Careplus QR Profit RM5,181,000

i3Value

Publish date: Mon, 08 Jun 2020, 05:34 PM

On 5 June 2020, Careplus release QR 31-Mar-20.

Profit is RM1,141,000. EPS is 0.21 sen.

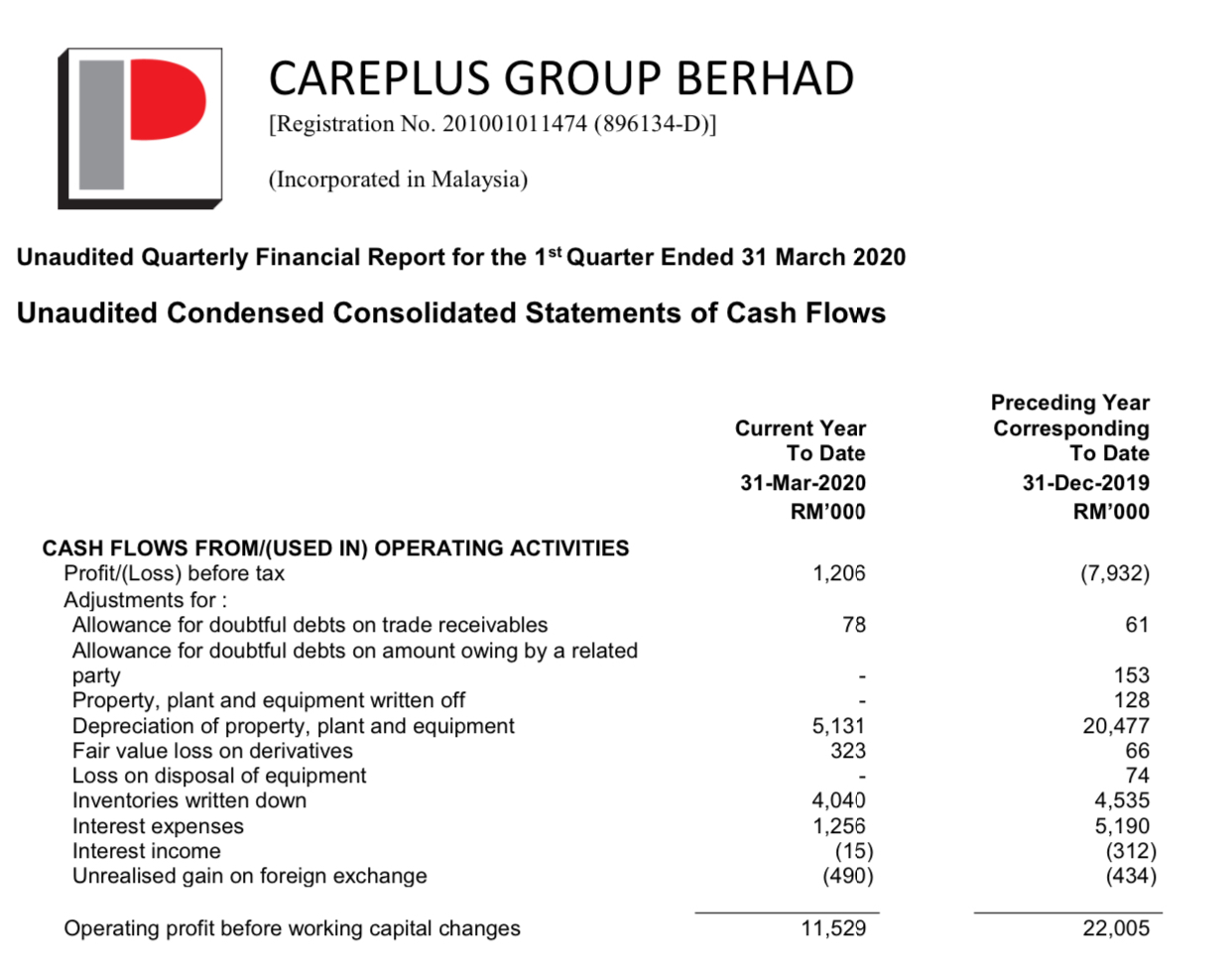

If look inside report, see inventories written down is RM4,040,000. This cannot be find inside notes but is in cash flow statement. I do not know why is not mention in the note 7. Normally is mention there.

If remove this write off, profit for quarter is RM5,181,000. This is quite good. Careplus always is make loss company. And the profit likely is March. Jan and Feb still quiet about Covid.

