JCY (5161) FANTASTIC TURNAROUND RESULTS CONFIRMED WHAT DUFU & NOTION REPORTED! HDD BULL RUN COMMENCING IN EARNEST, Calvin Tan

calvintaneng

Publish date: Thu, 23 May 2024, 06:30 AM

Dear friends of i3 Forum

Latest Fantastic Turnaround Results Solidify THE UPCOMING BULL RUN OF HDD & SSD STOCKS Like JCY, NOTION & DUFU

Let's See

Refer Bursa

SUMMARY OF KEY FINANCIAL INFORMATION31 Mar 2024 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | ||||

| CURRENT YEAR QUARTER | PRECEDING YEAR CORRESPONDING QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR CORRESPONDING PERIOD | ||

| 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2024 | 31 Mar 2023 | ||

| $$'000 | $$'000 | $$'000 | $$'000 | ||

| 1 | Revenue | 147,146 | 104,618 | 273,858 | 215,861 |

| 2 | Profit/(loss) before tax | 5,459 | -25,329 | 2,888 | -61,734 |

| 3 | Profit/(loss) for the period | 5,346 | -25,283 | 2,700 | -57,354 |

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,346 | -25,283 | 2,700 | -57,354 |

| 5 | Basic earnings/(loss) per share (Subunit) | 0.25 | -1.20 | 0.13 | -2.72 |

| 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | ||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3256 | 0.3240 | ||

YoY REVENUE UP from Rm104.6 Millions to Rm147.1 Millions

Or Up Rm42.528 Millions (Up by 40.65%)

Loss of Rm25.283 Millions to PROFIT OF RM5.346 MILLIONS

From a loss of 1.2 sen to a Profit of 0.25 sen

AND THIS IS ONLY THE BEGINNING!

See How Sanguine Management of JCY BOD are

Refer Quarterly Report

Detailed Analysis for current quarter and cumulative period

The Group recorded a revenue of RM147.1 million for the reporting period, this represents an

increment of 40.7% in revenue for the reporting quarter compared to previous year's

corresponding period. The Group recorded a net profit of RM5.3 million for the reporting

quarter, compared to net loss of RM25.3 million recorded in the previous year's corresponding

period. The improvement in results is driven by two main factors:

a) Revenue increasing driven by increasing demand for storage products, both Hard Disk Drives

(HDD) and Solid State Drives (SSD). Our customers have started seeing some recovery in HDD

demand and that is translating to more demand for the Groups offerings. We are seeing this

sustained increasing factory capacity utilisation throughout the whole quarter.

b) An improved Group cost structure allowing the Group to turn to profitability even at a much

lower factory capacity utilization rate. This improved cost structure is a result of a continuous

effort by the Group to drive factory yields and productivity. This process is evident as we have

reduced our Gross Loss consecutively Quarter on Quarter for the last 4 quarters.

The improved cost structure and higher customer demand driving higher factory capacity

utilization resulted in our first Net Profit quarter since Dec 2021. This result is even more

significant given that the Group’s capacity utilisation is still less than 50% in the reported quarter

FANTASTIC GREAT JOB!

Read Again!

This result is even more

significant given that the Group’s capacity utilisation is still less than 50% in the reported quarter

WELL DONE! WELL DONE!!

DOING LESS FOR MORE!

NOW IF THEY GO FULL FORCE?

IT WILL BE ASTOUNDING TURNAROUND GROWTH FROM HERE

They say "LUCK IS PREPARATION MEETING OPPORTUNITY!"

JCY SURVIVED & PREPARED AHEAD IN LEAN TIMES

SO WITH MUSHROOMING OF AI AND NEW DATA CENTERS ALL OVER THE WORLD (NOT JUST MALAYSIA)

JCY WILL STAND TO REAP

Already Shows Abundant Change This Quarter

Go See Qtrly Report Again (Refer Bursa)

Inventories

Rm193,558,000 (As at 31 March 2024)

Rm230,122,000 (As at 30 Sept 2023)

In 6 months Inventory dropped by Rm36.564 Millions

Cash and bank balances

Rm 130,943,000 (As at 31 March 2024)

Rm103,126,000 (As at 30 Sept 2023)

Net Cash Up Rm27.817 MILLIONS

Short term borrowings

Rm 33,517,000 (As at 31 March 2024)

Rm 44,143,000 (As at 30 Sept 2023)

Debt paid off by Rm10.626 Millions

TOTAL CASH POSITIVE BY

RM27.817 MILLIONS + RM10.626 MILLIONS

= RM38.443 MILLIONS

WELL DONE INDEED!

AND ALL THESE WERE ONLY WITH 50% CAPACITY!

RESOUNDING SUCCESS!

ALL ROUND APPLAUSE!!

BUT THE BEST IS YET AHEAD

See Its Brightening Prospects Still In Front!

