Fed Rate Hike Survey

Equityengineer

Publish date: Tue, 28 Jul 2015, 11:52 PM

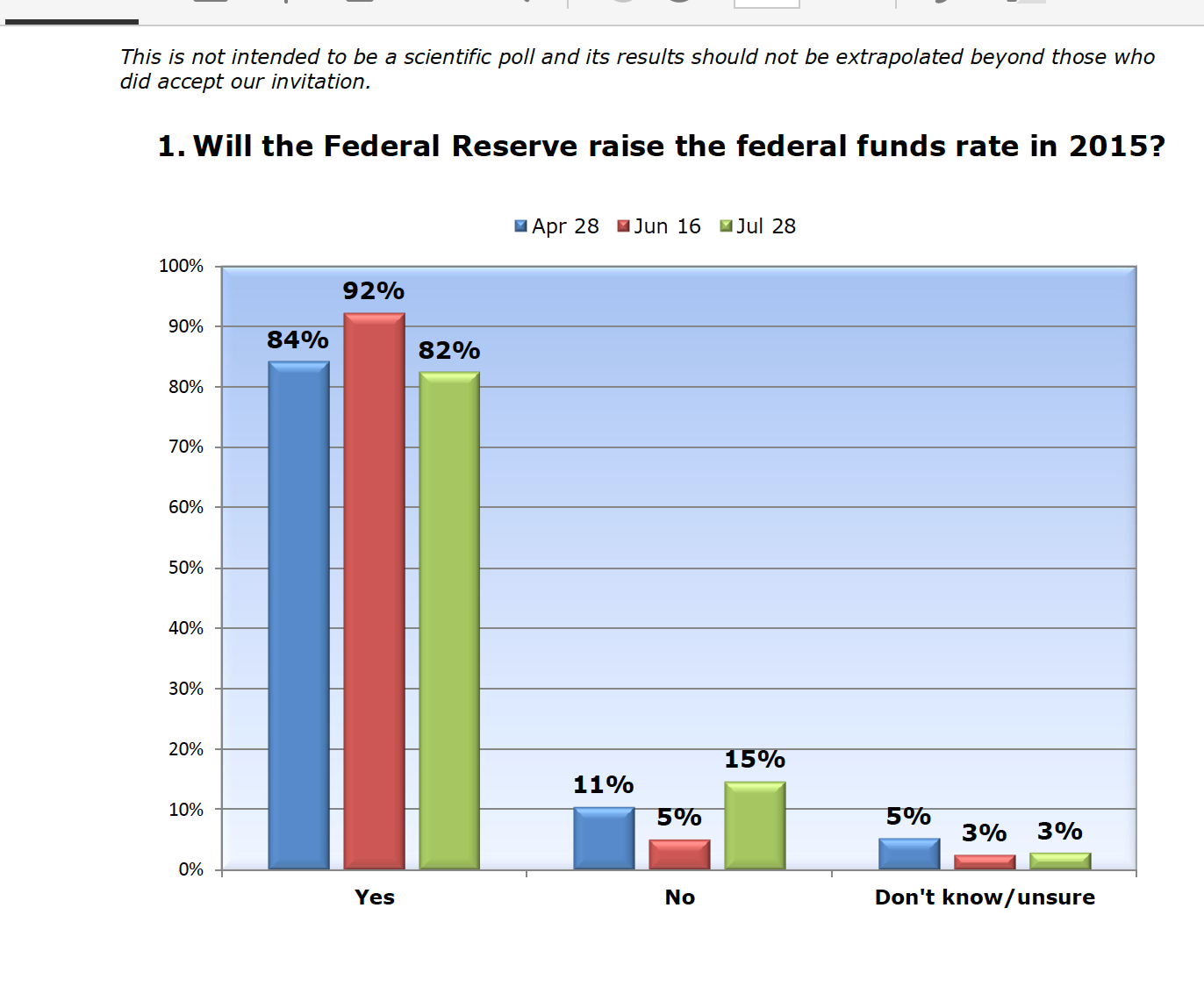

Today is the crucial FOMC meting start, it narrowing the hint of increasing US interest rate for the first time after 9 years

Lets see what does some money managers is saying. This week market had taken beat,

Comments:

Robert Brusca, Fact and Opinion Economics

: Monetary policy is

not 'too tight ' as I said because of interest rates that are 'too high.'

It is bank regulation and the imposition of high capital/asset ratios

IN CONJUNCTION WITH the way Fed stress tests are performed that

make policy restrictive. I still don't think that the Fed thinks of its

policy that way and that is the reason why monetary policy stays too

tight. Since banks have to keep capital relative to assets in order to

survive the pit of a draconian stress test, the effective capital asset

ratio they have to have is really much greater. It is why banks are

not lending more. Fed policy on banks is really onerous regulation

and is highly restrictive. Overseas.. EMU IS IMPOSING AUSTERITY.

Where could growth possibly come from, let alone inflation?

Commodity and oil prices are crashing, gold is imploding, the dollar

is strong and the FED is ITCHING to hike rates. Wake me when this

bad dream is over! Janet! Who really thinks that the economy will

pick up in the second half of the year? Good luck with that. By the

way, Greece is still just an accident waiting to happen. It needs too

much debt relief to be able to survive and it will not get enough of it.

Greece is forming a new ring of Hell in Dante's inferno.

Thomas Costerg, Standard Chartered Bank

: We think the FOMC

will adopt a ‘do no harm’ approach when it meets this week: the

statement is unlikely to give explicit strong guidance about a near-

term rate hike, in our view. The only hint we foresee might be a

more upbeat tone about the domestic economy in the first

paragraph. We still expect a September rate hike, but this hinges on

an improvement in domestic data ahead of the meeting, particularly

signs of an uptrend/bounce in wages/inflation and signs of

improvement in H2 GDP growth after a meagre performance in H1.

John Donaldson, Haverford Trust Co.

: There is an exceptionally

wide range of predictions regarding the Fed. One extreme expects no

action until the middle of 2016. The other extreme calls for a 3%

funds rate by the end of 2016. Both do not take the FOMC at its

word that moves will be soon and gradual. We take the FOMC at its

word and expect the first move in September and that subsequent

moves will be very gradual. When a Fed Chair uses a word (gradual)

three times in one comment during Congressional testimony, you

should pay attention