(Tradeview 2020) - Recession is finally here? Or is it an Opportunity of A Lifetime?

tradeview

Publish date: Thu, 19 Mar 2020, 08:53 PM

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me at : tradeview101@gmail.com

But enough of Covid-19, I am sure most are sick and tired of this. Let me focus on what matters, how to make the most of the current situation. When Malaysia was a tiger economy in the 1990s until end of the millennium, the crisis hit us hard due to the Asian financial crisis. It took Southeast Asia economy almost 20 years to be on a sound footing.

Many have said, finally, this is it, recession. The recession they have predicted finally arrived. Some predicted it to arrive since 2013. I remember a very big fund listed on our share market was one of those. Well, surely a broken clock may be right once a day. The question is not about being right but if you are right, what are you going to do about it? This is the same thing I ask myself every single night before going to bed (second last thing is observing global markets indicators). Are we willing to pull the trigger?

The reason why heroes are so well loved because there are few and hard to come by. I believe once this whole entire episode is over, there will be only a handful that people will sing about. Specifically about their success in making the most of this frightening times. So let me share few simple viewpoints and of course some of our actions taken in this climate. I do not believe we will be right but if anything, history have taught us well and we should always head back to history to guide us especially in the times of uncertainty and great crisis. I believe this is a major crisis and especially so unexpected to the start of a new decade.

1. What rises will fall & similarly what has fallen will rise :

With the triple whammy of political instability, oil plunge and Covid-19, the perfect storm has come to the shores of Malaysia. None can escape unscathed. Now when the market is on a bull run, we think it will keep going up. Ex: At 15x PE, analysts say its cheap comparing to global peers which valuations stands at 25x. Today, those so-called cheap laggard counters are actually down to a valuation of only 4-6x PE valuation. True it is unfair to generalise as it is a downtrodden market affected even the best investors in the world. However this is a reflection of the market sentiment and investor confidence.

