Why Air Asia Should Worth At Least P/E 8 (Rm4.20) Above

Xeno

Publish date: Sat, 09 Dec 2017, 08:23 PM

Lets compare the P/E ratio of Airlines around the world:

1) Singapore Airlines = 27.06

2) Jet Airways (India) = 20.27

3) Easy Jets = 19.36

4) Ryan Air = 17.36

5) Eva Airways = 15.26

6) American Airline = 12.98

7) Jet Blue Airline = 11.20

8) All Nippon Airways = 10.14

9) Japan Airline = 8.90

10) Air Asia = 6.21 (at current price rm3.22)

Air Asia could be the CHEAPEST airline stock in the world.

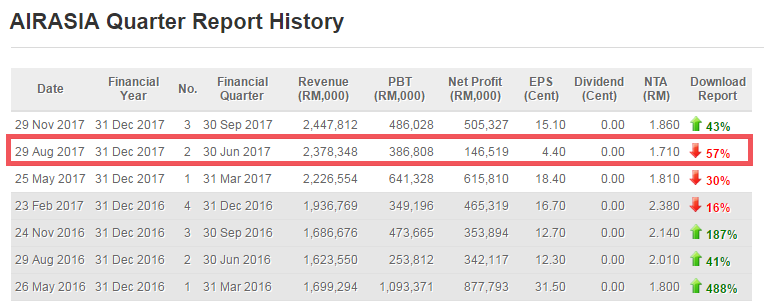

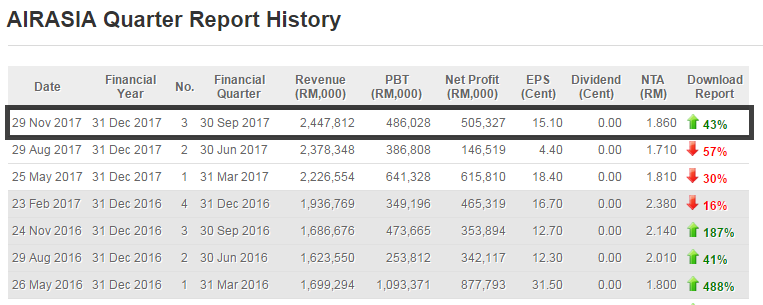

TECHNICAL

The reason why Airasia share price stayed sideways from AUGUST to NOVEMBER and drop to lower lower RM 3.00 is due to bad QR announced at 29th August. The poor result due to one off tax by IAA, also dragged the price to stay sideways.

HOWEVER Impressive result announced on 29 NOVEMBER proved Airasia growth sustainbility and it HAS BEEN UPTREND SINCE QR.

Air Asia currently at P/E 6.22, next QR predicted to be even more impressive as it is the travel peak season in malaysia. The uptrend is predicted to be continue. Furthermore Strengthening of MYR to USD will Signficantly benefit Air Asia.

CATALYST: Strengthening of MYR, Peak travel season in Malaysia, and Growth

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Yes agree it is like a bomb, that's why EPF always ceased interest and dispose most of the share before QR, and after good QR, EPF come back and acquire millions of share for 2 months, then dispose again before QR

2017-12-10 15:00

Next year oil price will be down too due to the upward strength of the USD.

2017-12-10 15:57

Don't worry oil has no future, now oil just temporally recover, but will go down soon

2017-12-10 16:02

I like AA but think most of the PEs are out of date. Just look at AA on its own. I did!

2017-12-11 09:58

RainT

Airasia is like a bomb

The profit is very hard to predict because it have many many accounting items such as loss of this and that, defferred tax and many more

Even the sales go up but the net profit can be reducing ....if you are Airasia shareholders for more than 1 year at least , you will know what I mean ....

It is not as simple as low PE then have potential for share price to go up , it's quarter report also very complete understand compare to others

Future prospect remain good , but each quarter you need be prepare for occasionally heart attack

2017-12-10 12:30