What are you waiting for? Hoot 9 e

lifeisajourney

Publish date: Sat, 30 Jan 2021, 10:37 PM

It has been quite some time since my last blog as i was busy with some other things. Going through 2021, many would hope that the market would pickup and economic activities would reopen again. However, history repeats itself again and needless to say, Malaysia has been recording more and more cases ever since. With the number of cases on the rise, i'm not too sure when are we free to roam around again.

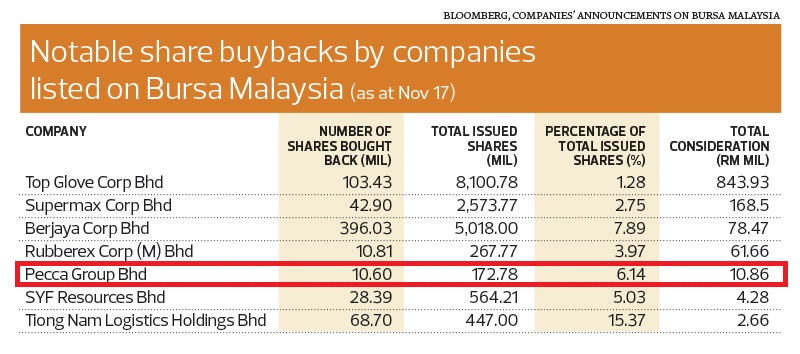

While it was all grim on the economic outlook, it was not too bad looking for this company. Being one of the company with high positive cash flow and notable share buyback in 2020, it was obvious that the price of this company will keep on go up and up.

Yes, you've guess right, the company that i'm discussing today is Pecca Group. If you refer to my earlier blogs, i've started looking at this company when it was price at 0.90. However, the technical and fundamentals was not there at the time and i've missed the boat. When the timing was right, i've posted another blog on it (around Oct 2020), of which the price is at RM1.22 (With RHB giving it a target price of RM1.75).

Who would have thought that in just mere few months, the price has shot up to RM1.80, exceeding the TP given by RHB. While market has recently been hype up by the GME and BB shares in which retailers are fighting over big fund managers, Pecca has took a bit of a quiet but success route. Looking at the fundamentals and the financials or the company, i would say that the company is on track to achieve a record profit this Financial Year.

That being said, the main story of my blog today was one of the company's annoucement dated 25th Jan 2021. One must have already realise that with such a huge amount of share buyback, what is the company possible trying to achieve? It makes no logical sense for the company to spend so much to buyback and just keep the shares in treasury. Surely it is planning something that would be related to the share buyback that it has been doing.

And my hunches were right as the company has announce a share dividend of 1 Treasury Shares for every 16 shares held. Well, don't ask me the reason of why handling out based on 16 shares held, maybe some Fengshui Master would like to englighten me on this. The point being that how would this benefit us, the retailers? Is it too late now to buy in? As i'm a technical person, i would prefer to look at the technical charting to find out more.

Technical Chart

Technical wise, everything is pointing towards a newer high going to be achieved soon. The share has breakthrough its 7,14,100 days moving average. Buying pressure is stronger than selling pressure and the chart is staying above its ichimoku indicator.

Given that the Ex-Date of the Share dividend is 11 Feb 2021. I believe that we will see another surge prior to this and also even thereafter. I believe that it'll mimic Public Bank, as the price jumped almost 10% when it first announces for Bonus Issue. Even after the ex-date, it is still on a uptrend as well.

It will be interesting to see what will unfold in the coming quarter as well (usually announce during February). Perhaps the share dividend is timed on Feb as a better quarter is up ahead? Given that the company has ramped up on it's health care businesses, it will not be shocking to see the company performing better than it did last quarter. I would definitely be keeping a lookout on this.

*I'm just a newbie in this field and this is just my thoughts. My views are not a buy/sell call. This is just my 2 cents on this counter.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|