If use this profit, EPS for quarter is 1 sen.

How much is profit April, May and June? Should be continue improve.

Will Careplus go up or down on Tuesday? I do not know. Different people different idea about profit result. I just show hidden item in report only.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Nothing wrong with his English. No need to be too judgemental as malaysia just use rojak english

2020-06-08 17:56

wahahahahahaha.....wahahahahaha....wahahahahaha

showing desperate sign to the public......

2020-06-08 18:30

thanks for the info dude. If I happen to dump my share later, I will certainly rebuy tjis extremely high potential stock!

2020-06-08 18:38

what kind of accounting are you trying to interpret? Why don't you just remove all the expenses too since you don't like it?

2020-06-08 19:09

But last year written off inventories about the same amount. Need more info to understand better. Could be normal in gloves biz to write off old inventories. Also last year depreciation/write off of equipment also very high 20m hence loss of 7m otherwise will be in black for 13m. higher than this quarter. More question marks.

2020-06-08 19:21

You guys here who condemned should learn more about accounting

An inventory write-down is treated as an expense, which reduces net income. It considers the cost of goods sold, relative to its average inventory for a year or in any a set period of time.

It is a way to show a lower income

2020-06-08 19:25

Every company has their own method of showing income and policy of depreciation and valuation of stock. We look at the future of the company, expansion plan and global pandemic still here. You should come to the investor press so that you could ask anything you need more info.

2020-06-08 19:29

Even with pandemic, we have inventory write down, means inventory become worthless that's why they impair it down.

So means, its's a bad news on top of another bad news.

2020-06-08 19:38

Trying to put the write down and add back to profit just to make Careplus result good lol. Last quarter also have write down the same amount you didn't mention?

You would hope that no write-down during a pandemic, but now it has.

Bad news on top of bad result.

2020-06-08 19:39

Maybe, Written off inventories can be the certain production batch with quality issue, hence downgraded to scrap.Customers refuse to take shipment due to non conformance.

2020-06-08 20:33

This has a serious impact on any business’s net profit or balance sheet, as changes in the value of any inventory or assets will affect the profitability of the business.

2020-06-08 20:41

You should remove depreciation too , Careplus total profit cross above 10m , eps is 2cts , total eps 2x 4 x 100(top glove PE) TP RM 8.00

2020-06-08 22:29

congratulation to little newborn k+

turning black in jumps quarters

profit trending up qoq +45.72% yoy +214.33%

increase production capacity from 4.1 billion pcs to 6.5 billion pcs

what else you want

careglove ansell corp exec deal done

expect higher growths 8% min 2-3yrs

expect accelebrate good QR coming

special dividen given

bonus possible

what else you want

you expect result boom boom flowerly like as big3

gila la lu...you dream la....wakkkkakakakkak !

2020-06-09 07:59

Why this bloger does not mention about 4.535m Write off from previous QR 31-Dec-2019?

2020-06-09 23:07

CCCL Maybe, Written off inventories can be the certain production batch with quality issue, hence downgraded to scrap.Customers refuse to take shipment due to non conformance.

08/06/2020 8:33 PM

=================================================

I found this to be the most acceptable explanation!!

Still if you put back the value into sales (no written down), additional profit only up $40k (1% margin from that $4m goods).

2020-06-10 00:23

https://www.firstpost.com/health/covid-19-situation-worsening-worldwide-says-who-chief-protests-in-us-eu-spark-fears-of-a-second-wave-8463371.html

covid 19 worsening

second waves coming coming coming

brazil india russia worsen....wakakkkakkak !

2020-06-10 07:53

clap clap clap

noticed after big selldown 2 june 2020

big4 making record high ever

topglove 17.24

harta 13.50

kossan 9.33

supermx 9.30

play play play

one by one to take turn

small cap gloves one by one

play play play

comfort ruberex k+ .....wakkkakkkka !

2020-06-10 08:52

Glove game is over!

This darling stock will make a comeback!!!

https://klse.i3investor.com/blogs/winningstocks/2020-06-10-story-h1508724518-THIS_DARLING_STOCK_WILL_COMEBACK_AFTER_GIVE_A_WAY_TO_GLOVE_STOCKS.jsp

2020-06-10 15:52

OngKawKaw

Apa lu cakap? Use mandarin or bahasa also can. You punya english saya read kepala sakit o

2020-06-08 17:48