DUFU (7233) OVERSOLD & TOP REASONS WHY IT HAS THE MOST POTENTIAL NOW FOR UPSIDE, Calvin Tan

calvintaneng

Publish date: Fri, 30 Aug 2024, 01:53 PM

Dear Friends of i3 Forum (Please read to the end as we type now)

As we have stated before - the Sell Down of HDD/SSD Stocks together with Tech Stocks are unwarranted & present us a Good Buying Opportunity

And these are Our Reasons

Daniel 12:4

But thou, O Daniel, shut up the words, and seal the book, even to the time of the end: many shall run to and fro, and knowledge shall be increased.

Aramaic Bible in Plain English

But you, Daniel, seal these words and be silent and seal this book until the time of the end. Many shall seek and knowledge shall be multiplied

Yes, things will get more and more advanced & Knowledge show increase by leaps & bounds as we enter the time of the ending

That is why we MUST ADAPT TO THE CHANGING TIMES OR BE LEFT BEHIND

Kodak & Polaroid Camera went Obsolete at the emergence of the Digital Camera

Nokia analogue hand phone got wiped out by the appearance of the Digital iPhone

Latest Casualty Was Intel

What happened to Intel?

While Nvidia is winning the AI revolution, Intel has stood painfully still

While Nvidia is up 3000% in the past decade, Intel is almost unique among semiconductor companies in failing to grow from the AI boom.

INTEL FAILED TO CHANGE WITH THE TIMES!

LEFT BEHIND IN THE Ai BOOM

As a result Intel share price crashed 25%

Intel shares sink more than 25% as US stocks fall on jobs data

NEW YORK — Wall Street stocks fell early Friday following weak US jobs data while Intel shares sank more than 25 per cent after it announced deep job cuts.

The US economy added 114,000 jobs last month, down from June's revised 179,000 figure, while the jobless rate rose to 4.3 per cent, the highest level since October 2021.

The new data come on the heels of downcast manufacturing data on Thursday that sent shares lower, stoking recession fears.

By AFP - Aug 03,2024 - Last updated at Aug 03,2024

That's it

In the Contest for More Knowledge Products of the End Times: Ai with Supporting HDD/SSD is a MUST Not an Option

AND KNOWELEDGE SHALL BE INCREASED

AND WILL CONTINUE TO INCREASE

WITH THE THE MUSHROOMING OF DATA CENTERS ARE UNSTOPPABLE AS LONG AS LIVES EXIST ON EARTH

See how many New Data Centers have sprouted Up all Over the World

How Many Data Centers Are There and Where Are They Being Built?

By the end of 2024, there will be 5,697 public data centers worldwide—5,186 colocation sites and 511 hyperscale sites. Asia-Pacific has the highest concentration of data center locations, with Europe and North America following. ABI Research anticipates 8,410 data centers will be in operation by 2030.

As enterprises continue to digitally transform and leverage advanced technologies, demand for cloud resources and larger data centers has peaked. Although the number of data centers being built worldwide is growing, regional differences exist due to varying regulatory, legal, and space availability factors. Moreover, North America and Europe are already well-established markets for data center construction, leaving room for major growth in other regions.

Number of Colocation Data Centers by Region, 2024-2030

By the end of 2024, there will be 5,186 colocation data centers worldwide. Growing at a Compound Annual Growth Rate (CAGR) of 6.6%, the number of colocation data centers will increase to 7,640 by 2030.

Today, Asia-Pacific has the most data centers (1,811 sites) worldwide, followed by Europe (1,558 sites) and North America (1,357 sites). Some of the countries with the most data centers built in these regions include China, the United States, Germany, the United Kingdom, Japan, Australia, Canada, and France. By the decade's end, ABI Research anticipates Asia-Pacific (2,126 sites), Europe (2,108 sites), and North America (1,803 sites) to sustain the first, second, and third most colocation data center locations, respectively.

Number of Colocation Data Centers by Size, 2024-2030

The size of data centers is increasing, driven by the rapidly growing adoption of generative AI and other data-intensive technologies relying on the cloud. While the number of micro and small-sized data centers will decrease throughout the rest of the decade, the construction of large and mega data centers will grow robustly.

Today, large and mega-sized colocation facilities account for only 28% of total data centers worldwide. However, that number will grow to 43% by 2030 as companies build larger data centers that can accommodate AI/generative AI workloads and other data-hungry applications.

By 2030, the aggregate power capacity of large and mega-sized data centers will reach 142,682 Megawatts (MW) and 289,259 MW, respectively.

Hyperscale Data Centers on the Rise

Hyperscale data centers are large, remote facilities with greater cloud computing capacity than enterprise data centers. Cloud service providers Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM, Alibaba, and Oracle are investing billions of dollars in building data centers around the world. This will increase the number of hyperscale data centers from 511 in 2024 to 770 in 2030.

