5 Things You Need to Know About Ramssol IPO – A 69% Upside on Its Debut on Bursa Malaysia?

MartinMystery

Publish date: Sun, 11 Jul 2021, 03:30 PM

5 Things You Need to Know About Ramssol IPO – A 69% Upside on Its Debut on Bursa Malaysia?

Ramssol Group Berhad (RAMSSOL) is scheduled to be listed on Ace Market of Bursa Malaysia on 13th July 2021. RAMSSOL achieved a compounded annual growth rate (CAGR) of 26.5% over the past 3 years. In this article, we share a few things that you might need to know about this company.

1) What RAMSSOL does?

RAMSSOL is principally involved in:

i) Human capital management (HCM) and student management solutions

It aims to improve the efficiency of workforce management functions of organisations and student management functions of educational institutions respectively.

ii) Information technology staff augmentation services

Recruit and supply IT professionals to its customers, for their internal IT projects and to meet their IT operational needs, on fixed contractual periods.

iii) HCM technology applications

Reselling of Feet’s, Lark and Zoom by fitting their customers’ needs.

With RAMSSOL's expertise, its consulting services comprise the following essential steps: i) understanding all aspects (from hiring to resignation/retirement) of an organisation’s HR practices through a user requirement study, ii) designing HR workflow processes and solutions to address the organisation’s HR issues and/or potential areas for improvement, and iii) proposing an optimised HCM solution to the organization, with considerations of present HR trends and methodologies as well as local employment laws.

Similarly, as for educational institutions, RAMSSOL studies and understands their campus and student management practices (from enrolment to graduation) together with requirements for the student management solutions before designing an optimised student management solution.

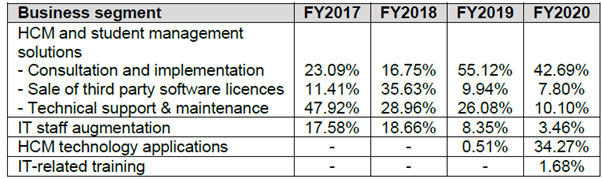

Revenue Segmentation by Business Segment

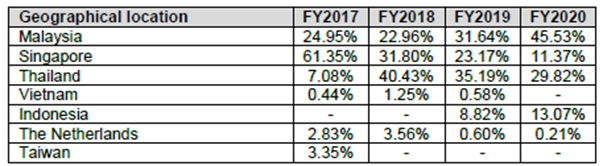

Revenue Segmentation by Geographical Location

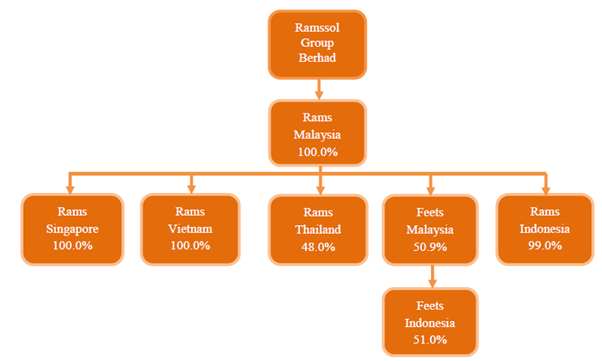

Group Structure post listing

2) What is the plan on utilising its IPO Proceeds?

The company is raising a proceed of RM25.1 million from its listing on Bursa Malaysia.

|

Utilisation of Proceeds |

RM (‘mil) |

|

Business expansion into the Philippines |

2.5 |

|

Expansion of Feet’s and Lark in SEA |

6.3 |

|

R&D Expenditure |

4.1 |

|

Working Capital |

7.6 |

|

Listing Expenses |

4.6 |

|

Total |

25.1 |

3) Its Strong Orderbook and Financials

As at 24 May 2021, RAMSSOL's total secured orders of RM51.52m includes orders secured in FY2021 of RM19.74m whilst the remaining RM31.78m was secured prior to 1 Jan 2021. The strong orderbook provides an earnings visibility of 2 to 3 years to the company.

The unbilled amount as at 24 May 2021 of approximately RM16.24m is expected to be billed in FY2021 with the remaining balance of RM1.64m is expected to be billed in FY2022 and RM0.76m is expected to be billed each in FY2023 and FY2024 respectively.

CAGR growth of 26.5% over the past 3 years has shown that the company is riding on a hypergrowth trend of the industry. RAMSSOL can be highlighted as a significant beneficiary of the pandemics as corporates and enterprises have been adopting digital reforms in their business to improve productivity and efficiency.

On its balance sheet, RAMSSOL had a reasonable gearing ratio of 0.56 times and current ratio of 2.61 times.

4) 102.88 Times of Oversubscription

RAMSSOL saw its public portion and Bumiputera portion of its initial public offering (IPO) oversubscribed by 135.37 times and over 70.39 times. The overall 102.88 times oversubscription is a new record in recent IPOs.

100% Up on Debut Day – Will Ramssol continue this high-flying trend?

|

IPO Companies |

Listing Date |

Debut Trading Day Performance |

|

MOBILIA HOLDINGS BERHAD |

23 Feb 2021 |

+143% |

|

TELADAN SETIA GROUP BERHAD |

16 Mar 2021 |

+18.75% |

|

FLEXIDYNAMIC HOLDINGS BERHAD |

30 Mar 2021 |

+115% |

|

VOLCANO BERHAD |

6 Apr 2021 |

+38.5% |

|

TUJU SETIA BERHAD |

19 May 2021 |

+10.71% |

|

PEKAT GROUP BERHAD |

23 Jun 2021 |

+154% |

|

NESTCON BERHAD |

29 Jun 2021 |

+14.3% |

Looking at the overwhelming subscription response from the Malaysian investors, a victorious debut of RAMSSOL is highly anticipated.

5) Does RAMSSOL Command An Expensive Valuation Given its Solid Fundamentals?

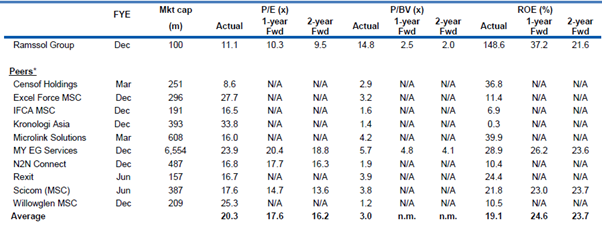

Based on an IPO issue price of RM0.45 per share, RAMSSOL’s valuation of P/E 11.1x looks very compelling against its local peers of software-related companies listed on Bursa Malaysia.

Comparing to its competitor’s steep average earnings valuation of 20.3 P/E, we believe Ramssol should trade higher, given the growing trend of digitalising the HR function, increased employee engagements, and collaboration functions.

Pegging a conservative fair P/E multiple of 18 times and EPS of 4.2 cents for FY2022, we would derive a target price of RM 0.76 per share. It implies a significant upside of 69% from its IPO price of RM 0.45 per share.

Given its competitive strengths, bright industry prospects as well as strong financials, we see a decent chance of a valuation re-rating for RAMSSOL after its IPO. Its listing would present a good opportunity for those who are looking to tap into the digitalisation innovation trend.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Pick

Created by MartinMystery | Feb 08, 2021

Created by MartinMystery | Feb 07, 2021

Created by MartinMystery | Aug 06, 2020

Created by MartinMystery | Jun 14, 2020