A Technical Outlook For GENTING.

Lau333

Publish date: Thu, 07 Dec 2017, 10:18 PM

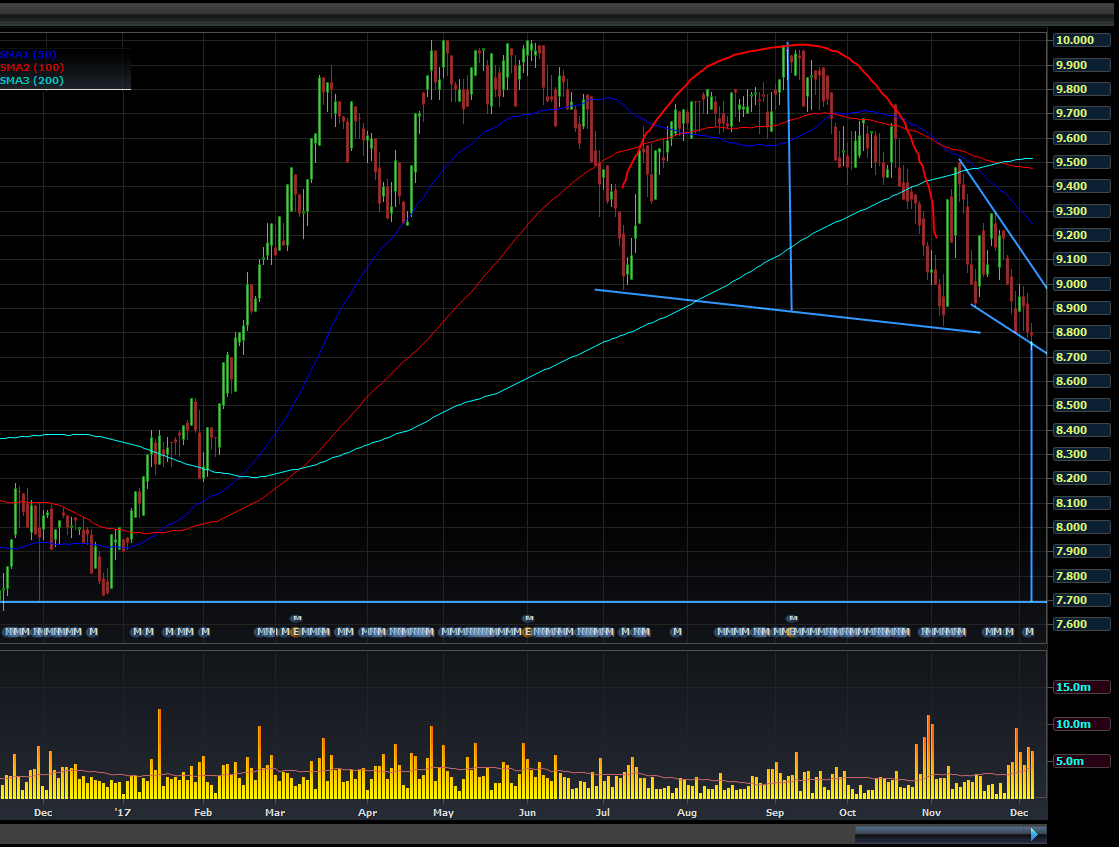

GENTING share price is below its 200 moving average level since late October, and has continued sliding downward to RM 8.83 at early November. Although GENTING staged a 5% rebound on the following day, the upward momentum was short-lived. Downtrend continued with the formation of another bearish signal-a death cross (50 days MA crossed below 200 days MA) at mid-November. A pattern of invert cup and handle spanning July to November is nearly completed (breaking below the lower trendline but closed above it today). Measured target upon closing below is around RM7.70 which lies within a cluster of bottom support of RM7.55-7.80 around July-Sept 2016.

A decision on Mashpee Wampanoag Tribe’s casino bid should be anytime now. A negative one will likely compel Genting’s 49.3% owned Genting Malaysia to impair its US$347.4m loan to the tribe. Will it be the trigger for the breakdown?

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018

Discussions

Bystander123,

The initial target will be ~RM9.50 where the handle high, 100 MA and 200 MA converge. Closing above there will bring RM10.00 into focus. A breakout above there probably needs the return of the foreign shareholders.

2017-12-08 21:02

Bystander123

Thanks for the timely alert. what would be the rebound target if positive news on Mashpee Wampanoag Tribe’s casino bid ?

2017-12-08 19:41