Currency, USD Rising themes

Equityengineer

Publish date: Sat, 25 Jul 2015, 03:05 PM

The upbeat on US federal raising the interest rate has been the topic this year. US currency appreciated against all currency and the FED will most certainly raise the rate slightly. Some predictions say as much to 0.35%. Economists at research houses, offer their forecasts for Interest rates in the US for 2015, 2016, and 2017 and in the longer-run, expecting the Fed to hike rates twice this year. Definitely, the FED will be looking at the core economy indictor before raising rates

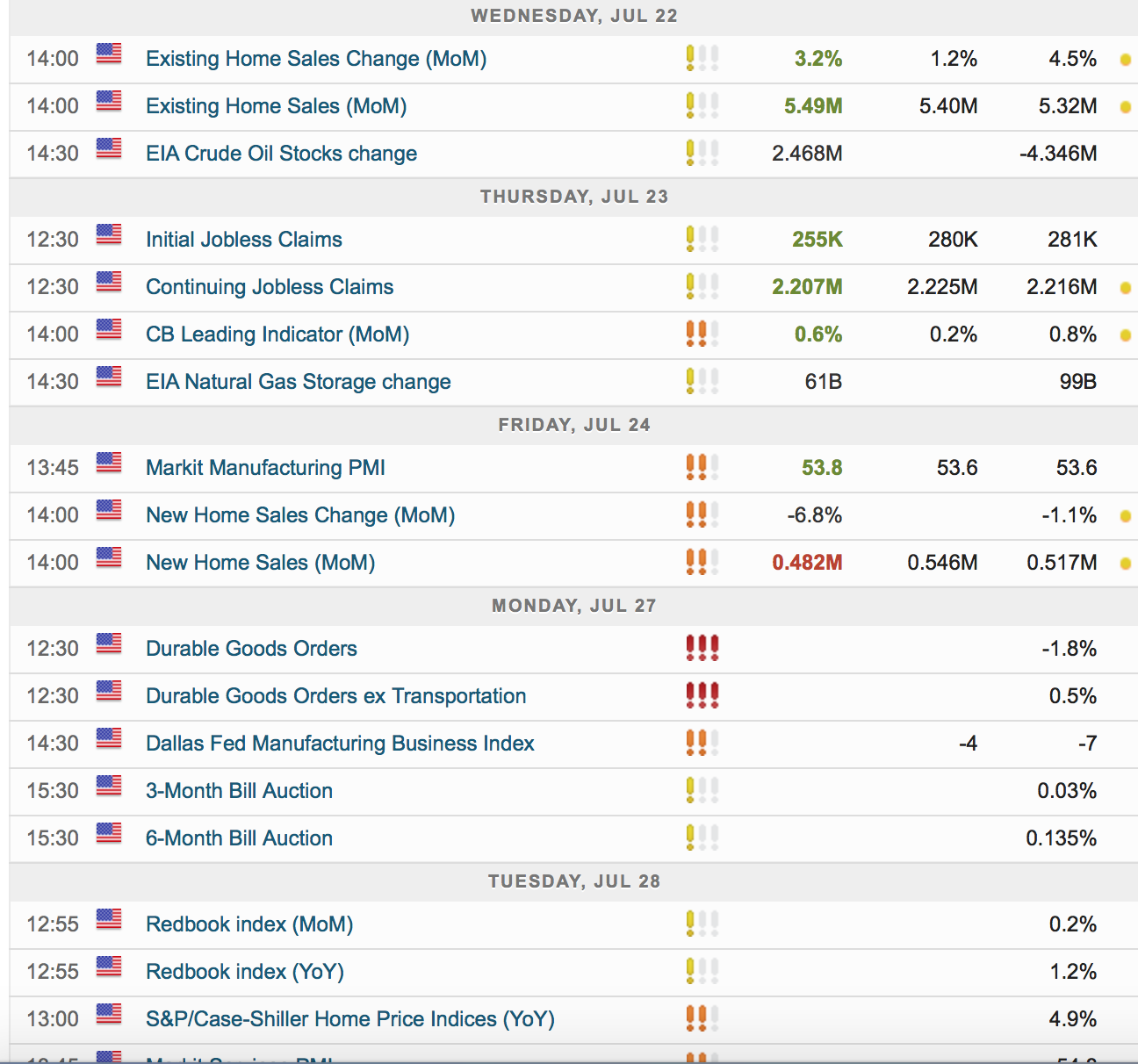

The snapshot below shows the economy indicators last week to coming weeks. So far, new home sales misses target so far. Please ignore the EIA which belongs to energy sector

