August 2015 turmoil

Equityengineer

Publish date: Sat, 29 Aug 2015, 06:31 PM

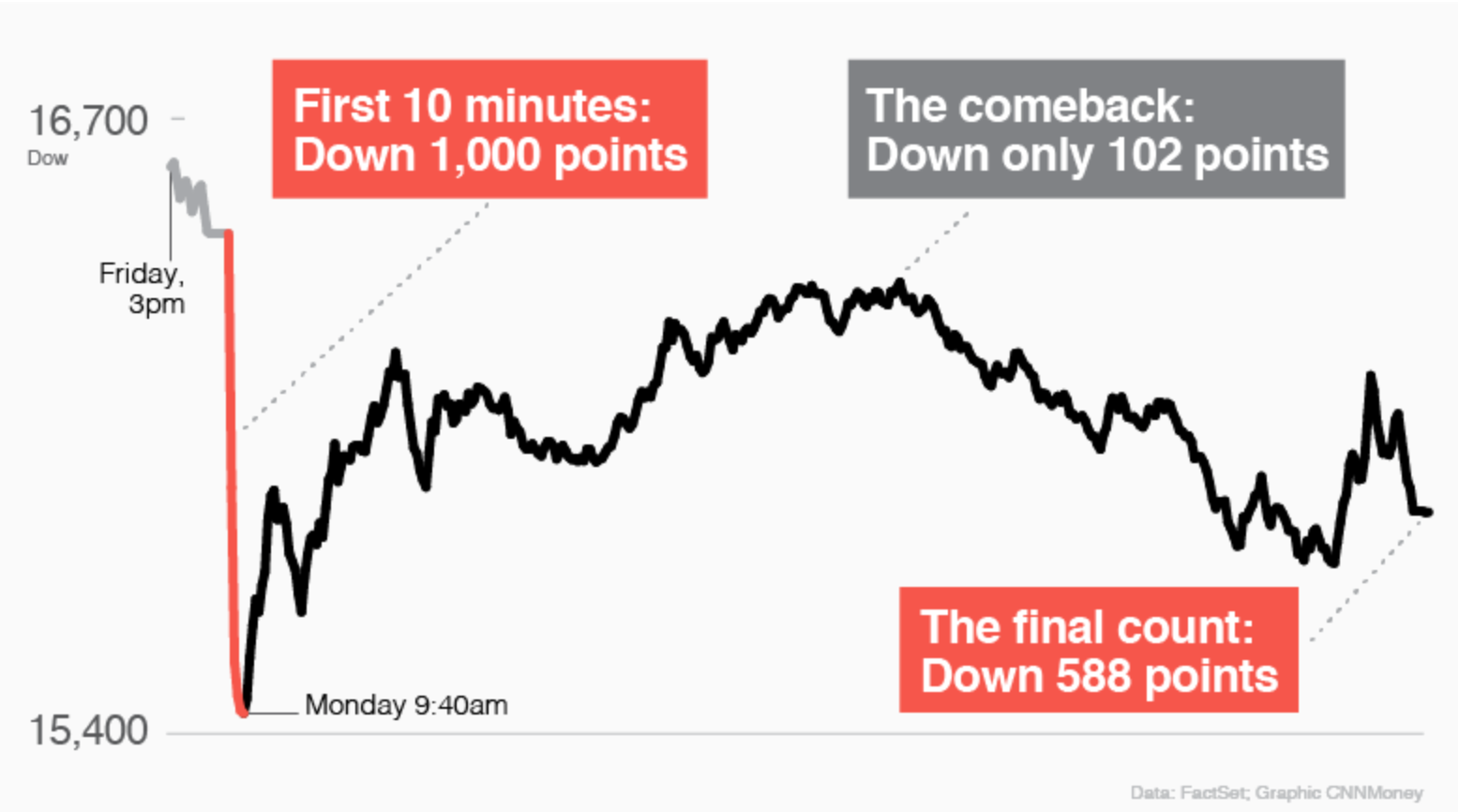

This week version of “Black Monday" is pretty one of a kind to be honest. The trigger was actually by CHINA. The chinese economy shows some kind of slowdown amid the US is showing recovery and waiting for the right timing to increase the interest rate. Chronologially it goes like this, Shanghai Composite drops more than 8%. China ecomony have large appetite for raw materials therefore the sell off spread to the emerging market and commoditties drop.There is no escape for emerging market if China slowdowns. The extended US market and the DOW plunges 1089pts at the opening. Investors who have stocks in US markets would be shocked to see that. Some iconic stocks like Apple, Starbucks,Google end up losing I don’t remember how much, but to look at it going downwards, pretty ugly.

