It may seem an incredibly obvious statement to make but as investors, we should strive not to lose our capital.

You don’t need to read lots from the likes of Benjamin Graham or The Sage before you hear them extolling the virtues of protecting your capital. Graham highlights the extreme example beautifully when he states:

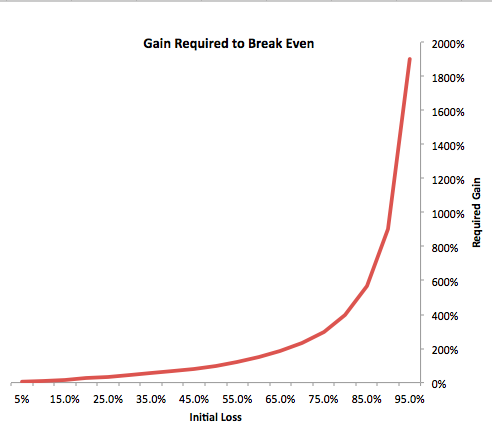

Once you lose 95% of your money, you have to gain 1,900% just to get back where you started

The above example is of course an extreme case (unless you invested in the dot com boom leading up to 2000 where it was much more common) however let’s look along the curve to see some less extreme values:

What should be immediately apparent from the graph above is that as your losses grow on a particular investment, the subsequent gain required to get back to where you started, grows exponentially. Now that we have observed this effect we can draw a pretty strong conclusion:

Not losing money is more important for investment success than making money.

So now we know how important capital preservation is lets look at some strategies you can use to preserve it.

Strategies to Preserve Capital

Stock markets rise and fall on the whims of the buyers and sellers each day. Investors need to understand that prices do not always reflect the underlying value of the asset in question. In fact prices rarely reflect the true value of a company, but instead the markets sentiment towards an asset and its prospects. This is what adds volatility to the markets.

For every share or fund I purchase I do with the knowledge that it is highly possible that it may lose 30% of its value in the next 12 months or so. You only have to look at the FTSE 100’s historical record over the last 2 years to see that big dips in prices are the norm.

So having accepted that your portfolio is going to take a big hit at some point, your job as an investor is to minimize the damage to your capital.

The main way to achieve capital preservation is to always factor in some ‘margin of safety’ into your buy decisions. Below are a few ways you can do this.

1. Buy Cheap

Always aim to buy stocks when they’re cheap. Simples.

Unfortunately the occasions when a listed companies shares trade for less than its net assets are rarer than hen’s teeth. However the market has a tendency to over react to situations and put shares on big discounts from time to time.

A great example of this was BP.L after the 2010 Deep Water Horizon disaster. As the disaster unfolded the shares traded down from around £6.39 to a low of £3.05, more than half of its pre disaster value. This was a classic case of the market over reacting and putting the shares on sale.

Sure BP was facing a PR disaster, pressure from the US government and a huge legal/compensation bill running in to the billions. However by losing that one well, it wasn’t like the firm had lost over half of its oil (revenue) producing assets in that disaster. If you’d taken the opportunity to buy cheap in 2010-11 then you’d have locked in some significant margin of safety.

Likewise if you’re investing in investment trusts then you may want to only invest when they’re trading on a discount to their net assets. In such cases you’re effectively buying a stake in the trust assets for a price less than they are worth. Over time the price should return back to fair value, leaving you sitting on a profit.

Of course ‘buying low’ (never mind ‘selling high’ for now) makes perfect sense to us all. However implementing it as part of your investment strategy is often harder than it sounds. The vast majority of investors find it impossible not to succumb to heard mentality and will happily buy an over priced asset because they are jealous of the gains made buy others and want a piece of the action for themselves.

For a perfect example of how to change your investment approach during market ‘sales’ check out EA’s tale of two bear markets. It usually takes a good dose of fortitude to put your chips on the table when everyone else is taking theirs off.

2. Buy Boring

As my investing career has progressed, my strategy has steadily shifted to what many would call a defensive strategy. I keep a very small part of my portfolio assigned for ‘speculative’ buys but on the whole I only invest in businesses that are reliably profitable.

The more certain a company’s future profits are, the less likely there are to be any future drops in price. Where there is stability there is also safety.

Consider a company like National Grid (which provides/maintains the pipes for our power network). With huge barriers to entry NG.L effectively runs a monopoly. National Grid has its allowable profitability rates set by the UK regulators every 10 years or so. As a result as an investor, I know that so long as the management doesn’t screw up, they should make a certain amount of profit each year until the next regulatory agreement is made in 8 years time. This is my margin of safety on this investment.

Now consider the future profitability of National Grid to a company like Twitter where it’s anyone’s guess if it will even still exist in 8 years time. The result:

As you can see Twitter share holders have had a rough old ride this year and have lost around 26% of their capital since February (which out of interest will require a 33.3% increase to claw back).

Meanwhile shareholders of National Grid (myself included) have been trundling along steadily increasing our capital (+11.5%) as well as picking up an annual dividend in the region of 4.5%. What’s more thanks to that margin of safety my investment requires very little maintenance, worry or ongoing research.

3. Focus on Income

We’ve written before about the hugely beneficial effects that compounding can have on portfolio performance if you give it time. If your portfolio is generating regular income it won’t be too long before that accumulated income will add up to an amount that starts to make any short term price fluctuations irrelevant.

Most of the investments I hold produce regular income in the form of dividends. So long as these dividends can be funded in the future (and hopefully grown in real terms) then I’m happy. The market price will always change as a result of macro political/economic events, minor deviations from financial targets, news from competitors, scandals, personnel changes etc etc.

What really matters amongst all of this noise is the company’s long term ability to generate profits. If quarterly earnings fail to meet analysts consensus by 0.19% should I care as an investor? Based on my personal experience the answer should be no. Sure the share price might slump 5% but the long term prospects of a company won’t be determined by such a tiny deviation from plan.

Capital Conclusions

In much the same way that my buy to let investment strategy is completely agnostic to house prices, I don’t really care too much about short term share prices. So long as I’m receiving a steadily increasing stream of income I consider myself a happy and successful investor.

Of course there is a difference between short term price fluctuations and long term capital destruction. If you don’t want to have to climb the red line in the graph at the top of this page then rather than chasing capital appreciation maybe you should be focussing your efforts on preserving your capital.

{ 8 comments… add one }

This is a great article (even without the Escape Artist link which was a bonus!). Its consistent with my approach: I won’t buy a non-dividend paying stock (although I often avoid buying the highest yielding stocks with risk of a future divi cut). Reading this was the first time I’ve seen the exponential loss recovery graph shown like that….powerful stuff!

Escape Artist,

I too was shocked when I put that graph together to be honest. While I have been gradually adopting a more conservative investment approach in the last few years, looking at that graph has certainly made me think even harder about limiting any future downsides.