Coming week, would be important indicators for US economy. US growth picked up in Q2. It will also feature some important data releases in the US. The first estimate of Q2 GDP growth (Thurs) is expected to show a significant rebound, after stagnation in Q1. and annualised growth of about 3%. A bigger question is whether the Fed wants to send a clearer signal that it intends to hike in September. This is the last FOMC meeting before September.

Malaysia currency is trading at 10 years high which is before the FED reduce the interest rate. Now the hiking interest rate been in play and the price has been factored in in some way. There is still way to reach the unchartered territory. There is plenty of speculation let it be ringgit will fall further or some thinking currency pegging. Currency pegging can bring the foreign investors come back to equity market in KLSE. If, there is further appreciation export-based company will be the stocks to look into. The manufacturing stocks already seems move upward and next quarter report will be a gauge on performance and many will look into FOREX effect their revenue.

Many export related stocks in KLSE is making a move. Receivables in terms of USD have been a theme. There is more positive sound than ever for furniture, apparels and manufacturing sector. Currently the USD to MYR is 3.81. In perspective it’s trading at 10yrs high which is before the US fed reduce their interest rate

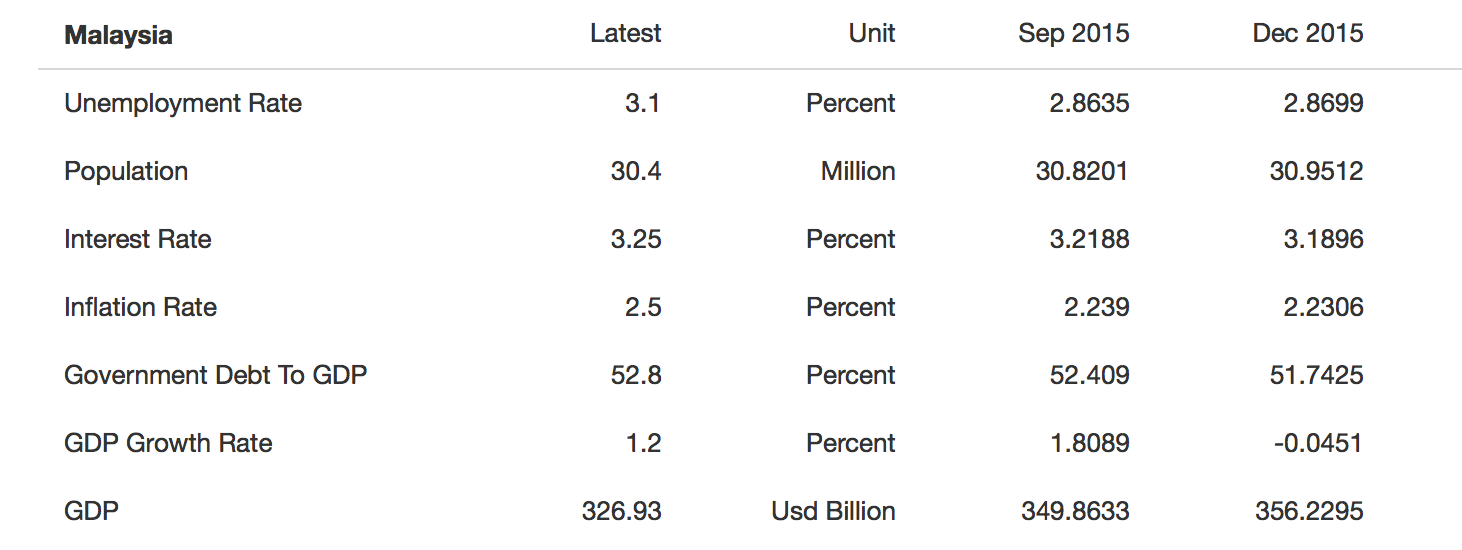

Trading economy reported following on the short term outlook:-

The Malaysian economy advanced 5.6 percent year-on-year in the first quarter of 2015, moderating from a revised 5.7 percent expansion in the previous period but better than market expectations. The private sector remained the key driver of growth while exports contracted.

