(CONNIE555) JAKS - WHAT OTB SAY IS REAL!!!

Connie555

Publish date: Fri, 01 May 2020, 02:59 AM

Again a picture is worth more than a thousand words!

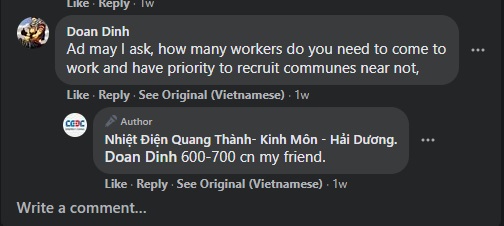

OTB is being attacked because of the information of Jaks. Hence I try to dig futher about the commencement of the Power Plant. It might be tally with the information given to OTB by Jaks Management - " I was told COD should be around June/July time frame. Hope there is no further delay."

Please check the Chinese writing below, this is not a translation, it is directly written by the Page Admin, Official CEEC Hai Duong Power Plant Facebook Page Admin.

For those who cant understand Chinese, it says "COD should be around June"

I hope this may clear the doubt of most of the investors.

BONUS:

They are recruiting about 600 to 700 persons, how can the Power plant is fake??

I only believe in facts and figure....and also some business sense but ofcourse not that ROC as Ricky Yeo and Jon Choivo. Thank you.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on You are not alone.

Created by Connie555 | Apr 16, 2020

Created by Connie555 | Apr 07, 2019

Created by Connie555 | Apr 06, 2019

Discussions

Well said, Philip.

I know you mean SOE Chinese contractor have good track record but "faith in Chinese counterpart" still sounds funny because 9/10 they cheated.

In addition to "China SOE risk", who knows Vietnam will join in rank to claim from China despite they have rather few Coronavirus cases.

2020-05-01 08:56

For those who can't translate Chinese to English,

大概六月份电厂才能发电 = the power plant will generate electricity in June, approximately.

It could just mean grid synchronization, not necessarily COD

2020-05-01 10:28

I agree with Connie - tis Jon Choivo is dumb ass who pretend 2 b expert talk crap and insult people all the time. Lousy track record and down 30+% in 2019. Yet want to con ppl to invest in his so called “fake fund”.

2020-05-01 10:53

haha never said anything about JAKS is fake, which makes you writing fake news.

2020-05-01 10:58

Haha,

One look at the Balance Sheet already know cash rich Insas BOD had nothing similar with ALP except inari is cash cow for Insas and JPP is cash cow to Jaks.

So fake news again from Philip

2020-05-01 11:21

Philip ( buy what you understand)

Ricky Yeo is in Australia lo. Very young man and handsome and still writing articles that sound good but have no results one la.

Of course very sarcastic, he thinks just because he emigrated to Australia he is better than the average Malaysian, not knowing that while he is earning peanuts in a foreign land and jumping from job to job, others are making millions in Malaysia, the land of the hard working asians.

He is also another one who want to start a stock competition ( 10 years woh) with me,

https://klse.i3investor.com/servlets/pfs/138504.jsp

>>>>>>>>>>

https://au.linkedin.com/in/jiayeo

2020-05-01 13:14

otb's call doesn't work in the market now. All new investors don't know who is him. When he buy call Samchem..does it move? when he sell call on Lctitan, lctitan move 14% higher on the next day. haih..负了天下人,真的负了

2020-05-01 13:14

nobody here thinking of keeping Jaks for 5 years........everybody hopes Jaks $ 1 to $ 1.50. Me? I think 80 sen more likely than $ 1.50.................

2020-05-01 13:16

oh start operating June 2020 ? that is just next month !!!

thanks Connie (both for the COD date as well as Choivo bashing)

2020-05-01 14:11

Haha,

Correction JPP is a very big cash cow to Jaks (RM 300 million) per year for next 25 years). Come monday morning will top up Jaks.

2020-05-01 14:16

Dear Ricky Yeo,

I do not know you are such a young man. Thumb up to you and do not allow Philip old man negative comment effect you. Just be yourself and free to do what your heart desire. You have my support.