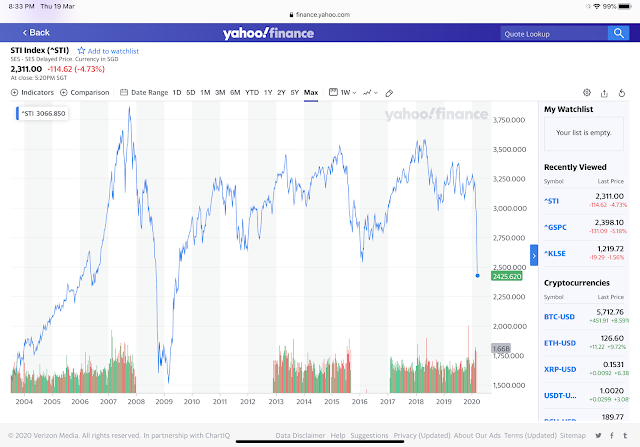

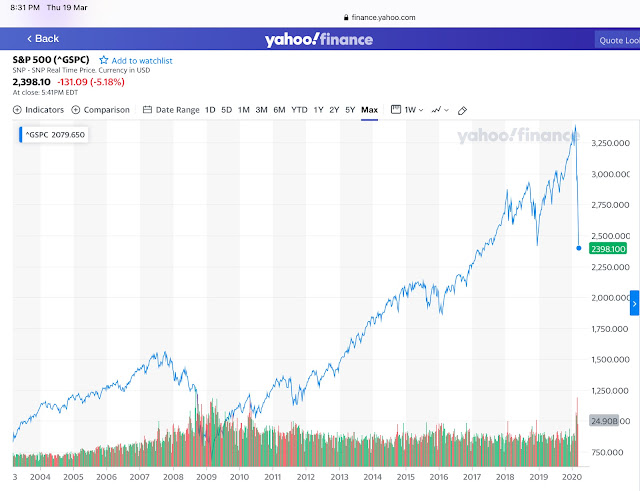

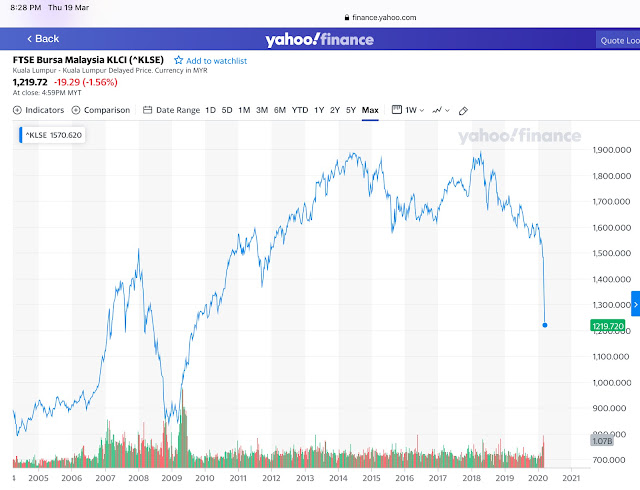

Let's have a look at the charts to compare :

Now if you compare the major dips from the peak to the bottom in 1997 - (1250 to 500), 2008 - (1400 to 800), & today 2020 - (1900 to 1219), it would appear there may be still some down side. On average each crisis, it falls close to or more than 50% from the peak of the market. Also you will notice the timeframe of recovery is between 6 months - 12 months from the bottom. 2008 was more of a V shape rebound compared to U shape rebound for 1997. Would 2020 crisis be a V or U shaped? In my view, it would be a U-shaped if the vaccine is not created sooner than later. After all, since the explosion of epidemic in Wuhan, China till today, it has been almost 4 months.

The important difference is this, so far there is no mass layoff yet and no street protest or unrest for Malaysia. Also, BNM is still solid and fundamentally sound compared to back in 1997. However, all this will get out of control if the new Government do not get their actions together to formulate a proper way out for the country. Remember, there is still shortfall from GST, shortfall from oil plunge income for the national coffers, increasing budget deficit, high debt outstanding from 1MDB amongst the many other issues we have yet to resolve. With limited fiscal room for the Government to manoeuvre, there is a risk our MGS will become less attractive for foreign funds especially with this global sell down, foreign funds as more choice than before where the global markets having lofty valuations compared to Malaysia.

2. Statesmanship to Lead the Country out of Turmoil :

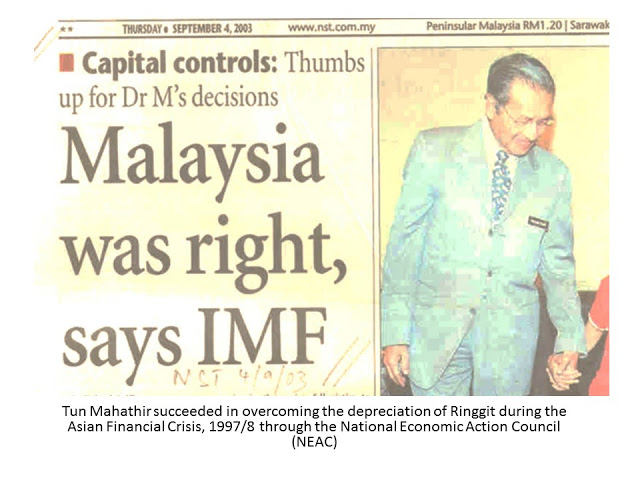

One of the most notable effort by our country leaders during the 1997 crisis was to implement capital control to help us out. Shortly in 1 year, Malaysia was back on growth track. Till today, many dispute this decision by our Govt then. It wasn't until much later that international community praised Malaysia government in rejecting IMF money by pegging Ringgit against USD.

The fact of that matter is today, we do not have the leader of comparable calibre to lead us, be it in terms of government policy or economic policy. The backdoor government only cares about their own position and power and in the midst of the Covid-19 played a terrible political play for their own personal interest leading to the spike in cases due to lapse in supervision and control measures implement.

Many things could have been prevented and many rescue plans could have been formulated if the government was still operating, not a window of 2 week coupled with further effort spent on politicking, trade bartering and on boarding for new / old but incompetent ministers. This is my biggest concern as I believe the international community will find a resolution to the virus but the aftermath will have long lasting effect on the country whereby the economy will take a long time to rebound due to poor leadership.

