(Tradeview 2017) - Your Risk Appetite Vs My Risk Appetite (on Notion VTec, Dnex)

tradeview

Publish date: Sun, 26 Mar 2017, 10:42 AM

Dear fellow readers,

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

My father have always reminded me when I first started investing, "The market is always there. If you missed the opportunity today, there is many other opportunities in the market. Do not rush into it just because everyone around you is doing so." This simple but poignant advise has always stuck with me all these years. I will admit, it is not easy sticking to this investment philosophy especially if people around you, colleagues, kopitiam customers, uber / grab drivers, pasar aunties and uncles are all sharing with you how much money they made from DataPrep, Dnex, Efficient, IWCity and many others.

Everyone has their own risk appetite. It may be low, medium, high and so on. However it differs from one individual is different from another. In short, it is subjective. Let me share with you through the illustration of a few stocks :

1. Notion VTec

Few months back when it was still around 45 sens, I received information from several parties that Notion will be in the play and TP was RM1. Quickly, we researched and decided against the investment. We felt Notion was too expensive and even if indeed the rebound play thesis came true, I rather put my money with Dufu, LCTH or Visdynamics for that matter instead of Notion. Why? My risk appetite did not allow myself to invest in Notion. Logic and sense prevented me from doing so. Clearly, my risk appetite prevented me from making a windfall. Today, Notion is RM1.26 and overvalued. Did I regret missing out? A bit. However, my funds was securely diverted to other companies which made me good return as well.

2. Dnex

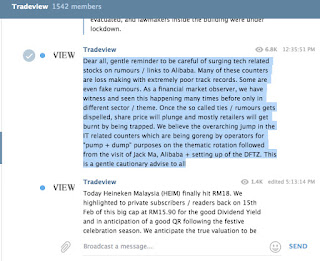

3. Jack Ma, Alibaba Effect + Loss Making Penny Stocks

Everyone has their own risk appetite. Some higher than others. Some lower than others. So the question we should all ask ourselves before every investment decision is "whether am I willing to take this risk to put my hard earn money in this counter". If the answer is yes, go ahead and invest. If the answer is no, avoid. If the answer is neither, take a step back to reconsider your position otherwise, just sit still. That way, at least your investments will give you the peace of mind when you go to bed every night.

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me at : tradeview101@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

"The market is always there. If you missed the opportunity today, there is many other opportunities in the market."

This is true statement, don't worry on the missing one, always worry of missing the next one. So, work harder.

2017-03-26 22:48

Better to have profits than losses for those who are risk averse i.e low risk appetite. Nobody becomes poor by taking profits, however little.

2017-03-26 23:08

memang market always there... tapi ada orang yang tak sabar-sabar....kesabaran ada asas dalam permainan stok... tanpa itu, mudah kesilapan berlaku secara tidak sengaja.....kalau kamu stock trader, volume dan charting/TA adalah keutamaan... tapi unruk pelabur jangka masa panjang; dividen, nilai dan fundamental adalah asas yang penting untuk pelabur memahami kenapa sesuatu perniagaan atau syarikat dapat menguntungkan pelabur....

2017-03-27 02:24

Haha interesting pick-up. Everyone let those penny flies higher =) It will not be too far. More and more NEAR NEAR NEAR.

2017-03-28 01:10

one have to imagined that this USD$50 billion or at least initial $10 billion from all e-trades permits approvals generate from DFTZ/Alibaba when start in 2018 or early 2019 is COMPULSORY/MUST pass tru DNEX (4456) e-services software platform tat currently been authorized by Gov to integrates with most gov agencies to get each items/goods pass on from shippers to consumers.

Just 1 segment from IT can rake up 1000% folds profits, haven't count others segments like O&G, Hydro Energy, Foreign Workers Permit, VEP and RFID profits.

2017-03-28 02:22

If during this bullish market momentum one still has difficulty to reap +ve return, he seriously ought to look at his trading strategy n stock picking techniques

2017-03-28 20:57

tradeview stock pick also have short term tp. he also sell when tp reach. if one asked him how he defined TP, its quite amusing, with biz sense LOL. then he buy back again. it was not a truly value investor anyway.. anyone also can be sifu nowadays.. funny.

2017-04-09 15:53

very true, nowadays many like to accuse the good writers and promote the lousy goreng ones...better be careful

2017-04-09 16:26

Kelingman, You are new, dunno anything, simply listen to ur fren, then come out and spoil a good writer reputation. That is v bad. Some more only 5 post from you. Dont do things like that. Bad karma

kelingman I notice many counter also commented by tradeview.. the price will up..

tradeview do u do subscription? im new here

15/03/2017 13:49

kelingman my fren told me tradeview claimed he is a value investor but he also always buy share veli frequent.

value investor should hold at least 3-5 yrs ma.. me oso tak tau how true o not leh..

like this how to beli and sell mana ada masa wor

29/03/2017 19:31

2017-04-09 16:43

Usually we do not entertain or reply to nonsensical replies but half witted idiots. However, for kelingman who have been talking rubbish and spoiling our reputation for a long time, we will need to address. Please refer to our value investing portfolio which we share to the public with both entry and exit price including all losses and profit documented every month without any manipulation. We are the only group who publicise our call and still share it transparently every month. To date, our value investing portfolio has hit more than 35% YTD exceeding KLCI YTD return of only around 7%. All these are based on our fundamental metrics.

Refer to the link below :

https://klse.i3investor.com/blogs/tradeview/135686.jsp

2017-11-12 16:48

I give my support to Tradeview...

Most of his picks are fundamentally strong.

2017-11-12 17:28

.png)

Tai KT

If you are trader, you will look at the price. if you are investor, you look at the value.

2017-03-26 14:15