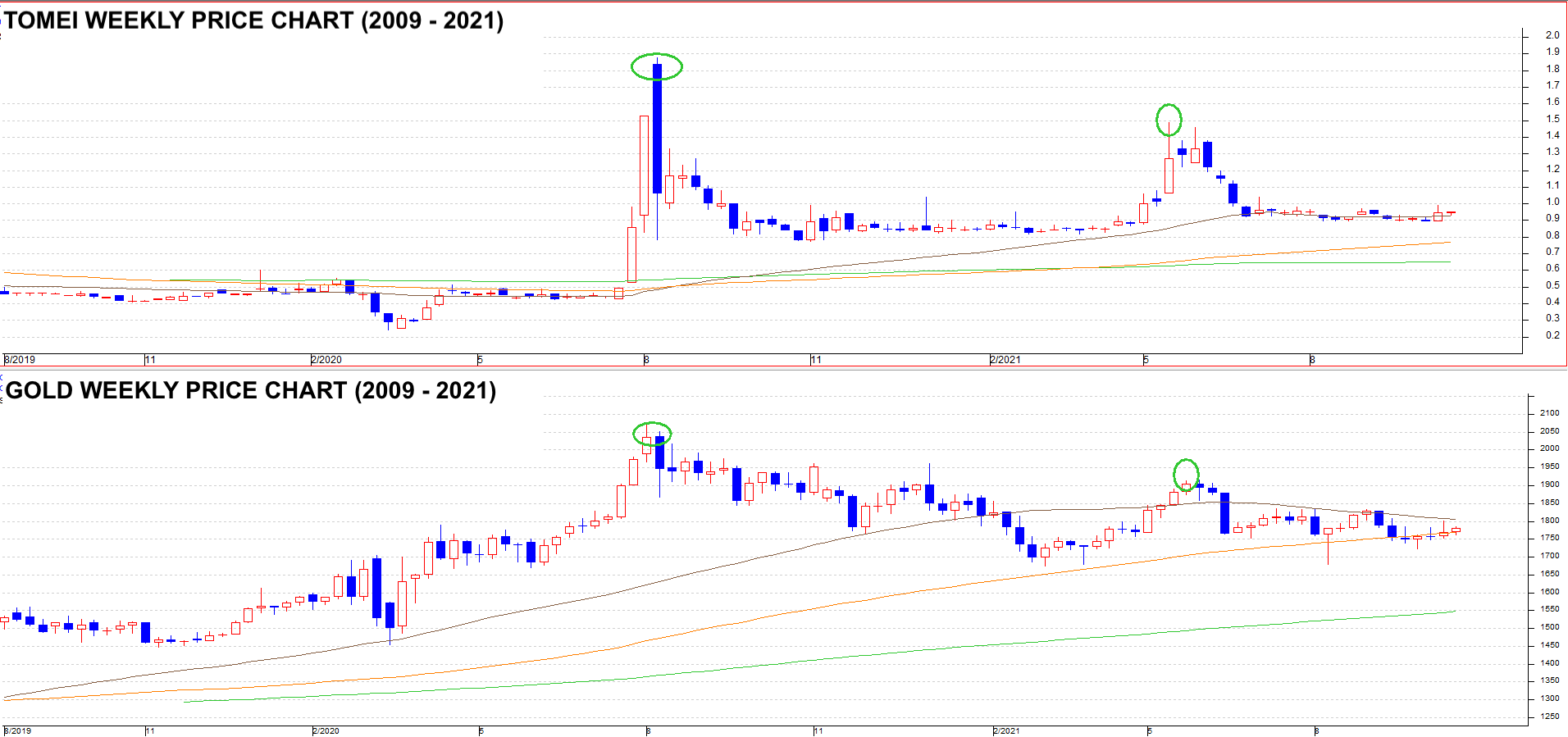

We can see a very strong correlation from TOMEI price chart vs Gold prices.

- TOMEI hit all time high of RM1.88 on 10 August 2020, which also coincided with gold prices hitting all time high of USD 2,089 on 7 August 2020

- This year, TOMEI hit a year high of RM1.49 on 18 May 2021, which again coincides with gold prices hitting the year high of USD 1,910 on 31 May 2021.

- At the current price of RM0.95 there is very little downside from a technical perspective for TOMEI.

- Should gold rise above USD 1,800 (which I am not uncertain will happen in the next 4 months!) there is very little resistance in the TOMEI chart until RM1.30!

Looking at the correlation between rising commodity prices and stocks, we have recently seen phenomenal gains in stocks like Hiap teck and AYS (coinciding with the rise in steel prices), PMB Tech (also following the rise in aluminium and metallic silicon prices) , OM Holdings Ltd (rising prices of ores and ferroalloys) and most plantation stocks (rising palm oil prices)

Conclusion

To take full advantage of this seasonal trend, I would buy into Tomei at RM0.95 and hold it till end of Febuary OR if it hits a minimum target of RM1.30. I would place a stop loss of RM0.88 for a good risk-to-reward trade setup.

In my view it is always good to have some gold exposure in any portfolio. Commodities always tend to move parabolically when it is their time to move. My trading philosophy has always been to spot trends early in the markets before they become obvious to everyone! Happy trading!

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks.Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Discussions

Gold is at1795 now! See if it can break the pivotal 1800 later tonight!

2021-10-22 16:04

TheAlphaTrader

Paul Tudor Jones is one of the smartest guys on wall street! I would’t want to bet against him!

2021-10-20 23:05