We previously shared the following stocks as our favourite :

- CCK

- OCK

- RCE Capital

- DKSH

- Riverstone Holdings

- Pintaras Jaya

- GCB

- MFCB

- Scicom

- RHB Bank

- Pentamaster

- Public Bank

- QL Resources

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

The firm has nearly halved its baseline global growth forecast for 2020 to just 1.3 per cent from 2.5 per cent in the December 2019 GEO.

2020-03-20 13:55

”But even on this basis we now expect eurozone growth to be minus 0.4 per cent this year. The baseline forecast for US growth is one per cent in 2020 compared with a pre-virus outlook of two per cent and GDP is expected to fall by 0.5 per cent (or two per cent annualised) in 2Q20.“

2020-03-20 13:57

It expects global growth to fall to 1.3 per cent in 2020 from 2.7 per cent in 2019, which would be weaker than global downturns in the early 1990s and in 2001.

2020-03-20 13:59

With key economic data worldwide continuing to disappoint amid the novel coronavirus (Covid-19) outbreak, experts say the worst is yet to come.

2020-03-21 14:59

Being a trade-reliant country, with trade accounting for 131% of its gross domestic product (GDP) in 2018 according to the World Bank, Malaysia has minimal chance - if any - to escape a recession if the world plunges into economic turmoil.

2020-03-21 15:03

Fund allocation...

35% of investment fund - during range 1200 ~ 1300

35% of investment fund - during range 1050 ~ 1200

30% of investment fund - during below 1050...............

Example :-

Assumption investment fund : $ 200,000

During 1200 ~ 1300 lvl, intend to purchase 5 Co. (35% of total investmet funds allocation)

Co.A @ 2.00 = allocation of $ 18,500 = 9,200 units

Co.B @ 1.70 = allocation of $ 15,500 = 9,100 units

Co.C @ 1.50 = allocation of $ 14,000 = 9,300 units

Co.D @ 1.30 = allocation of $ 12,000 = 9,200 units

Co.E @ 1.10 = allocation of $ 10,000 = 9,000 units

If index further decelerated to 1050 ~ 1200 lvl, then another 35% of total investment funds allocation

Co.A @ 1.50 = allocation of $ 19,000 = 12,600 units

Co.B @ 1.30 = allocation of $ 16,500 = 12,700 units

Co.C @ 1.10 = allocation of $ 14,000 = 12,700 units

Co.D @ 0.90 = allocation of $ 11,500 = 12,700 units

Co.E @ 0.70 = allocation of $ 9,000 = 12,800 units

If index further decelerated below 1050, then balance 30% of total investment funds allocation

Co.A @ 1.10 = allocation of $ 19,000 = 17,200 units

Co.B @ 0.90 = allocation of $ 15,500 = 17,200 units

Co.C @ 0.70 = allocation of $ 12,000 = 17,100 units

Co.D @ 0.50 = allocation of $ 8,500 = 17,000 units

Co.E @ 0.30 = allocation of $ 5,000 = 16,600 units

## So total share holding & average price for each company :-

Co.A = $ 56,220 / 39,000 units = $ 1.4415

Co.B = $ 47,460 / 39,000 units = $ 1.2169

Co.C = $ 39,890 / 39,100 units = $ 1.0202

Co.D = $ 31,890 / 38,900 units = $ 0.8198

Co.E = $ 23,840 / 38,400 units = $ 0.6208

%% At the end, the final average price of each company almost lower than the price during 1050 ~ 1200 index level

@@ This is illustration & reference only....

2020-03-21 18:02

Will not be a recession loh ....

Recession most prominent criteria --> high jobless rate + layoff ...now is not the economy issue loh ....

Hope an effective vaccine will finally be found to end the fear.

2020-03-23 00:23

Scientist in S'pore published the latest findings - Covid has mutated into a less lethal common flu.

2020-03-23 09:37

osted by Junichiro > Mar 23, 2020 9:37 AM | Report Abuse

Scientist in S'pore published the latest findings - Covid has mutated into a less lethal common flu.

===============

the L and S strains.............

2020-03-23 09:42

firehawk

DJIA drops to 3yrs low, KLSE drops to 13 yrs low, really a chi pek !!!

Ppl rise we don't rise, ppl drop we drop more ....

2020-03-19 23:31