PPHB - Part 1 (Sell is overly done)

wongkl0307

Publish date: Thu, 27 Feb 2020, 12:56 PM

PPHB - Part 1 (Sell is overly done, why say so?)

Just want to write for sharing purpose. I have been investing for almost 7 years from now, I am still learning every single day. Market is changing everyday, some day you see gloves stocks up, some days you see packaging stocks up, it is changing rapidly and you might loss your mind how did this happen and you are holding the unrealised loss stocks.

I usually choose stocks based on theme, sustainable business, growth stocks over the years. I hardly look at charts. I am not a TA person. I used to be TA, but I was losing money all the time.

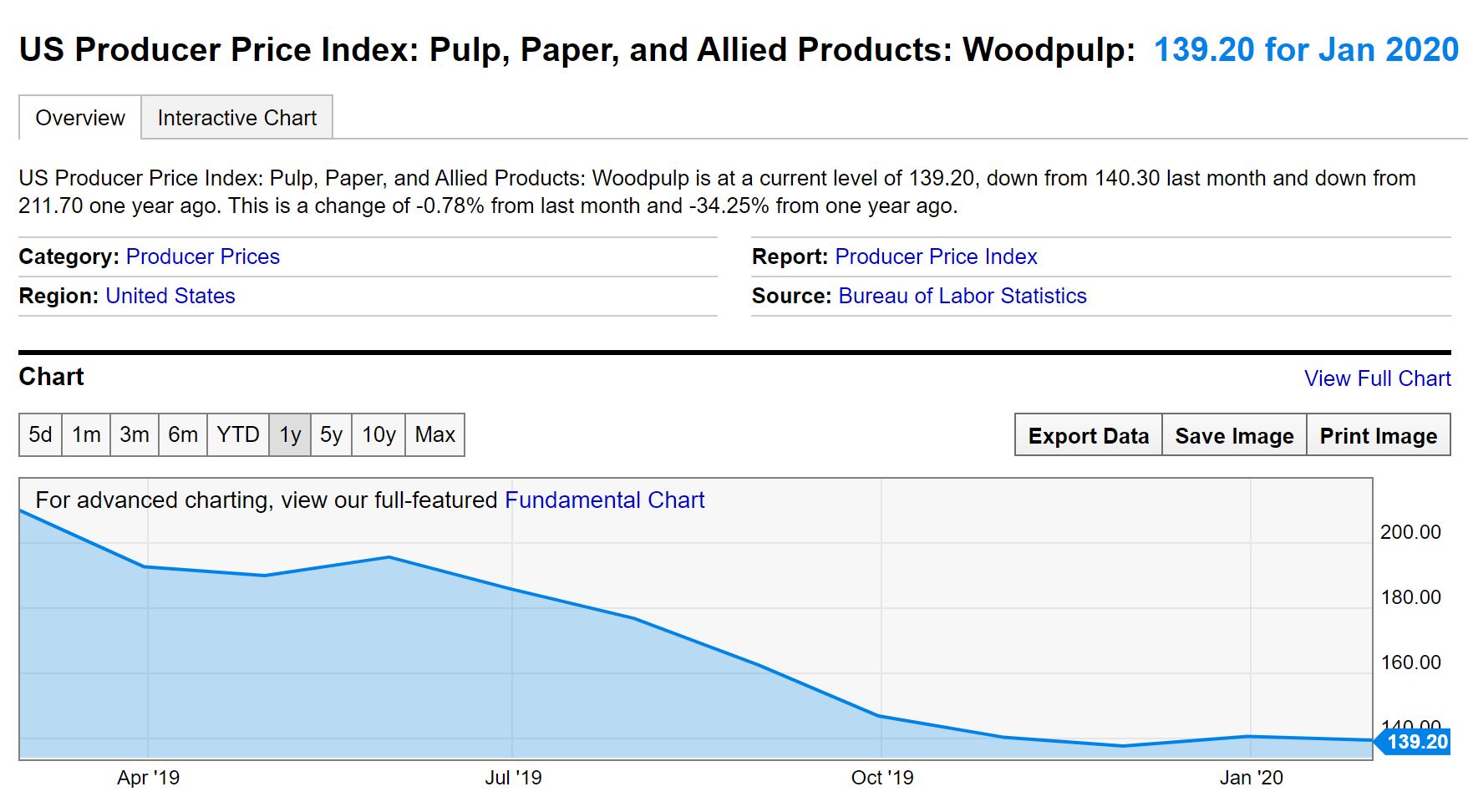

I have an eyes in PPHB when the paper price was sliding down. It means that the paper manufacturer will be making less money, BUT the product manufacturer using paper will benefit instantly! Product manufacturer using paper we have a list of them PPHB, ORNA, etc.

Of course, ORNA is better than PPHB & MUDA in term of profits growth in Q4FY2019. I made assumption that ORNA controls their inventory purchase better than PPHB. PPHB on the other hand might selling the inventories on paper price purchased at early September 2019 when the price is still high which impacted their Q4FY2019. Both ORNA and PPHB are net cash company, definitely can survive under crisis.

(Source: https://ycharts.com/indicators/us_producer_price_index_pulp_paper_and_allied_products_woodpulp)

So the paper price is still low, but their selling price is only adjusted a little. So high margin retained at 11.6% in year 2019 as compared with 9.6% @ year 2018 & 8.7% @ year 2017.

I love seeing this kind of company with uptrend business growth. How can you not love this kind of company. 7 years ago, the share price is at 20c, now it is at high RM1.39. 7-folded in 7 years time, CAGR of 31.91%!!!!

When the price went to 82c, this is buying opportunity for me! It was 40% correction from the high plus recent sentiments. Buy when everyone is fear. When I look at the paper price, I know this company will be making money in upcoming FY2020 and the revenue and profit will continue to rise up. You can see from the financial highlights. The sales person is doing the job, and the operation is cutting the cost, you have both of match up, the company will get the deserved profit. I love the management of maximising the shareholder value. Thanks Mr Koay!! I will be attending your AGM in 2020 that I have attended in 2019 and 2018.

Disclaimer: This is my personal portfolio for information purposes only and doesn’t constitute a recommendation of solicitation or expression of views that influence readers to buy/sell stocks. I may have position in or may be materially interested in any of the stocks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Fabien "The Efficient Capital Allocater"

and the price went further down to 52sen.

how is ur conviction now?

2020-03-12 22:45