Value Investor Club

PANASONIC MANUFACTURING MALAYSIA BERHAD VALUE EVALUATION

noobxiaoz

Publish date: Wed, 07 May 2014, 09:56 PM

A long time branded electrical appliances manufacturer, Panasonic has successfully positioned the consumer's brand with its high quality products. When it comes to durable goods, purchases are only stimulated when economy is considered stable and don't fluctuate much. Therefore when the trend is there, consumers tend to pick electrical appliances that are branded rather than the low ends because of the utilization of their money value. With the emergence of popular retailers like Harvey Norman and SenHeng, these outlets further provide credit for consumers to pay in instalments which further diminish the price difference between Panasonic high ends to the other products. Of course, it is undeniable that the presence of multiple competitors in the market is stiffer than ever, making it difficult to expand its market shares. Therefore, Panasonic started to emphasize on controlling their operating cost in a more efficient and stable way. In electrical manufacturing industry, much research and developments are needed to satisfy the every complicating consumer's demand. In Panasonic case, an average of RM15 million capital expenditure is utilized which is in my opinion insignificant with its strong RM600 million revenue.

As company like this is consider a cyclical revenue generator, its income is highly affected by the economic situations domestically and internationally. Upon economic downturns, durable goods are the first thing to be listed off from the consumer's wish list. At times of global index positioning at the price earning of 17, I don't think it's a suitable time for a cyclical stock to strive. Aside of that, surviving in appliance manufacturing industry, maintenance of inventory is extremely complicated compared to food and clothing industry, regular checkup is needed for stocks with low turnover.

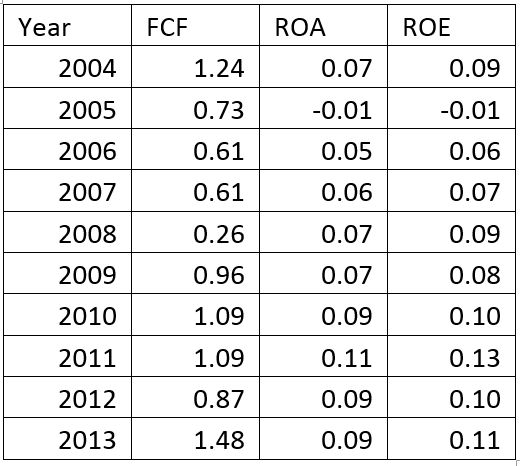

In order to obtain an average growth rate, growth of cash flow is derived from 2005 to 2013 figure which makes up 9% of compounding rates for eight years which is still satisfactory. As for ROA is above standard unlike ROE. It's performance reflects a moderate growth which does not fulfil my stock picking criteria. Filtered out.

Stock: PANAMY Code: 3719

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Value Investor Club

Discussions

Be the first to like this. Showing 0 of 0 comments