2020-05-01 14:36

Thanks for putting everything into my mouth Philip. You're such a physic that you know that I think I am better than average Malaysian. I didn't even know that! Thanks for telling me. Despite the fact that I don't like to boast how much I make unlike some Malaysian.

Omg how did you know I jump from job to job. Thanks for sharing my linkedin btw, so ethical. Yea I do the competition to shut your trap. I don't know how old you're Philip. But 20 years competition won't make sense because probabilistically and statistically, you're more likely not to be around than I'm. No hard feeling or cursing. Just stats. So to make sure you have the last laugh, 10 years is reasonable. I don't have millions but I still think for others.

2020-05-01 15:05

Yg ni coming from someone yg dulu had 0 integrity (mungkin now jugak) who screwed up big time who had to pretend a disappearance n absorbed to d deep jungle in Sarawak

But nevertheless condemning others for life based on d past

Never giving 2nd chance

Klau bini n mertua u hv d same thinking mcm u u r gone case long ago

Gajah di hadapan mata x nampak nyamuk di seberang nampak

Btw Andy x seteruk mcn u mcm wat u hv said

Philip ( buy what you understand)

Their history already shows execution risk.

... JAKS gets the earnings, how sure are you they will be able to either pay a consistent dividend, buyback shares, use the earnings to take on bigger profitable jobs instead of going further into debt?

Their history already shows execution risk.

01/05/2020 7:56 AM

2020-05-01 19:36

Andy Ang will seek for election during the AGM. If you dont like him remove him. I believe if all minority shares more than Andy Ang and his geng

2020-05-01 20:15

Philip ( buy what you understand)

Boring every time same answer, but one simple question until today not answered. Why is it for the last 5+ years with the same balance sheet is INSAS trading at such a huge discount to balance sheet? Why are banks avoiding, institutional investors who avoiding, Philip avoiding? Was it the right action not to invest in INSAS for the last 5 years despite huge difference in balance sheet? Why is this happening?

Can sslee stop repeating same balance sheet story and explain why for last 5 years INSAS share price is trading to such huge discount, similar to icap also trading at a discount?

Will the same story repeat 5 years of from now? Will INSAS still trade below its NAV 10 years from now?

Sslee. Learn to scuttlebutt. Don't just try on CEO teatime. Visit dome. Visit melium. Go visit numoni. Go use vigcash, tribecar. Go use their trading facility.

Then you will know that business is so much more than just pieces of paper.

FYI. I have used tribecar in Singapore.

Have you used any of INSAS services and products?

>>>>>>>

Posted by Sslee > May 1, 2020 11:21 AM | Report Abuse

Haha,

One look at the Balance Sheet already know cash rich Insas BOD had nothing similar with ALP except inari is cash cow for Insas and JPP is cash cow to Jaks.

So fake news again from Philip

2020-05-01 20:20

Haha Philip,

I start to invest in Insas 8n yeat 2017 and top up Insas year by year and will continues to do so for the next 5 year. May I ask when is your last time top up QL? Dare to top up more for the next 5 years?

2020-05-01 20:44

Philip ( buy what you understand)

That is not an answer.

>>>>>>>>

Posted by Sslee > May 1, 2020 8:44 PM | Report Abuse

Haha Philip,

I start to invest in Insas 8n yeat 2017 and top up Insas year by year and will continues to do so for the next 5 year. May I ask when is your last time top up QL? Dare to top up more for the next 5 years?

2020-05-01 22:09

Buy roses for ur wife everyday to ur father in law too

Klau Addy x pandai pandai lagi after IPP we all go AGM every year to betul betul taruk x bagi chance lagi Andy

2020-05-02 09:39

Philip ( buy what you understand)

so you cannot even answer why INSAS stock underperformance for 5 years? Do you even know INSAS business or the products they sell? Have you tried buying their products on a daily basis or visited their production center, or talked to their suppliers, contractors, staff? Do you even know why DS thong sell his entire 4.5 million stake in inari?