Refer Bursa

B3. FUTURE PROSPECT

The reported quarter total HDD storage market showed a 3% increase Quarter on Quarter (QoQ)

in units shipped and 22% QoQ total Storage Capacity shipped, increasing to 262 Exabytes(EB). This

is the 2nd straight quarter that the industry is seeing unit HDD shipment increase. The industry

has also reported that inventory levels in the supply chain are back to normal levels. Based on

current market trends and barring any unforeseen circumstances, the Group expects the

performance of the second half year to be better than the first half. The group is projecting that

our factory capacity utilisation rate will increase as our customers improve their units shipped.

Our short to medium term strategy remains to strengthen our core in the storage industry while

diversifying into other industries. We aim to be recognized as a Quality focused, engineering based precision casting, machining, and assembly company.

We remain focused in growing our portfolio. We strongly believe that being vertically integrated in

Mold making, Casting, Machining and Coating gives us a strategic advantage in the industry to

capitalise on the disruption in supply chain driven by the world’s geopolitical tensions. We are

working with new customers in product qualifications. We do recognise that this is a slow and

laborious, part by part qualification, process and will take 2-4 years to reach some maturity. The

group remains invested in the long-term partnerships to grow together with our customers.

NOTE AGAIN

The reported quarter total HDD storage market showed a 3% increase Quarter on Quarter (QoQ)

in units shipped and 22% QoQ total Storage Capacity shipped, increasing to 262 Exabytes(EB)

From above we understand why do less earn more

1. HDD Storage market showed 3% increase

But Storage Capacity shipped increased by 22%

In other words JCY is selling "HIGHER VALUE HDD & SSD!"

THE PROFITS ARE VERTICLE!!

2. the Group expects the

performance of the second half year to be better than the first half. The group is projecting that

our factory capacity utilisation rate will increase as our customers improve their units shipped.

2nd Half Will Be Better than the first half. And JCY will ramp up its Production

ALL ABOVE ARE VERY BRIGHT TURNAROUND SCENARIOS INDEED!

JCY now 39 sen

Will it go back up to its Glory Days of Near Rm2.00?

Yet to be seen

But very possible

In fact we might even see the Impossible.

Just like in year 2020 Corovirus powered Big Gloves to over Rm20.00

SO THE HUGE COMBINED CATALYSTS FROM AI & NEW DATA CENTERS WORLD WIDE MIGHT MAKE THE IMPOSSIBLE COME TRUE

With Warm Regards

Calvin Tan

Please buy/sell after doing your own due diligence or consult your Remisier/Fund Manager

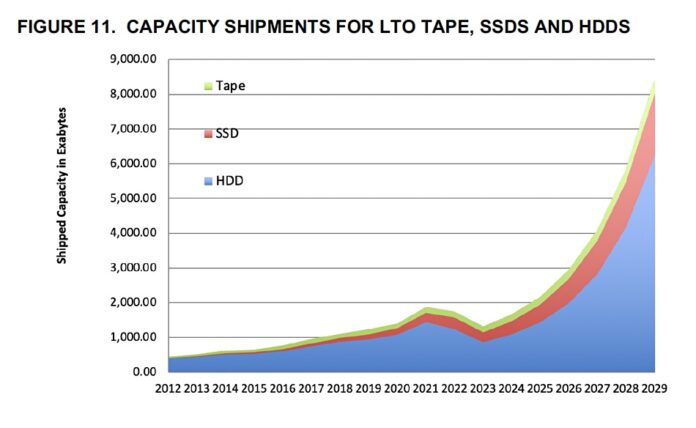

Future Projected Sales of HDD & SSD of which Both Are in JCY's Exports!

AND THEY WILL BE INCREASING ALL THROUGH THE YEARS OF 2024 TO 2029!

JCY WILL BE A LONG TERM UPTREND STOCK FROM NOW!

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 30, 2024

Created by calvintaneng | Aug 30, 2024

Created by calvintaneng | Aug 29, 2024

Created by calvintaneng | Aug 28, 2024

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Discussions

https://www.youtube.com/watch?v=lrt9_lpW2Ow

The Spark started with Notion

Now it spreads to JCY

And later to...................?

2024-05-23 06:58

Inside a Google Data Center

See

https://www.youtube.com/watch?v=XZmGGAbHqa0

See carefuly

At the Very "Center" of Data Center are HARD DISK DRIVES (HDD) Rows and Rows and Rows of HDD!!

