ATFX Trader Magazine

Crude Oil - Will Crude Oil Rally Despite Market Worries About an Economic Recession?

newsroom

Publish date: Tue, 17 Jan 2023, 11:30 AM

Crude oil prices have witnessed a fair amount of weakness after failing to re-capture the $90-a-barrel critical level towards the end of 2022. Demand concerns have weighed heavily on investor sentiment towards oil as the US dollar strengthens amid fears of a global slowdown in demand.

However, China’s border reopening and loosening strict COVID-19 rules could lead to higher oil demand. According to some central bank economists, crude oil demand could rise by 1 million barrels daily in 20223 from 2022 levels.

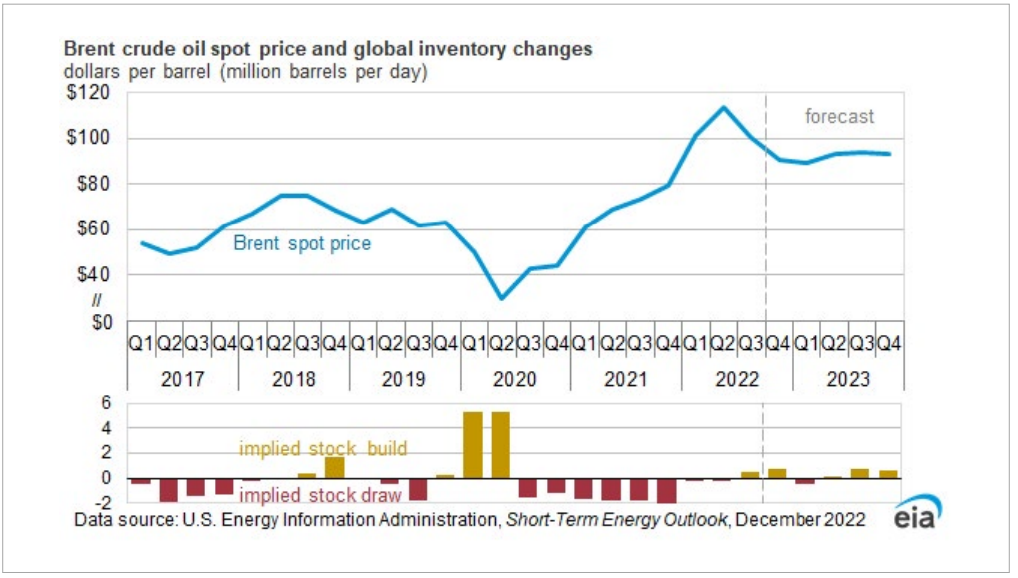

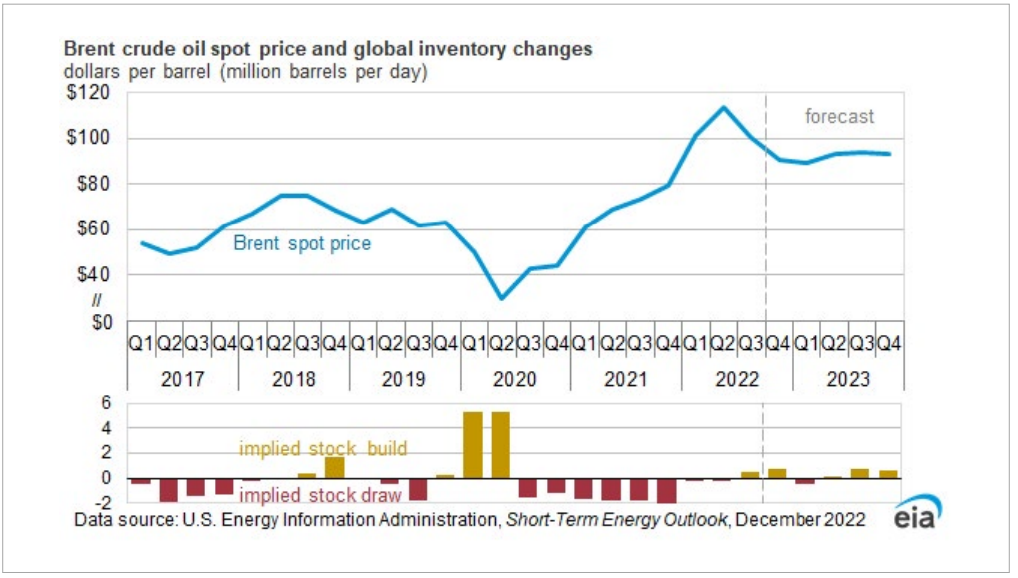

On the supply side, OPEC+ decided to stick to their existing policy of reducing oil output by 2 million barrels a day from November through Q1 2023. Meanwhile, as global economic growth concerns persist, the EIA expects global inventories to tighten in early 2023, supporting crude oil’s rally back to $90 a barrel. However, supply and demand will likely be balanced in the second half of 2023.

On the other hand, the EU ban on Russian crude imports and a G7 price cap on Russian seaborne exports at $60 per barrel recently came into effect. According to the International Energy Agency (IEA), the move is expected to reduce Russia’s exports to the European Union by 430,000 barrels per day to 1.4 million BPD. Therefore, crude oil prices will continue to experience significant uncertainty during Q1 2023.

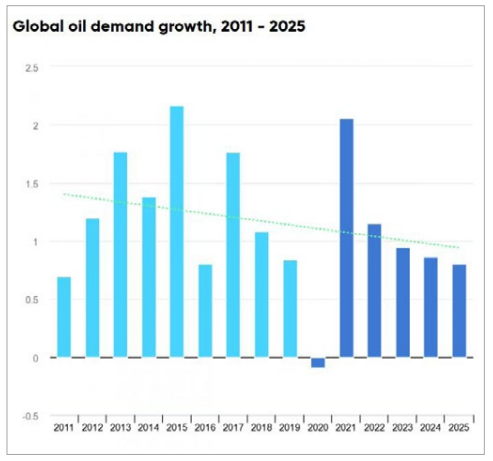

However, the aggressive interest rate hikes from leading central banks to combat spiralling inflation, combined with market concerns about the risk of a global recession, could damage global oil demand. According to the IEA, the global oil demand growth from 2011-2025 might continue rising since peak rates are yet to be reached.

