ATFX Trader Magazine

USDCAD - The BoC Could Provoke Economic, Oil Price and CAD Price Shocks

newsroom

Publish date: Tue, 17 Jan 2023, 11:28 AM

After tightening monetary policies for nine months, including seven interest rate hikes, the Bank of Canada (BoC) hinted that it was planning to pause further interest rate hikes at its last meeting in December. This means that the central bank may choose to stand by throughout Q1 2023 as it observes the effect of its previous consecutive interest rate hikes on Canada’s economy.

Given that domestic housing investments make up almost 10% of Canada’s GDP, the risk of a downturn in the housing market as the household debt-to-income ratio soars globally is increasing, which is fueling the economic pressures in Canada. At the beginning of December, the inverted curve of Canadian government bond yields further deepened with a rate difference much higher than that of the U.S. government bond yields, indicating a potentially more severe economic recession than expected.

Canada’s inflation rate was recorded at 6.9% in October. Despite a slowdown, it was still higher than the 2% target the Bank of Canada set. Despite the slowing economic growth in 2023, it is estimated that inflation will linger at a high position, around 5%, for quite a long time. If it takes longer to cool down inflation, the possibility of a soft economic landing will be lower.

Both personal spending and housing investments in Canada dropped during the previous quarter. According to a Reuters survey, housing prices dropped by 17.5% from their peak, which was about twice the decline witnessed during the financial crisis of 2008-2009. The Canadian central bank predicts that the country’s economy will stagnate from Q4 2022 to mid-2023.

With limited willingness for interest rate hikes among central banks, the U.S. Fed is still advancing its interest rate hikes in 2023, which means that CAD will decline due to the changes in monetary policies. This expectation has already been gradually proven since the last quarter. The only exception is if there is a milder economic recession in Canada than expected, which could support the CAD.

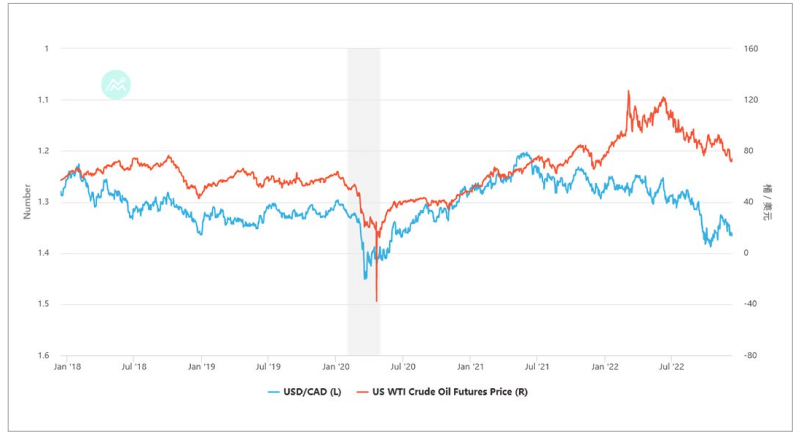

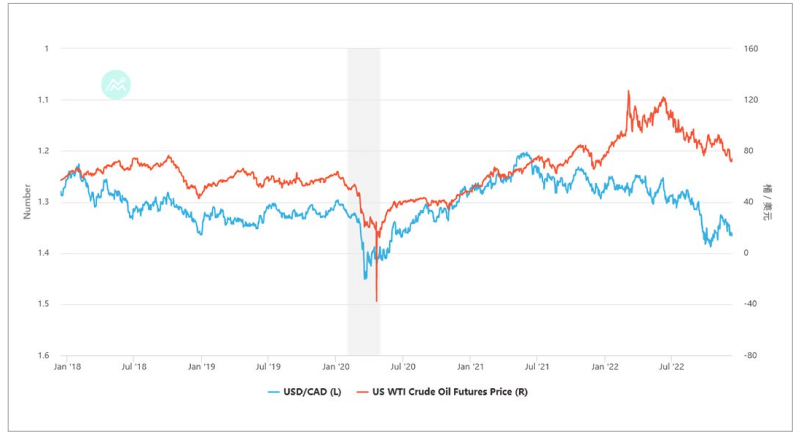

Another crucial factor influencing CAD movements is international oil prices, which have been falling gradually due to the global economy’s slowing down since last year. As a result, oil prices in early December completely offset the rally seen earlier in 2022. The continuous drop in oil prices also sent Canada’s current account into a deficit, reflecting the adverse effect of weak oil prices on Canada’s economy and the CAD.

In the new year, major global economies will face recession pressure. This will further decrease oil demand from the U.S., Canada’s largest crude oil importer (accounting for over 50% of total U.S. oil exports), negatively impacting the Canadian economy. However, since the implementation of the European Union’s ban on Russian oil last December, the EU will have to turn to other alternative energy providers, which could divert part of the demand to Canada, relieving some pressure from the demand side.

Technical Analysis

The weekly USD/CAD chart shows that the exchange rate has been within a wide fluctuation range, which met resistance at 1.4000 (a high from 2004), triggering the current retracement. The pair may attempt to test the 10MA support before breaking it again. Combined with the USD index’s upward advantage, the exchange rate may rebound and break the resistance zone between 1.4000 and 1.4300. Suppose international oil prices rebound and drive CAD upward in Q1 2023, according to the latest institutional predictions. In that case, we should note that the downward pressure on USD/CAD may extend below 1.3000 (2009 high converting it into support), making 1.2640 its next target.

By Jessica Lin, ATFX (Asia Pacific) Global Market Analyst

More articles on ATFX Trader Magazine

Crude Oil - Will Crude Oil Rally Despite Market Worries About an Economic Recession?

Created by newsroom | Jan 17, 2023

Gold & Silver - A Recession May Boost Prices Amid Rate Hike Pressure

Created by newsroom | Jan 17, 2023

European Stock Indices - How Will Euro Stocks Perform vs Monetary Tightening and a Recession?

Created by newsroom | Jan 17, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)