On the expenditure side, private consumption advanced 8.8 percent year-on-year, accelerating from a 7.6 percent growth in the last quarter of 2014. The robust expansion was mainly supported by stable labor market conditions and higher wage growth and the flood relief efforts early in the year. The front-loading of household spending prior to the implementation of the Goods and Services Tax (GST) also contributed to the growth. Public consumption expanded by 4.1 percent, advancing from a 2.5 growth in the preceding quarter, due to higher growth in supplies and services amid moderate growth in emoluments.

Private investment grew by 11.7 percent, up from 11.1 percent in the December quarter. Public investment grew by 0.5 percent, rebounding from a 1.9 percent contraction in the previous period, mainly due to higher capital spending by the Federal Government.

Exports declined by 0.6 percent, slowing from 1.9 percent growth in the preceding quarter, due to sluggish in exports of services and moderation in exports of goods. Imports increased by 1.0 percent from a 2.6 percent rise in October to December, following a moderation in both imports of goods and services.

On the production side, the services sector recorded a steady growth of 6.4 percent, underpinned by growth in all sub-sectors, particularly consumption-related sub-sectors. The manufacturing sector rose 5.6 percent year-on-year, from a 5.4 percent expansion in the previous quarter, mainly driven by stronger performance in the exports-oriented industries, particularly the electronics and electrical (E&E) cluster. The construction sector was supported mainly by the non-residential and residential sub-sectors. The mining and quarrying sector grew by 9.6 percent, mainly due to higher crude oil production. Meanwhile, the agriculture sector contracted as a result of lower palm oil production, arising from flood-related disruptions.

Moving forward, Malaysia's GDP is expected to remain on a steady growth path with domestic demand remaining as the key driver of growth amid falling oil prices. Investment is projected to remain resilient with continued capital spending by both the private and public sectors. While private consumption is expected to moderate as households adjust to the introduction of GST, the steady rise of income and stable labor market would support household spending.

On a quarter-on-quarter seasonally-adjusted basis, the economy grew by 1.2 percent, slowing from a revised 1.8 percent expansion in the previous three months.

Statistics to look at:-

Besides the KLSE index, buying USD give some diversification to us. Many invested in the US stocks and depite some negative performing stocks they still have made leverage due to forex advantage. Some currencies that was battered same like ringgit.

NZD/USD

The Reserve Bank of New Zealand cut its official cash rate by 25 basis points to 3.0%. RBNZ Governor Graeme Wheeler said in a statement: “A reduction in the OCR is warranted by the softening in the economic outlook and low inflation (…) At this point, some further easing seems likely. (…) While the currency depreciation will provide support to the export and import competing sectors, further depreciation is necessary given the weakness in export commodity prices.”

The New Zealand is the first developed economy to rasie interest after the 2007-2008 recession. This year they have cut 0.25% cut this year and further easing is down the line

AUD/USD

CHINA is an important trading partner to Aussie, the chines economy indicator reflect in the Aussie dollar at certain extent.A ustralia's economy is dominated by the service sector (65 percent of total GDP). Yet its economic success in recent years has been based on the mining sector (13.5 percent of GDP) as foreigners paid more each year for key commodity exports, triggering huge investment in resources infrastructure. All the metals prices going downawards and no one could predict the lowest they may get. This can give pressure to AUD

USD/CAD

Slowdown in Chinese manufacturing activity ,according to the Caixin report, which was formerly HSBC, Chinese manufacturing contracted at its fastest pace in 15 months. Adding salt,il price decline put pressure to Canadian dollar. If you look closely the peripd Apr-Jun seems to be better for Canadian dollar when NYMEX trading above 55usd/barrel

The country with commodities as main trade is facing massive depreciation this year and the US FED view to raise interest causing more worries to commodity. As for now, USD theme related stocks and USD continue appreciation speculation seems like to intact for now aligned with the interest rate raise coming within this year. There is always risk in this theme, how if the economy indicator magnitude does not satisfy the FED. That may cause volatility everywhere. Uncertainty is what traders love but certainty what investors wants.

Happy Weekends