In summary, the crude oil market is expected to tighten during 2023 as the EU ban on Russian crude oil products is implemented, along with OPEC+ supply cuts. As a result, we expect crude oil prices to strengthen in the first quarter of 2023.

Technical Perspective

Crude oil is down over 20% from its November 7th peak, and a bounce off $70.00 allowed it to trade higher before peaking at $76.

Sellers may remain in control pushing crude oil prices to retest their lowest levels since oil prices have already broken below the range between $93 and $76.58 a barrel. Hence, if the crude oil price fails to re-capture the $80 per barrel level, it could potentially extend its decline towards $70. Once this crucial support level breaks, sellers may continue pushing prices lower to the $65 or $62 a barrel (29th November 2021 Low) support zone.

Alternatively, from a bullish perspective, a sustained move above $80 a barrel would indicate the presence of buyers. The buying could come from an aggressive and bullish outlook. If such a move generates enough upside momentum, the next resistance level would be at the $84 (1st November High) level.

To summarize, crude oil prices look bearish from a shortterm perspective. However, crude oil prices might gain bullish momentum during the first half of Q1. A break above the nearby resistance of $80 is expected to trigger more buying pressure.

By Jason Tee, ATFX (Asia Pacific) Global Market Strategist

More articles on ATFX Trader Magazine

Gold & Silver - A Recession May Boost Prices Amid Rate Hike Pressure

Created by newsroom | Jan 17, 2023

USDCAD - The BoC Could Provoke Economic, Oil Price and CAD Price Shocks

Created by newsroom | Jan 17, 2023

European Stock Indices - How Will Euro Stocks Perform vs Monetary Tightening and a Recession?

Created by newsroom | Jan 17, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)