ATFX Trader Magazine

GBPUSD & EURUSD - The GBPUSD Will Rise After UK Inflation Peaked and the BoE Tightens Monetary Policy

newsroom

Publish date: Tue, 17 Jan 2023, 11:28 AM

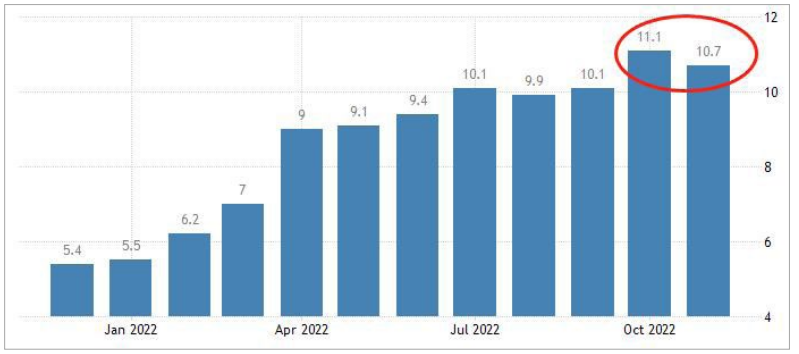

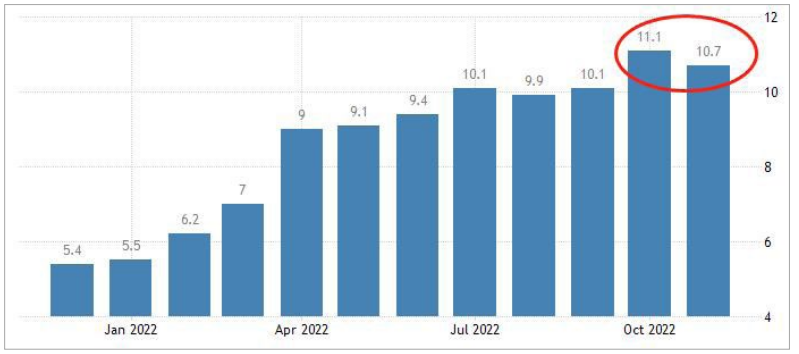

In November 2022, the UK’s nominal CPI growth rate was 10.7%, lower than the previous 11.1%, indicating that a shift from its high inflation could be underway. The same scenario was seen in August when the inflation rate saw a month-onmonth decline but rebounded in September. Therefore, whether this shift is permanent remains uncertain, as this depends on the changes seen in the next two months.

The US economy is a bellwether not only for the global economy but also for the EU and British economies. When the US inflation rate reaches an inflection point, the high inflation rate in the EU and the UK will also drop. America’s nominal CPI growth rate hit an inflection point as early as July 2022, and so did its core CPI growth rate in October. Therefore, the decline in the UK’s nominal CPI growth rate in November will likely be a robust peak turnaround point for its high inflation.

It is noteworthy that Europe and the US differ on oil and natural gas supply. Oil produced locally in the US can meet its own needs, and even if there is a gap, which only occurs occasionally, the US can still import oil from Canada. Comparatively, Europe’s oil and gas are mainly supplied by Russia, which influences its lower level of autonomy. The EU continues to adopt additional sanctions against Russia. Measures such as the “maritime oil embargo”, “oil price cap”, and “abandonment of the Nord Stream 2 pipeline” will gradually deepen the energy crisis in EU countries. Thus, whether the UK inflation will continue to fall in Q1 2023 still hinges on how the Russia-Ukraine conflict goes.

The inflation rate data will affect the Bank of England’s (BOE) monetary policy. The BOE’s last interest rate decision in 2022 reduced the size of a single rate hike to 50 basis points (bps) from the previous 75 bps and raised its benchmark interest rate to 3.5%. The easing of the year-long aggressive interest hike policy signals that the BOE is optimistic about the downward trend in CPI data. Andrew Bailey, the BOE Governor, said, “We think the data released this week shows that we may have seen glimmers of hope on the horizon. Not only has inflation begun to decline, but it is also slightly lower than our previous expectations.”

The GBPUSD’s trend depends mainly on the BOE and the Federal Reserve (Fed) monetary policies. In Q1 2023, the BOE will make two interest rate decisions on February 2 and March 23, each expected to raise rates by 50 bps; the Fed will also make two interest rate decisions on January 26 and March 23, respectively. And the size of the interest rate hikes will likely drop from 50 bps to 25 bps. Because the turning point of the UK’s inflation rate was later than that of the US, the BOE may press ahead with its 50 bps rate hike policy longer than the Fed. In light of that, the GBPUSD will likely continue its upward trend in Q1 2023, and we can temporarily set the medium-term target at 1.3.

Expectations often reverse when realized. The GBPUSD’s rise in the last two months of 2022 was driven by expectations that the Fed would reduce the size of a single interest rate hike. The Fed’s interest rate decision in December has already met this expectation, and the funds betting on this forecast may have already taken their profits. Therefore, the GBPUSD will probably see a drop in January 2023. Technically, as long as it does not break below the 1.15 support level, the bullish uptrend remains intact.

By Dean Chen, ATFX Guest Analyst

More articles on ATFX Trader Magazine

Crude Oil - Will Crude Oil Rally Despite Market Worries About an Economic Recession?

Created by newsroom | Jan 17, 2023

Gold & Silver - A Recession May Boost Prices Amid Rate Hike Pressure

Created by newsroom | Jan 17, 2023

USDCAD - The BoC Could Provoke Economic, Oil Price and CAD Price Shocks

Created by newsroom | Jan 17, 2023

European Stock Indices - How Will Euro Stocks Perform vs Monetary Tightening and a Recession?

Created by newsroom | Jan 17, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)