This is the same as sarifah just buying JAKS just because of a power plant, and he doesn't even own the power plant but a minority stake of the plant, as JAKS will own 30% of the powerplant, and sarifah owns 0.00000001% of jaks, so she can't even influence any decision andy ang makes on jaks earnings, much less "taruk" andy ang. He will just ask you, "berapa share you ada kat JAKS? 100K share? diam lah klu tak ada duit beli, buat gelak ja keyboard warrior but no investment capability.

This in a nutshell explains the conundrum of INSAS selling far far FAR below balance sheet of .. .RM3.6? or whatever figure you want to put today or next week.

People who think investing is easy, buy today sell tomorrow, those are not investors. Those are speculators.

Speculators who are stuck in an investment to become long term holders are not called investors. Those are called egoistic amateurs. if you hold a stock for more than 3 years, and you still don't see any improvement in earning, revenues and changes in the company? Then you are just another donald trump wannabe, investing large capital based on gut feel.

>>>>>>>>>>

Sslee Haha

Of cause this is not an answer but a challenge.

02/05/2020 8:18 AM

2020-05-02 12:11

U need understand under performance 5 years does not mean it cannot outperformance the next 5 years loh...!!

Good example is Penta it is underperforming last 5 years, but now it is a darling and outperforming loh...!!

Posted by Philip ( buy what you understand) > May 2, 2020 12:11 PM | Report Abuse

so you cannot even answer why INSAS stock underperformance for 5 years? Do you even know INSAS business or the products they sell? Have you tried buying their products on a daily basis or visited their production center, or talked to their suppliers, contractors, staff? Do you even know why DS thong sell his entire 4.5 million stake in inari?

This is the same as sarifah just buying JAKS just because of a power plant, and he doesn't even own the power plant but a minority stake of the plant, as JAKS will own 30% of the powerplant, and sarifah owns 0.00000001% of jaks, so she can't even influence any decision andy ang makes on jaks earnings, much less "taruk" andy ang. He will just ask you, "berapa share you ada kat JAKS? 100K share? diam lah klu tak ada duit beli, buat gelak ja keyboard warrior but no investment capability.

This in a nutshell explains the conundrum of INSAS selling far far FAR below balance sheet of .. .RM3.6? or whatever figure you want to put today or next week.

People who think investing is easy, buy today sell tomorrow, those are not investors. Those are speculators.

Speculators who are stuck in an investment to become long term holders are not called investors. Those are called egoistic amateurs. if you hold a stock for more than 3 years, and you still don't see any improvement in earning, revenues and changes in the company? Then you are just another donald trump wannabe, investing large capital based on gut feel.

>>>>>>>>>>

Sslee Haha

Of cause this is not an answer but a challenge.

02/05/2020 8:18 AM

2020-05-02 19:19

Philip ( buy what you understand)

in my opinion of JAKS, I am not an investor. This is because I cannot invest directly in the power plant. Instead, I have to put money into JAKS itself, which is run by a CEO that I do not trust or respect in Andy Ang who hides information from shareholders and does poison pill defence, a management that does a poor job in building a shopping mall in a place no one wants to go to (evolve), and has multiple LAD and delays in its property development (50 million incoming LAD to STAR), and a legacy business of steel pipe supply that cannot compete locally. The company also has a history of funneling company funds to many ventures like that has expenses but so far no adequate returns on capital. Many cash calls, zero dividends.

The power plant is definitely going to complete and COD will strike. Hopefully before December when the LAD will kick in.

I have faith in the chinese counterpart to complete the power plant on time.

I have zero faith in JAKS management to manage the earnings from the power plant to grow shareholder value.

I compare the power plant to inari, and JAKS to INSAS. Why is INSAS selling at such a huge discount to assets despite holding a huge portion of INARI shares?

2 words: Management Execution.

I wish connie all the best. You are a brilliant investor, especially coming from kuantan. But the fact is, once JAKS gets the earnings, how sure are you they will be able to either pay a consistent dividend, buyback shares, use the earnings to take on bigger profitable jobs instead of going further into debt?

Their history already shows execution risk.

2020-05-01 07:56