(Tradeview 2016) - Value Pick No.9 (Analabs Resources Bhd.)

tradeview

Publish date: Mon, 29 Feb 2016, 12:43 PM

Dear fellow traders,

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. To join my telegram channel : https://telegram.me/tradeview101

_____________________________________________________________________________

Value Pick No. 8: Analabs Resources Bhd (Intial TP RM2.64)

Following the January 2016 rout, many counters have gotten whack down regardless of their valuation. I understand if those expensive counters or overly optimistic forward looking target faced sell down. How about those companies which has shown progress or turnaround and is on track to achieving good results? Should these companies be punished as well? Sadly, market is driven by sentiment and sentiment do not discriminate.

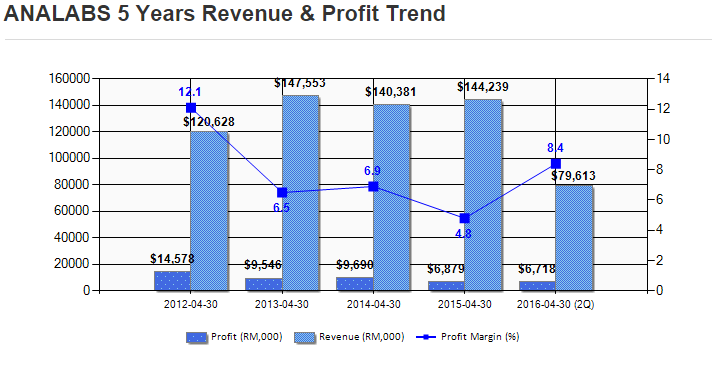

I consider Analabs as it is in turnaround mode and have shown improved performence for the 3 quarters. With 1 more quarter in sight, if Analabs deliver, it will show a full year of consecutive profit growth. The latest quarter results in December, the revenue was record high at RM44 million arriving at EPS of 6.39 sens which was an increase of over 118% YoY. Taking the first two quarters results combined, the EPS for half of the 2016 financial year is 12 sens. By annualising the first two quarters, the full year EPS would be estimated to be around 24 sens. At current price of RM2, it is only trading at a PE of 8x only. There is also dividend although the yield is only 1.5%.

Additionally, a plus point is the improved profit margin for their products. Based on the first two quarters, the profit margin currentl stands at 8.4%. Although it is still away from the record high 12% (where a dividend of 5.5 sens was offered as well), with two more quarters for the full year ahead, there is a good chance Analabs is able to exceed both revenue and EPS with increased profit margin.

Indeed, it is true that Analabs is beneficiary of FOREX gains due to weakening MYR. The margins did improve substantianlly from the gains in translation. Hence, for those who believe that MYR will stay above RM4/1USD, this counters fit the view. However, for believers that MYR will strengthen to below RM4, than maybe the counter is not as interesting.

What interest me is the business has been around for a long time with links to the Singapore HQ. It is also one of the few companies in Malaysia that has the ability to execute water treatment, recyling and waste management service at a high level protecting. The core business is manufacturing and formulation of reisin, chemicals and building materials. The increase in exports was also one the reason it was able to benefit from the FOREX gains. That aside, there is increases in the sales volume as well. So it was not purely a case of forex gain alone. Additionally, the business is not cyclical in nature as it is involved in the following activies:

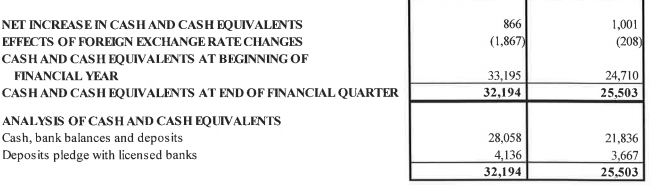

I am also keen due to the solid balance sheet. The NTA stands at RM3.91 per share but current price is only RM2. That means the company is holding net assets worth 2x its current share price. In additiona, the net cash position has increased from RM25.5 million to RM32.2 million.

There is some minor buy backs by the company of their shares from open market at average of RM1.70 per share to be placed into the company treasury in 2015. This would show some level of guidance to potential investors on the bottom for Analabs as well as signify confidence the management has towards the company.

Should Analabs is able to maintain their performance for the next two quarters as they had delivered in the previous two quarters, at EPS of 24 sens with a historical PE of 10x, Analabs FV should be at least RM2.40. I of the view PE of 10x is too conservative and would likely place 11x as reasonable bringing it to RM2.64. (32% upside). This figure excludes the historical dividend payout.

To join my telegram channel : https://telegram.me/tradeview101

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

May good fortune come your way!

Disclaimer: This is not a recommendation to trade. It is merely the expression of the author's personal opinion and shall not be held responsbile for potential gains or losses executed by readers.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

Muscle i remembered you were following Tradeview call for FFHB and Gadang. You made money from tradeview call right? Cause I followed I saw you there also.

2016-03-09 20:55

leelc99

This muscle guy so useless. No contribution to the society. Please shut up.

2016-02-29 13:12