5 Things You Need To Know About Samaiden IPO – Can Samaiden double its market capitalisation on its listing day?

MartinMystery

Publish date: Wed, 14 Oct 2020, 01:08 AM

5 Things You Need To Know About Samaiden IPO – Can Samaiden double its market capitalisation on its listing day?

Samaiden Group Berhad is scheduled to be listed on Ace Market of Bursa Malaysia on this Thursday, 15th October 2020. A similar listing story like Solarvest In this article, we share a few things that you might need to know about this company.

1) What Samaiden does?

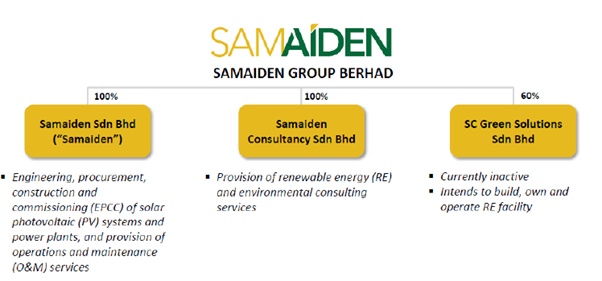

Samaiden Group Berhad (Samaiden)’s revenue is mainly generated from Engineering, Procurement, Construction and Commissioning (EPCC) of solar photovoltaic systems and power plants (98.0%) as well as Renewable Energy and Environmental Consulting Services (2.0%).

EPCC services is the core contributor to the group, generating 96%, 99% and 98% of the group’s revenue for FY18, FY19 and FY20 respectively, with the remaining revenue being derived from consulting services and O&M.

2) What’s the plan on utilising its IPO Proceeds?

The company is raising proceeds of RM29.4 million from its listings on the exchange.

|

Description |

Estimated timeframe for deployment |

Amount (RM million) |

% of Total Gross Proceeds |

|

Purchase of corporate office |

Within 24 months |

7.0 |

23.8 |

|

Business Expansion & Marketing Activities |

Within 24 months |

2.5 |

8.7 |

|

Working Capital |

Within 24 months |

15.4 |

52.6 |

|

Capital Expenditure |

Within 24 months |

1.2 |

4.0 |

|

Estimated Listing Expenses |

Within 3 months |

3.2 |

10.9 |

|

Total Gross Proceeds |

|

29.4 |

100 |

3) How Does Its Financials Look Like?

Samaiden experienced strong revenue growths over the past 3 years with a CAGR of 126.8%, driven by strong EPCC job wins. It demonstrated a similar range of gross profit margin of 15% to its listed peer, Solarvest.

On the balance sheet, Samaiden has been sitting at a net cash position since FY2017. With the RM29 million IPO proceeds, its financial strength bodes well for the Group in future expansion with its negligible debt and minimal finance cost.

The Group is actively bidding jobs from Large Scale Solar Photovoltaic (LSSPV) Plant 3 and LSS@MEnTARI projects over the months to ensure the sustainability of orderbook. Samaiden is set to benefit greatly from the RM4 billion LSS@MEnTARI project, judging from its solid track records in LSSPV 1 & 2. We believe government will scrutinise the job bidders’ background closely and to prioritise the projects to companies with majority local shareholdings.

With an outstanding order book of RM31.35 million and its good project winning track record, we believe the order book replenishment process of the group will be smooth.

4) 65.91x IPO Oversubscription

Samaiden Group Berhad saw its public portion and MITI portion of its initial public offering (IPO) oversubscribed by 65.91 times and over 40 times. The 65.91 times oversubscription is a new record in recent years. Its listed competitor, Solarvest was oversubscribed by 35 times during its IPO at the end of last year.

Referring to Solarvest’s listing date performance of 111% gain, a victorious debut of Samaiden is highly anticipated by investors.

5) Does Samaiden Command An Expensive Valuation Given its Solid Fundamentals?

Based on an IPO issue price of RM0.48 per share, Samaiden’s valuation looks very compelling against its local peers, Solarvest. Its P/E is well below its competitor’s steep earnings valuation of 33 P/E.

Given its strong track records, bright industry prospects as well as strong balance sheet, we see a decent chance of a valuation re-rating for Samaiden after its IPO.

Pegging a conservative fair P/E multiple of 30 times and EPS of 3.7 cents for FY2022, we would derive a target price of RM 1.11 per share. It implies a significant upside of 231% from its IPO price of RM 0.48 per share.

Its listing would present a good opportunity for those who are looking for the solar energy play.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Pick

Created by MartinMystery | Jul 11, 2021

Created by MartinMystery | Feb 08, 2021

Created by MartinMystery | Feb 07, 2021

Created by MartinMystery | Aug 06, 2020

Created by MartinMystery | Jun 14, 2020