The root cause of all the turmoil recently started on June 12 shanghai index peaked then capitulation happened withShanghai index lost about a third of its value. China retail investors is taking profit and cutting losses at that time. China moved aggressively to control the crisis. The government gave money to brokerages to buy stocks and ordered company executives not to sell their shares. New company listings were suspended. The central bank cut interest rates to a record low. Regulators and security officials launched an investigation into illegal short selling borrowing stocks so you can trade them in the hope they fall -- and rumor mongering. Only approved brokers are allowed to engage in short selling in China.

For a while, CHINA's plan appeared to work, but the Shanghai Composite has resumed its decline. The index has dropped more than 40% from its June 12 peak, erasing all gains year to date. The latest Friday closing is positive to China Global stocks extended their recovery into the final trading day of the week as investors cheered a second day of gains in Chinese and U.S. markets.

The news reported, China's benchmark ended 5 percent higher, with gains accelerating in the final half-hour of trade. Friday's rally followed a 5.4 percent gain on Thursday amid reports late in the session that the People's Bank of China purchased blue-chip stocks and requested that state-owned banks buy more Yuan on its behalf. Despite the stellar gains, the index still ended the week down 7.8 %.

Aside from the rally in equities, the Department of Energy released their latest crude oil inventory data, showing that supply contracted by 5.5m barrels and also that US production fell for another week to its lower level in more than 3 months, from 9.34 million barrels a day to 9.33 million. While these may be small changes for now, they hint that US producers are feeling the pain of this collapse in prices and that demand within the world’s largest economy is strong. Many oil and gas counter around the world rebounded all together reacting to this news. At the moment this upwards momentum is just one of the bulls without any hard evidences. The supply glut still persists. With Iran oil to come in, the factor of oversupply still awaiting us to be understood. However certain period of time, consumption for oil will increase, this can cause oil futures to go up. The facts that oil at below 40USD is very much cheap that can cause many oil and gas business to close. Below is oil NYMEX index.

As the Chinese PMI contracted further and the stock market suddenly nose-dived since Monday last week caused global stocks to plunge. The market fears more slowdown from China, which will further worsen the outlook for commodities. China reacted by cutting interest rates and the required reserve ratios for banks on Tuesday. On the contarary, the U.S. Economy indicators posting green each week showing healthy US economy. The market now believes that there is only a 26% chance of a rate hike in September compared to 48% just a week ago.

Next week is data driven market .What is to monitor?

Its all starts on Monday, Chicago Purchasing Managers Report ; The Fed is looking for any sign that proves that the economy is strong enough to handle a rate hike.

On Tuesday its all about China, it could be a volatile day again. China manufacturing PMI and then comes the RBA (Australia) getting ready for reducing interest rate. AUD have lost much again USD and further bad economic condition in CHINA will force thenm to cut rate in coming months and the following day will be Q2 GDP for Australia which is expected to grow.

The all-important NFP report is a major factor in the setting of monetary policy in the US. It will be released on Friday. NFP expected 218K unemployment rate exp. 5.3%, average hourly earnings exp. 0.2% m/m.

KLSE, our domestic market rebounded from sell off but YOY we are still decline14% and August MoM closing we are down 6.4%. This can be one of the worst monthly performances. The chart shows better picture last for last week.

Selected stock performances, some stocks keep declining when fundamental of the company changes after relesing quarter report. Overall rebound is healthy and hope index moves up and boost further in coming months which is definitely will be difficult to say. One of the toughest months and quarter are expected to follow.

“Life is like riding a bicycle. To keep your balance, you must keep moving.”

― Albert Einstein

Discussions

has everyone gone to Bersih and now just resting?

i3 seems quiet...

I have a feeling PM leaving the office is becoming certain.

So how will the market react?

2015-08-29 20:38

I agree with probability it is quite likely

Last time i give 30% chance

Now I give 70%

The Umno division head sue him

That is what made me feel he is losing

He can arrest others if they speak out

But once people sue you in court, what can u do ? U appear in court and cerita lah. The more he cerita, the more the Rakyat knows

I think he is in deep shit

2015-08-29 21:07

Tang Khangseng

Good sharing, but what is the message?

2015-08-29 20:19