TOMYPAK HOLDINGS BHD (7285) - REBUILD AND RESTART

TheAlphaTrader

Publish date: Fri, 01 Apr 2022, 10:06 AM

BUSINESS BACKGROUND

Tomypak Holdings Berhad (Tomypak) is a manufacturer of flexible packaging materials including polyethylene, polypropylene films and sheets.

Since incorporation in 1979, Tomypak Holdings Berhad and its subsidiaries has established itself as a leader in the flexible packaging marketplace. Tomypak listed on the main board of Bursa Malaysia in 1996.

GAME CHANGER INCIDENT

On 19 December 2021, a massive fire broke out at Tomypak’s wholly owned subsidiary, Tomypak Flexible Packaging Sdn Bhd’s (TFPSB) factory in Senai, Johor. The blaze occurred in the afternoon at 12.30pm and was finally contained at 7.00am the next morning.

In an immediate disclosure to Bursa Malaysia on 20 December 2021, the company had assured the investing public that TFPSB has adequate insurance coverage of up to RM271 million for property damage and stock in trade and another RM80 million for business interruption up to 24 months.

PRICE CHART

Tomypak share price was trading at the RM0.50 level just prior to the fire incident. Unsurprisingly, there was a huge gap down in price to RM0.30 at the open of trade on 20 December 2021 in reaction to the incident. However, it was perceived to be overdone and closing way off the lows at RM0.36 by the end of the day. In fact, the subsequent rebound in the following days, impressively closed the whole gap on the daily chart when it managed to trade as high as RM0.505 on 27 Dec 2021.

The price started drifting down towards the RM0.40 level where it has found good support. Investors probably turned cautious on the stock as there was lack in guidance from management as well as several Investment Banks ceasing coverage on the company.

Technically, the current breakout move from the 3 month long consolidation phase looks strong and aims to test the immediate resistance of RM0.50 and RM0.62 thereafter.

NEW MANAGEMENT TEAM TO TURN AROUND THE BUSINESS?

Tomypak has long been regarded as a market leader in the flexible packaging industry. It once commanded a market capitalisation of over RM500 million and had boasted a 12 year track record of consistent yearly profits from 2005 till 2017. At the peak in 2015, Tomypak recorded a very respectable profit of RM23.2 million. However, since 2018 the company has not been performing, clocking in consecutive yearly losses. Reasons cited by management included higher cost of materials and depreciation charges stemming from the company relocating its plant from Tampoi to Senai.

Tomypak has seen some big changes in senior management with the stepping down of Eddie Lim Hun Swee as the Managing Director from 31 Dec 2020. Eddie Lim is also the second largest shareholder of Tomypak. His replacement, Mr Tan See Yin has been with Tomypak since 2014, also brought in some new key management personnels in operations and marketing, to turn the business around.

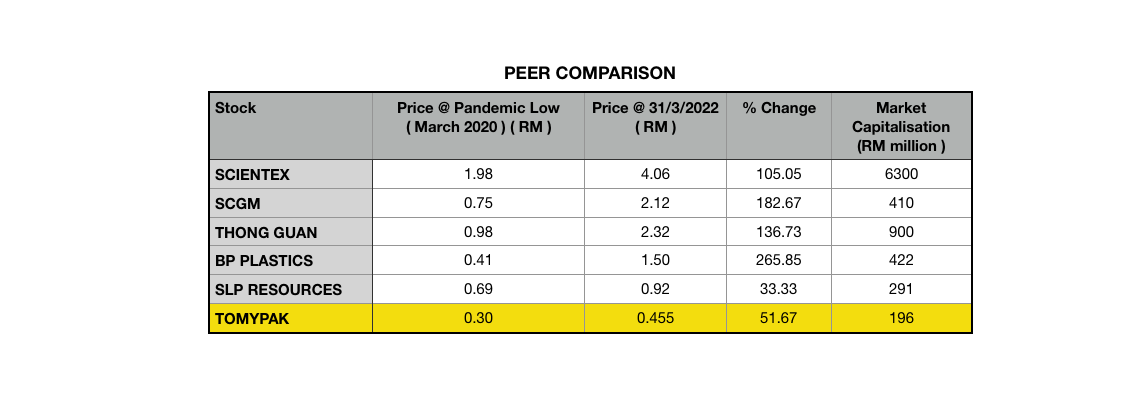

From the table above, it is clear that Tomypak has clearly underperformed against the majority of its peers in the last 2 years in terms of share price and market capitalisation. Ironically, the fire incident could present an unusual opportunity for the new management team to implement new ideas and also acquire new state of the art machines that could increase productivity and profits.

FIRE-SALE PRICE!

The largest shareholder of Tomypak who is also the current Chairman Adrian Yong, first purchased a 25.4% stake back in 2014 from the founders, the Chow family. The adjusted cost ex-corporate exercise price paid would be RM0.48 per share. From Bursa Malaysia announcements, Adrian Yong was also actively buying Tomypak since 2020 when prices were trading above RM0.50.

Bursa filings have also shown that Eddie Lim had also been actively buying shares of Tomypak since 2019.

So it is safe to say that if Tomypak can navigate back to its glory days, buying in at RM0.45 seems like a good bargain.

CONCLUSION

Often, unfortunate and unforeseen situations create unusual investing opportunities. Tomypak has just announced that they have received and accepted an offer on 31 March 2022 for the first interim insurance compensation of RM60 million for material damage and RM15 million for Business Interruption Loss. This could be viewed positively as it means the insurance company has done its due diligence and have agreed to compensate.

This is a good first step in the rebuilding process for Tomypak. Even if the final insurance compensation amount to 70% of the total amount insured, this could boost the net cash per share of Tomypak by RM0.57 per share.

With the insurance payout, this poses a good starting position to rebuild the business from scratch with a huge cash pile. Nevertheless, a lot will also depend on the Management’s ability to execute and capitalize on the current situation. It should be noted in the latest Bursa announcement that some of the new ordered equipment will be delivered beginning in Q3 FY2022, which implies that business operations could resume quite soon.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Discussions

TOMYPAK quick analysis:

Debt/Equity = 1.07 [NO]

Current Ratio = 0.55 [NO]

ROE = -191 [DISGUSTING!]

Growth [HORRIBLE!]

Number of negative quarter in last 4Q: 2 [RUN]

FCF(TTM) negative [RUN]

Dividend Yield = 0 [NO]

Verdict: RUN FOR LIFE!

The gold standard for a buy is to have all yes.

Read the method in detail here: https://klse.i3investor.com/web/blog/recent/fundamental_trading

2022-04-03 07:30

pokerpro88

hextar Ind so nice I better buy some Tomy!

2022-04-01 16:28