AWS has the most data center sites worldwide among all cloud hyperscalers, with 126 as of 2024. By 2030, that number will increase to 185. This gives AWS a market share of roughly 25%. Microsoft Azure and GCP will closely trail AWS through 2030 for the most amount of data centers built.

While North America and Europe remain innovation hubs for hyperscale data centers, Asia-Pacific is the fastest-growing region. AWS and Google Cloud have announced their plans to build data centers in Malaysia, Thailand, and New Zealand in the last couple of years. Microsoft currently operates a data center in India and plans to open new facilities in Taiwan and Indonesia.

Cloud hyperscalers have also taken a keen interest in South America and the Middle East & Africa. Although these regions are home to far fewer data centers than other regions, they will experience significant growth in facility construction throughout the decade. Saudi Arabia, with aspirations to become a tech hub in the Middle East, has piqued the curiosity of hyperscaler tech companies. For example, Saudi Arabia’s plans to become a manufacturing hub will necessitate expanding cloud resources. This growing appetite for cloud-based solutions will present a huge opportunity for data center owners and construction companies.

They are building Lots More Data Centers Worldwide

And they are building More Higher Performance HYPER SCALE CENTERS

Very Good For DUFU as It is able to Adapt to Ever Expanding Needs by its Actuator Arms for multi platters

Of the three JCY, Notion & Dufu -- DUFU Commands the HIghest Growth Value

Even Norway Norges Funds took notice and bought into DUFU to be among its Top 30 Substantial Shareholders

Refer Bursa (Top 30 Holders of DUFU)

8. Citigroup Nominees (Asing) Sdn Bhd

Qualifier: CBNY for Norges Bank (FI 17)

11,416,200 2.15

9. Wang, Kuei-Hua 10,112,130 1.91

10. Amanahraya Trustees Berhad

Qualifier: Public Islamic Opportunities Fund

9,896,300 1.87

11. Amanahraya Trustees Berhad

Qualifier: Public Smallcap Fund

9,543,400 1.80

12. DB (Malaysia) Nominee (Tempatan) Sendirian Berhad

Qualifier: Deutsche Trustees Malaysia Berhad for Eastspring Investmentssmall-Cap Fund

7,465,600 1.41

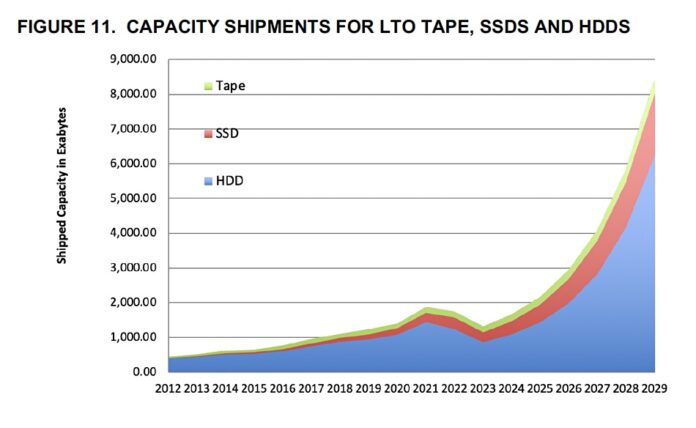

Let us see again the demand for HDD/SSD

After Covid 19 over by year 2022 & Nations Opened Up

MANY MANY NEW DATA CENTERS ARE PROPOSED, PLANNED AND NOW IN BUILDING

ALL THESE THOUSANDS OF NEW DATA CENTERS SHOULD BE READY BY END 2024 TO 2030

EVER INCREASING DEMAND STILL AHEAD

SO THE RISE OF HDD/SSD SHARES ARE STILL IN ITS EARLY DAYS

THE BEST IS YET TO COME

HOLD TIGHT

GOT EXTRA CASH BUY MORE

NOT ENOUGH CASH?

THEN SELL OTHER TECH STOCKS (NOT DOING HDD/SSD) & SWITCH INTO DUFU NOW!

With Warm Regards

Calvin Tan

Please buy or sell after doing your own due diligence or consult your Remisier/Fund Manager

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 30, 2024

Created by calvintaneng | Aug 29, 2024

Created by calvintaneng | Aug 28, 2024

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Discussions

Michael Dell: AI to drive data center demand up 100x over next 10 years

https://www.datacenterdynamics.com/en/news/michael-dell-ai-to-drive-data-center-demand-up-100-fold-over-next-10-years/

1 hour ago

.png)

calvintaneng

https://www.datacenterdynamics.com/en/news/michael-dell-ai-to-drive-data-center-demand-up-100-fold-over-next-10-years/

1 hour ago