2024-05-25 00:13

THERE ARE MORE THAN 10,000 DATA CENTERS IN THE WORLD & ONLY 3 HDD MANUFACTUERERS, Calvin Tan

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-05-25-story-h-160749967-THERE_ARE_MORE_THAN_10_000_DATA_CENTERS_IN_THE_WORLD_ONLY_3_HDD_MANUFAC

calvintaneng

53,609 posts

Posted by calvintaneng > 3 minutes ago | Report Abuse

SEE MALAYSIA MENTIONED IN DATA CENTER NEWS

https://www.datacenterdynamics.com/en/news/

only Seagate, Western Digital & Toshiba supply HDD to all these thousands of DATA Centers Worldwide

JCY

NOTION

DUFU

WILL BENEFIT TREMENDOUSLY

FROM NOW TILL REST OF THE DECADE THE HOTTEST THEME IS AI AND DATA CENTERS

2024-05-25 20:13

Posted by Goldberg > May 25, 2024 8:07 PM | Report Abuse X

Is flash storage the key to effective and sustainable AI?

Agreeing with that finding, Pure Storage’s CEO Charlie Giancarlo asserts that the conventional hard disk drive (HDD) — which consists of a spinning disk to read and write/store data magnetically — will not be able to cope with the demands of an AI-driven organisation. “HDDs used to be in everything, but they’re no longer in your laptop, handphone and more. Today, enterprise mass storage, data centres and hyper scalers are the last remaining bastions of hard disks,” he said in his opening keynote at last month’s Pure//Accelerate 2023 conference in Las Vegas. He also boldly claims that no new HDDs will be sold by 2028 as they will be entirely replaced by flash storage, whose capabilities have been rapidly developing over the years to address the needs of AI.

AI’s requirements

At the same conference, Pure Storage’s chief technology officer Rob Lee shares the IT infrastructure (particularly from storage and computing) requirements for AI.

The first is performance. He explains that AI is a game of “who can collect the most data, feed it into graphics processing units (GPUs) the fastest [for analysis], and repeat the process the most”. Therefore, the infrastructure must enable AI to perform all those tasks efficiently and across different data types such as text, images and video.

https://www.theedgesingapore.com/digitaledge/focus/flash-storage-key-e...

Goldberg

2703 posts

Posted by Goldberg > May 25, 2024 8:16 PM | Report Abuse X

Data Storage

WHAT IS FLASH STORAGE?

Flash storage is a data storage technology based on high-speed, electrically programmable memory. The speed of flash storage is how got its name: It writes data and performs random I/O operations in a flash.

Flash storage uses a type of nonvolatile memory called flash memory. Nonvolatile memory doesn’t require power to maintain the integrity of stored data, so even if your power goes out, you don’t lose your data. In other words, nonvolatile memory won’t “forget” the data it has stored when the disk is turned off.

Flash storage uses memory cells to store data. Cells with previously written data must be erased before new data can be written. Flash storage can also come in several forms, from simple USB sticks to enterprise all-flash arrays.

https://www.netapp.com/data-storage/what-is-flash-storage/

Goldberg

2703 posts

Posted by Goldberg > May 25, 2024 8:18 PM | Report Abuse X

FLASH STORAGE IN THE DATA CENTER

Flash storage offers unique benefits to enterprises that are grappling with exploding data volumes and slow, unpredictable data access. As all-flash storage solutions become increasingly affordable relative to spinning disk, enterprises can now realize flash benefits at scale, including:

Accelerated application performance. This is often the first benefit that people think of when they think of flash. With 20x the performance of HDD technology, flash can accelerate common enterprise applications, such as Oracle Database, MS-SQL, SAP, and VDI, as well as big data analytics such as Hadoop and NoSQL databases. The speed of flash enables customers to access information faster and more effectively. It frees IT staff to focus more on strategic business goals and less on unplanned fire drills. And it empowers the business to capitalize on new opportunities, outcomes, and markets with increased productivity and faster time to market.

Improved data center economics. With the development of high-density flash technologies, today’s all-flash storage solutions offer faster performance and higher capacity in a fraction of the data center footprint. As their data volumes continue to grow, enterprises can see significant cost savings over time from simplified management and a reduction in space, power, and cooling costs.

Future-proof infrastructure. Modernizing your data center with flash is a critical step in digital transformation, but it's important to choose a flash system that supports changing business needs. Not all flash solutions are created equal. All-flash systems that offer nondisruptive scale-out make it possible to start small and grow big. Flash storage that is NVMe-ready can also help future-proof your infrastructure for new technologies and eliminate costly and disruptive forklift upgrades. If your IT strategy calls for a potential cloud element down the road, a flash system that supports cloud integration gives you maximum flexibility for the future.

2024-05-25 20:23

Seagate pushes back against SSD dominance claims

By Chris Mellor -May 1, 2024

HDD maker Seagate wants us to understand three truths about the myth of SSDs replacing disk drives: SSD prices will not match spinning disk prices, SSD fab capacity won’t match HDD fab capacity, and SSDs are a bad fit for nearline disk workloads.

The points are made in Seagate presentation deck that is effectively a response to Pure Storage CEO Charlie Giancarlo’s assertion that “there won’t be any new disk systems sold in five years,” meaning by the end of 2028. In other words, disk and hybrid array customers could still be buying disk drives after that to replenish existing HDD storage but new storage systems will be flash-based.

We note that Pure is not a commercial SSD supplier, buying in raw NAND chips and building its own Direct Flash Module (DFM) drives. SSD suppliers and NAND manufacturers are not supporting Pure Storage in its claims, at least not publicly.

The disk drive manufacturers – Western Digital, Toshiba and Seagate – think this is wrong. Although SSDs are replacing disk drives in notebooks and desktop computers and also in the enterprise 10.2K 2.5-inch market, they are not replacing high-capacity, 7,200 rpm nearline drives in the enterprise and hyperscaler markets. That’s because the total cost of ownership of SSDs is significantly higher than that of HDDs and will remain so.

Seagate’s pitch deck explains why they think this is true. It identifies three claims:

SSD pricing will soon match the pricing of disk drives

NAND supply can increase to replace all disk drive exabytes

Only all-flash arrays (AFAs) can meet modern enterprise workload performance needs

The Seagate slide deck then rebuts each argument.

Price point

Seagate believes that disk drives will retain a greater than 6:1 $/TB advantage over SSDs through to 2027. The average for the period is 6.6:1, with dips below that happening, but the price differential then recovering.

This is based on its analysis and three reports:

Forward Insights Q323 SSD Insights, August 2023

IDC Worldwide Hard Disk Drive Forecast 2022-2027, April 2023, Doc. #US50568323,

TrendFocus SDAS Long-Term Forecast, August 2023

Partly this is based on Seagate extrapolating disk capacity growth, and that depends upon the HDD makers being able to increase areal density. Equally it depends upon NAND suppliers increasing 3D NAND layer counts and manufacturing capacity. Here’s the chart from Seagate’s deck:

The TCO of HDDs and SSDs is composed of acquisition costs and then running costs, basically meaning power for operation and cooling, and other minor costs. Seagate asserts that SSD TCO is greater than HDD in $/TB terms over the product’s lifetime, saying the disk “price advantage is magnified at scale, where device acquisition cost is by far the most significant element of TCO.”

NAND manufacturing capacity

A NAND fab costs a great deal of money. For example, a coming SK hynix M15X DRAM fab in Korea will cost ₩5.3 trillion ($3.86 billion) and be ready in November 2025. There were 333 EB of NAND manufactured in 2023. TrendForce and IDC analyses predict that 3,686 EB of combined NAND and HDD capacity will be needed in 2027. The NAND industry could build 963 EB of that with HDDs contributing 2,723 EB.

Were that disk contribution to be replaced by NAND, the projected cost would be $206 billion, and Seagate says this makes SSD replacement of HDDs cost-prohibitive, as its chart indicates:

See full message by Seagate

https://blocksandfiles.com/2024/05/01/seagate-is-flash-killing-the-hard-drive-no/#:~:text=HDD%20maker%20Seagate%20wants%20us,fit%20for%20nearline%20disk%20workloads.

seagate

SHARE PRICE UPTRENDING\

https://www.google.com/search?q=SEAGATE+PRICE+CHART&oq=SEAGATE+PRICE+CHART&gs_lcrp=EgZjaHJvbWUyBggAEEUYOTIICAEQABgWGB4yCAgCEAAYFhgeMg0IAxAAGIYDGIAEGIoFMgoIBBAAGIAEGKIEMgoIBRAAGIAEGKIEMgoIBhAAGIAEGKIEMgoIBxAAGIAEGKIEMgoICBAAGIAEGKIE0gEJMTA3NDhqMGo0qAIAsAIB&sourceid=chrome&ie=UTF-8

2024-05-26 00:54

AFTER GREAT SUCCESS IN VSTEC - JCY & NOTION ARE TWO CHUN CHUN BUY CALLS OF CALVIN TAN

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-06-09-story-h-159761067-AFTER_GREAT_SUCCESS_IN_VSTEC_JCY_NOTION_ARE_TWO_CHUN_CHUN_BUY_CALLS_OF_

1 minute ago

calvintaneng

VSTEC (5162) A MONOPOLY ON THE INTERNET ECONOMY & E-COMMERCE PLUS HIGH DIVIDENDS , Calvin Tan Research

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2020-05-29-story-h1507893343-VSTEC_5162_A_MONOPOLY_ON_THE_INTERNET_ECONOMY_E_COMMERCE_PLUS_HIGH_DIVI

VSTEC IS LOCAL WHY JCY, NOTION & DUFU ARE GLOBAL!!

2 months ago

.png)

calvintaneng

The Spark started with Notion

Now it spreads to JCY

And later to...................?

https://www.youtube.com/watch?v=tadZ8nCLBsI

2024-05-23 06:34